Penalty Abatement Tax Relief

One thing that is for certain with the IRS is that there is a penalty for everything! Penalties are meant to encourage compliance with tax laws. What if you try to comply with the tax law, but you can't? That's where penalty abatements come in.

Penalty Abatement

A penalty abatement is when the IRS removes penalties after the penalties have been assessed to the taxpayer. There are two main types of penalty abatements - First Time Penalty Abatement and Reasonable Cause Penalty Abatement.

First-Time Penalty Abatement

The IRS may provide administrative relief from a penalty that would otherwise be applicable under its First Time Penalty Abatement policy.

You may qualify for administrative relief from penalties for failing to file a tax return, pay on time, and/or to deposit taxes when due under the IRS's First Time Penalty Abatement policy if the following are true:

- You didn’t previously have to file a return or you have no penalties for the 3 tax years prior to the tax year in which you received a penalty.

- You filed all currently required returns or filed an extension of time to file.

- You have paid, or arranged to pay, any tax due.

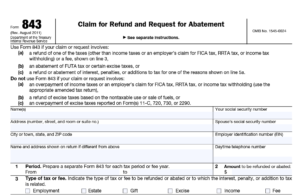

A First Time Penalty Abatement can be requested using form 843.

Case Study

Imagine $7 standing between you and $259,000 of penalty relief. That’s exactly what happened to Erik and Aspasia Oosterwijk.

Short story: For the 2017 tax year, the Oosterwijks reached out to their CPA to file an extension on their tax return and arrange a payment of approximately $1.8 million in taxes owed. The CPA made an error and did not actually file the extension, and the payment never came out. OOPS!

What about that First Time Penalty Abatement? For tax year 2014, the Oosterwijks received a $7 late payment penalty. That $7 late payment penalty made them ineligible for the First Time Penalty Abatement because the $7 penalty occurred within the 3 years prior to tax year 2017. Ouch!

If you don’t qualify for a First Time Penalty Abatement, you may qualify for a Reasonable Cause Penalty Abatement.

REASONABLE CAUSE PENALTY ABATEMENT

Reasonable Cause is based on all the facts and circumstances in your situation. The IRS will "consider any reason which establishes that you used all ordinary business care and prudence to meet your Federal tax obligations but were nevertheless unable to do so". Please note that the word ‘consider’ is underlined. The IRS will consider the circumstances, but that doesn’t mean they will accept your reasoning.

Here is a list of “sound reasons” IRS has listed on its website for failing to file a tax return, make a deposit or pay tax when due.

- Fire, casualty, natural disaster or other disturbances

- Inability to obtain records

- Death, serious illness, incapacitation or unavoidable absence of the taxpayer or a member of the taxpayer’s immediate family

- Other reason which establishes that you used all ordinary business care and prudence to meet your Federal tax obligations but were nevertheless unable to do so

The IRS also notes that a lack of funds, in and of itself, is NOT reasonable cause for failure to file or pay on time. However, the reasons for the lack of funds may meet reasonable cause criteria for the failure-to-pay penalty.

Facts necessary to establish reasonable cause

When trying to establish reasonable cause, there are certain facts one must be able to present:

- What happened and when?

- What exactly prevented you from meeting your tax obligation of filing and paying?

- Once the circumstances changed, how did you attempt to rectify the situation?

- You have to be able to provide documentation to support your claim. In the case of serious illness for example, one would provide hospital or medical records.

In the case of the Oosterwijks, one might believe that the CPA failing to file the extension would constitute reasonable cause. One would also believe that Oosterwijks “all ordinary business care and prudence to meet your Federal tax obligations but were nevertheless unable to do so”.

Uh. No.

In US v Boyle (1985), the Supreme Court decided that the failure to make a timely filing of a tax return is not excused by the taxpayer's reliance on an agent, and such reliance is not "reasonable cause" for a late filing under § 6651(a)(1).

The courts noted that the Oosterijks previously filed a paper extension in 2018. In the court’s eyes, they could have filed their own extension instead of relying on the CPA. The court ruled that the failure on the CPA’s part was not a reasonable cause for abatement.

My First Reasonable Cause Penalty Abatement case

When I first started my tax career, I had a client who was eligible for Reasonable Cause Penalty Abatement.

The client, we’ll call him Jim, came to the office the year prior (tax year 2014) to file his tax return. The office, at that time, was owned by someone else. Jim filed an extension. When he came back to file his return prior to the extension deadline, the office was SHUT DOWN! There was no warning. The previous owner did not notify anyone. What made it worse is that Jim had given the previous owner original documents!

NOTE: **Never give original documents to a tax professional.**

When we opened up the office in February 2016, Jim came to the office. We had to dig out Jim’s files from the old owner to assist him with completing his returns. Jim owed approximately $11,000 on his 2014, and another $9,000 on his 2015 tax return.

