How PPP Loan Fraud Gets Caught

Let me start by saying that I’m neither a detective, nor an attorney. I’m a tax professional. However, you don’t really need to be anything special to know how government systems work, especially when it comes to money. As it pertains to the Paycheck Protection Program, the Department of Justice immediately established a fraud detection unit when the CARES Act was passed in March 2020. The Inflation Reduction Act of 2022 increased the time to prosecute PPP Loan Fraud to 10 years. That has some people shaking in their boots. With this post, I’m going to share how PPP Loan Fraud is getting caught.

Loan amount over $2 million

When the Payroll Protection Program (PPP) was created, then Secretary of the Treasury Steve Mnuchin announced that ALL PPP loans $2 million or more WILL be audited. There was no flexibility in that statement. That’s where they started, not where they stayed. People and companies that received loans in the millions were audited. If they received loans based on fraudulent information or misused funds… #Busted!

Mismatch Schedule C

In my opinion, this is the most common way PPP scammers will get caught. PPP Loans required Sole Proprietors, Independent Contractors and Single Member LLC owners to submit the Schedule C in the loan application. In the initial round of PPP disbursements, your loan amount was based on the amount of profit you earned. The rules changed once President Biden was elected. The loan was based on the amount of gross revenue shown on the Schedule C. In either case, the max amount of the loan was based on $100,000, so that the max loan amount one could receive is $20,833.

People were submitting Schedule Cs to the bank that had not actually been filed. Because the banks were under pressure to get the money out quickly, there just wasn’t time to verify the information at the time of the loan application. An applicant could submit a Schedule C even if they had not filed their taxes yet. PPP scammers received loans of approximately $20,000 because they claimed they earned $100,000 in income.

One of the forms you signed to get the PPP loan was a 4506-T. This form allows certain entities to pull your transcripts from the IRS. If your Schedule C doesn't match your application, or you don’t file a Schedule C at all… #Busted.

Mismatch Employment Tax Returns (Form 941)

The purpose of the PPP Loan was to assist small businesses in continuing to pay their employees during the Covid Emergency. The loan was based on the amount of your payroll. People claimed fraudulent employees and created fraudulent employment tax returns (Form 941) showing employees and payroll amounts that didn’t exist. I had a caller tell me that someone on Clubhouse was advertising that they would create the fraudulent 941s for you to use to support your loan.

Employment Tax Returns (form 941 filed quarterly) detail: wages you paid, income taxes, social security tax, and Medicare tax withheld. This report determines how much money your business should have paid to the government (Federal and State). The government compares what you claim on your 941s to what they have in their records. They look to see if they have records of 941s AND the money you claim to have paid to the government. Once the government determines that you have neither filed the returns, nor paid the withheld taxes… #Busted!

Social Media

Social Media has to be my favorite method of the government catching thieves. These days, people can’t keep ANYTHING to themselves. They gotta flex for the ‘Gram. Oy! The government will use your Social Media posts to convict you. People were using their fraudulent PPP loan money to buy ridiculous things - expensive cars and jewelry, homes, and clothes, then posting about it on social media. There was even a guy who posted about how he was committing fraud on YouTube. What?!?! … #Busted!

Bank Secrecy Act

One of the things that PPP Loan Ballers did was take out large sums of money. The Bank Secrecy Act “requires U.S. financial institutions to assist U.S. government agencies to detect and prevent money laundering. Specifically, the act requires financial institutions to keep records of cash purchases of negotiable instruments, file reports of cash transactions exceeding $10,000 (daily aggregate amount), and to report suspicious activity that might signify money laundering, tax evasion, or other criminal activities.”

PPP Loan fraudsters were quick to withdraw money. Any time you withdraw $10,000 or more in cash, the bank reports it to the IRS. Banks were looking at accounts getting PPP loan money and then watching the activity afterward. Guess what… #Busted!

Look, lying on loan forms or any federal form is a felony. If you have to lie on a loan form, then you really don't qualify for the loan. You can go to prison. Many people thought that the government wouldn't prosecute loan scammers. They also thought that if they got caught, they would just have to pay the loan back under favorable terms. Yeah... No. Just don't lie. It's that simple.

IRS Gets $80 Billion For What?

You’ve seen the news. You’ve seen the lightning flashing, and thunder roaring. You’ve heard the cries in the street!

“Oh my God! The IRS is hiring 87,000 people to come get us!”

“They’re coming for the poor and middle class!”