We drafted a Reasonable Cause Letter for Jim providing the timeline of events, including the approximate date of closure from the previous owner. The letter also noted that the office opened under new ownership in January 2016. Jim filed both the 2014 and 2015 taxes in February 2016, when he had all of his documents available. The IRS abated his failure to file penalties, but not the failure to pay since he had a history of owing (even though he normally paid on time). The IRS asserted that he should have paid something towards his tax bill because he normally owes.

Penalty Abatements are not guaranteed

Penalty abatements are a privilege, not a right. When requesting a Reasonable Cause Penalty Abatement, one must be able to document the reasonable cause. Remember, relying on your tax professional won’t necessarily get you off the hook either.

Trust Fund Recovery Penalty

Storytime: I was perusing my daily news and came across a story of a business owner who was sent to jail for not paying employment taxes. On June 30, 2022, Frank Morrison, former owner of Thirsty’s Bar was sentenced to 13 months in Federal Prison for Failure to Withhold, Properly to Account for, and Pay over Tax.

What did he do?

Mr. Morrison withheld Federal Income, Social Security, and Medicare taxes from his employees’ paychecks, but FAILED to send the money to the government. Let's not call it a failure. That sounds like a mistake. He just didn't do it.

Anywho, Mr. Morrison withheld the money from the paychecks. Instead of paying it to the government the way he was supposed to, he decided to use the tax money for his personal expenses.

He stole from the government and his employees

We already know that not turning the money over to the government is wrong, but what EXACTLY is the problem? When employees file their tax returns, they will either be due a refund or they will have a tax liability reduced by the amount of tax paid through withholdings. The government will issue a refund on tax money they never received. In the case of a tax liability, the Treasury Department is assuming they have a certain amount already in the treasury from withholdings. The taxpayer to pays the balance, and the government is short. We pay into the Social Security system and expect to be able to withdraw from it when we reach retirement age. Imagine submitting for Social Security only to find that you have no credits. Either way, the math ain’t mathing!

Trust Fund Taxes

Taxes withheld from an employee’s paycheck are called Trust Fund Taxes. Trust Fund Taxes consist of Federal Income Tax, Social Security Tax, and Medicare Tax - what we commonly call payroll taxes. An employer has the added responsibility of withholding taxes from the employee’s paycheck and sending the money to the Treasury at the prescribed time. The taxes are called Trust Fund Taxes, because they are held “in trust” until they are paid to the Treasury. Both the government and the employee are trusting the employer to do that.

Employers must pay the employee’s Trust Fund Taxes, along with the employer’s portion of Social Security and Medicare taxes to the Treasury through the Federal Deposit System.

Trust Fund Recovery Penalty

Through Internal Revenue Code (IRC) 6672, Congress established Trust Fund Recovery Penalties. The penalty was designed to encourage business owners to promptly pay Trust Fund Taxes. The Trust Fund Recovery Penalty is a “pecuniary penalty’, which means the government is penalizing the offender for actual monetary loss for unpaid trust fund taxes.

The Trust Fund Recovery Penalty is equivalent to the amount of the unpaid balance of the Trust Fund Tax, which is based on unpaid income taxes withheld and the employer portion of withheld FICA Tax. In other words, you're going to pay double. Let's assume you owe $1,000 in Trust Fund Taxes and don't pay. You will then have to pay $2,000 - the $1,000 you owe + $1,000 in penalties.

Who can be assessed the Trust Fund Recovery Penalty?

This will throw you for a loop! The Trust Fund Recovery Penalty can be assessed against anyone who is responsible for collecting or paying trust fund taxes but willfully fails to do so. That could include officers of a corporation, employees or contractors with signature authority over bank accounts, bookkeepers, or accountants.

Willfully is defined as voluntarily and intentionally doing something that is against the law. It means the person knew or should have known the requirements of trust fund taxes, but ignores the law. In Mr. Morrison's case, he committed this offense from 2008 to 2020. If willful was a person, he's it.

What happens when the Trust Fund Recovery Penalty is assessed?

The person(s), against whom the Trust Fund Recovery penalty is assessed, will receive a letter from the IRS. After waking up from passing out, one has 60 days from the date of the letter to appeal (75 if outside the US). If one does NOT respond, the tax will be assessed and a Notice and Demand for Payment will be sent.

Once the penalty is assessed, the IRS will start collection action against the responsible person(s). This could be business or personal assets, including filing a tax lien or seizing said assets. Please note that Trust Fund Recovery Penalties generally can NOT be discharged in bankruptcy.

Back to Mr. Morrison

Not only is Mr. Morrison going to prison for 13 years, he must also pay a fine of $200,000, $684,927.56 in restitution to the IRS, and $100 assessment to the Federal Crime Victims Fund. Going to jail does NOT remove the debt. It will be waiting for him when he gets out. Because of his age, it is possible Mr. Morrison may die in prison. The debt isn't automatically forgiven. The IRS can pursue his estate.

At this point, you may be wondering if all Trust Fund Recovery Penalty cases result in jail time. The answer is no. Generally speaking, when small business owners don't pay over trust fund taxes, they are usually using the money to keep the business going - whether in operations or payroll. The belief is 'I'll just do it this one time, and then I'll pay it back'. That normally doesn't happen. For situations like this, the responsible persons generally aren't prosecuted, but the money still has to be paid. The IRS usually reserves prosecution for those special folks like Mr. Morrison, who use the money for personal gain.

What’s the takeaway?

Don’t steal the employees' or the government’s money! Easy enough. But seriously, if the IRS is going to pounce on you and show you no mercy, it would be with Trust Fund Recovery. They are aggressive in their trust fund efforts. The best way to stay out of trouble is to not get in it in the first place.

TIP: Keep your payroll funds separate from your operating expenses to keep you from spending money that isn’t yours to spend.

What's the solution?

If you're having issues with owing back payroll taxes, the best thing to do is tackle it immediately. There are options for resolving the penalty issue, but it can be complex. If you’ve got one of those letters, don’t pass out. Schedule a call with us to help you!

Mileage Rate Change July 1, 2022

The IRS announced they will increase the mileage rate the latter half of 2022. Starting July 1, 2022, the mileage rate has increased to 62.5 center per mile to help ease the strain of the rise in gasoline prices. Business owners will need to report mileage from January 1, 2022 through June 30, 2022, and then from July 1, 2022 through December 31, 2022 to be able to properly deduct business mileage when they file their 2022 tax returns.

With that out of the way, let's talk about the mileage deduction!

Mileage is one of the most audited items in a business, as it is one of the highest paying and most abused deductions. It is imperative for business owners to accurately report business mileage. Guessing or using ‘same as last year’ just ain't it.

Vehicle Expense Deduction

Business vehicles are cars, SUVS, and pickup trucks that are used for business activities. There are other restrictions to vehicles that qualify for the business use of vehicle deduction. Today’s post is about mileage and expenses.

There are two ways to deduct vehicle expenses - the actual expense method or standard mileage rate. Here is a brief summary of each method.

Actual Expense Method

The actual expense method allows a business owner to deduct a portion of actual expenses. This deductible portion is in relation to the amount of business miles to overall miles.

The expenses included in this method are:

Vehicle loan interest

Insurance

Maintenance and repairs

Tires

Licenses

Registration Fees and taxes

Garage Rent

Parking and tolls

Gas and oil

Rental or Lease payments

Depreciation

With this method, the taxpayer needs to know the total number of miles driven for business and personal use. The deduction amount is the ratio of business miles to total miles driven.

Example

Jack drove a total of 15,000 miles during the taxable year. He reported 8,500 business miles. Jack reported $10,000 of vehicle expenses. What is the amount of his deduction?

8500/15000 = 56.6% - rounded to 57%.

57% of $10,000 (vehicle expenses) = $5700 (not including the depreciation amount).

Standard Mileage rate

Every year Congress sets a standard mileage rate for business miles. For 2022, the rate was originally 58.5 cents per mile for business travel. Because gas prices are higher than Snoop Dogg, Congress increased the mileage rate by 4 cents per mile to 62.5 cents per mile to offset the steep increase in prices. Of those amounts, 26 cents per mile is allocated to depreciation.

Accurate Mileage Log

The lack of an accurate mileage log gets business owners every time! Regardless of the method you choose, you must have an accurate, detailed mileage log. An accurate mileage log contains the following information:

Date the trip was taken: (self-explanatory)

Origin: The address where you started.

Destination: The address of where the trip stopped.

Number of miles: total miles between the two points

Purpose: List the business purpose.

Your mileage log will also contain the total miles driven for business in a tax period.

Why It's Important

In a recent opinion issued by the Tax Court, a taxpayer’s deduction was denied because of a lack of sufficient records. In Pedersen v. Commissioner, the taxpayer claimed a mileage expense as part of Unreimbursed Employee Expenses on his 2016 tax return. Although the case was related to Unreimbursed Employee Expenses, the principles are still the same as they relate to a business.

The opinion states: “For expenses relating to passenger automobiles, a taxpayer must substantiate with adequate records or sufficient evidence corroborating his statement (1) the amount of each separate expense using either actual costs or the standard mileage rate; (2) the mileage for each business use of the passenger automobile and the total mileage for all purposes during the taxable period; (3) the date of the business use; and (4) the business purpose of the use. See Treas. Reg. § 1.274-5(j)(2); Temp. Treas. Reg. § 1.274-5T(b)(6).”

While the Internal Revenue Code does not specifically state that one has to list odometer readings, it certainly helps “substantiate with adequate records”. In the end, Mr. Pedersen had to pay back approximately $1000 for disallowed mileage + penalties + interest (which gets compounded daily).

I’m willing to bet lunch money that the 2022 tax year mileage will be watched closely. It will be very easy for someone to overlook the change in mileage rate change mid-year. On audit, some or all of the mileage could be disallowed, and the difference will have to be paid back to the government. Tax professionals will have to ensure their clients show mileage from January 1 - June 30, 2022 and then July 1 - December 31, 2022.

The mileage rate increase, as of this writing, is temporary. Congress may choose to extend the increased rate through 2023. That remains to be determined.

If you are being audited, and are in need of assistance, schedule a call with us.