“Audits are going to increase!”

Lions, tigers, and bears! Oh MY!

The IRS is getting $80 Billion

Yes, the IRS is getting $80,000,000,000. That’s what $80 Billion actually looks like numerically. Anywho, this $80 Billion will be dispersed over 10 years. Here is a breakdown of the funding: Enforcement $45.6 Billion, $25.3 Billion for Operational support, $4.8 Billion to modernize IRS business systems (administration of taxpayer services, operations, and cybersecurity).

Backstory: The IRS has been underfunded for DECADES. They have antiquated systems that rival MS DOS. The irony is not lost in that systems received the least amount of funding. The IRS is also dealing with the Great Resignation.

The IRS is hiring 87,000 new Agents

Cool your jets! 1. These are not all going to be auditors. 2. They aren’t being hired Tuh-Day!

The IRS is facing the normal attrition of retiring individuals. They are also facing the same hiring struggles as every other business.

“It’s hard to hire for the IRS, when Target is paying $20 per hour”. ~Chuck Rettig, Commissioner of the IRS

There isn’t going to be a formation of an Army of Revenue Agents looking like the First Order in Star Wars, at least not TUH-DAY!

More Audits?

In the IRS’s strategic plan from a few years back, they told us they were going to be targeting high income non-filers. That plan has not changed.

The headline of the Treasury Inspector General for Tax Administration (TIGTA) report from May 2020 was: “High-Income Nonfilers Owing Billions of Dollars Are Not Being Worked by the Internal Revenue Service”. Guess what’s going to be happening now?

The headline of TIGTA’s December 2020 report was: “Billions in Potential Taxes Went Unaddressed From Unfiled Returns and Underreported Income by Taxpayers That Received Form 1099-K Income”.

The enforcement initiatives are not a surprise. Now, everyone is yelling, “Get your documentation in order”. If you prepare your return as if the IRS will show up tomorrow, they could hire a million revenue agents, which wouldn't matter to you.

Enforcement

The lion's share of the funding is going to enforcement. The goal of enforcement is to close the tax gap. According to the Treasury Department, the tax gap was $554 Billion in 2019. Approximately 84% percent of taxes owed in tax-year 2019 were actually paid or collected.

During the pandemic, the government stopped collection action. Since the pandemic is ‘over’, collection actions have resumed. If you have an outstanding tax liability, the IRS is pressed to get some sort of resolution - whether it’s an installment agreement or Offer in Compromise. Your goal as the taxpayer is to pay the least amount possible. The IRS's job is to collect as much as possible.

PPP Loan Fraud

Ahhh, we can’t talk about enforcement without talking about PPP Loan fraud! What types of PPP loan applications do you believe dominated the fraud? It was the Schedule C application. People were promoting PPP loans like they were an MLM like this case. People with absolutely NO financial background were out in these streets selling PPP loan application assistance like candy, helping people apply for fraudulent loans in exchange for a cut of the proceeds. The thieves submitted fraudulent Schedule Cs and false employee tax returns (941s) to obtain money they weren’t entitled to receive. Now the chickens are coming home to roost. A New York Times article (Aug 16, 2022), states:

There are currently 500 people working on pandemic-fraud cases across the offices of 21 inspectors general, plus investigators from the F.B.I., the Secret Service, the Postal Inspection Service and the Internal Revenue Service.

It also states:

The federal government has already charged 1,500 people with defrauding pandemic-aid programs, and more than 450 people have been convicted so far.

The Inflation Reduction Act increased the time for the government to prosecute PPP Loan thieves to 10 years. They stole taxpayer money. Should the government not work to get it back?

Status of the IRS

The image above is of the cafeteria in the Austin Tx processing center. According to the Washington Post, as of July 29, the IRS had a backlog of 10.2 million unprocessed individual returns. The IRS has severely outdated systems - paper-people based systems, fax machines, and the lack of ability to scan documents in the computer. Paper returns have to be manually keyed in. The pandemic only exacerbated the situation.

You may not like it, but the IRS needs this funding. It's that simple. The changes will not happen overnight. You have time to get your documentation life together, so that in the event you are audited, you'll be ready.

All You Need to Know About Currently Not Collectible Status

When a taxpayer can’t afford to pay a delinquent tax bill, one of the first questions that cross their minds is: Am I going to jail? We don’t have a debtor’s prison in the United States. The only people who go to jail for not paying taxes are the ones who actively and illegally attempt to dodge their tax requirements. There are people who actually cannot afford to pay their tax liability. That taxpayer can be placed in Currently Not Collectible (CNC) status. While this can provide taxpayer relief, it’s not permanent and it’s not a guarantee.

What is Currently Not Collectible Status?

Currently Not Collectible (CNC) status temporarily delays the collection of an outstanding tax debt. The IRS can place a taxpayer in CNC status if it is determined that a taxpayer cannot afford to pay their delinquent tax bill. The taxpayer will remain in CNC status until the taxpayer’s financial situation improves. Currently Not Collectible status doesn’t remove the tax debt, it temporarily delays collection. The IRS will file a lien if you owe $10,000 or more, but the actual collection efforts will be delayed. Penalties and interest will continue to accrue during the CNC period, as well. The delay means that they won't levy your income or seize your property. The Collection Statute Expiration Date (CSED) clock continues to run. The IRS has 10 years from the date of assessment to collect a debt. Currently Not Collectible status does NOT stop that clock from running.

Who is eligible for Currently Not Collectible Status?

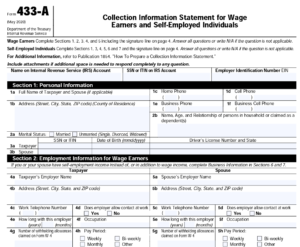

Just saying you can’t afford to pay your taxes isn’t enough to be placed in CNC status. A taxpayer who claims they can’t afford to pay their taxes will be asked to provide a Collection Information Statement (CIS) Form 433-A, 433-B, or 433-F. This Collection Information Statement details your financial situation - living expenses, assets, debts, and monthly income. Assets can include a wide variety of things - cryptocurrency, weapons, or a retirement account. The results of the CIS will determine if the taxpayer is eligible for CNC status.

National and Local Standards

As stated earlier, you can’t just ‘say’ you can’t afford to pay your taxes. You have to be able to prove that you can’t afford to pay your taxes, but this isn’t as easy it seems. The IRS has a guideline of allowable expenses, based on national and local standards. Items such as food, clothing and services, household supplies, and personal care products have a national standard for the allowable amount. There are national standards for healthcare and medical supplies. The amount of the standard takes into consideration the area of the country in which you live. The National Standard for housing in California is higher than in Virginia, for example. The standards also vary by county as well.

Monthly Disposable Income

The goal in completing the financial statement is to determine the taxpayer’s Monthly Disposable Income (MDI), which is the amount of money you have left after your allowable expenses are deducted from your income on a monthly basis. Your location and family size play a large part in calculating the amount of allowable expenses. If your MDI is zero or less, then you have a better chance to qualify for CNC. If your MDI is $1 or more, then you don’t qualify for CNC. Because you could actually be paying more for expenses than the IRS allowable amounts, your MDI may be different from the IRS's calculations.

Let’s look at an example: Jerry owes the IRS $27,000. The IRS is asking for $250 per month for payment. Jerry says, ‘I don’t have that money.’ Jerry is single, living in Alexandria, VA. He reports his expenses as this:

Monthly income: $4600

Rent and utilities: $3000 ($2500 rent + $500 Utilities)

Car Payment: $533

Car Insurance: $300

Food: $800

Credit card payments: $400

____________________

-$133 (monthly deficit)

However, the IRS reviews their National and Local standards for expenses. The IRS's CIS looks like this:

Monthly Income: $4,600

Rent and Utilities: IRS Allowable $2738

Car Ownership Allowable Expenses: $907

Food and supplies Allowable expense: $785

_______________________

$170 monthly disposable income

While Jerry doesn't have the $250 the IRS was initially asking for, based on the IRS's standards, he does have $170 monthly disposable income to pay toward his outstanding tax debt. This is when Jerry should contact us for assistance.

What about personal debt?

Personal debt tends to be a sticking point for taxpayers. As far as the IRS is concerned, they are your number one creditor. The IRS tends to ignore payments on personal debts such as credit cards or personal loans. There are some cases where the IRS will take those payments into consideration, but generally, payments on personal debt do not count toward your monthly expenses.

CNC is not permanent

The purpose of CNC is to provide relief to the taxpayer who is in a bad financial situation. The IRS will review the CNC status on an annual basis to see if your financial situation has changed. They may take refunds and apply them to the outstanding tax debt. It is important that the amount of tax debt does not continue to increase. The IRS may determine that you are not eligible for CNC status if your tax liability increases every year. You must remain current with your filings as well.