Injured Spouse or Innocent Spouse

Marriage is not a business, but there is business in marriage. Taxes have an impact on marriage. Outstanding tax debt definitely impacts a marriage. I recommend any couple contemplating marriage to swap credit reports and IRS account transcripts. Anywho, married couples have two options for filing - Married Filing Jointly or Married Filing Separately. Each has its pros and cons.

Married Filing Jointly

For married couples, filing jointly is usually the best way to go. The couple gets access to all the tax credits, and normally has a lower tax liability than filing separately. The downside of Married Filing Jointly is that each spouse is responsible for a tax liability, even if one spouse created it. The responsibility is attached to the tax year. It doesn’t matter if the couple divorces. Each person remains responsible for the tax debt until it is paid. For example: You were married in 2019 and filed jointly, but the tax bill was never paid. You got a divorce in 2021. Both spouses are still responsible for the tax debt for tax year 2019, even though you are no longer married.

Let’s assume that your spouse owes back taxes. When you and your spouse file your taxes, you’re due a refund. Yay! Then a few weeks later, you check the status of your refund to find that it had been applied to your spouse’s past tax debt.

Married Filing Separately

The benefit of filing separately is that each spouse is responsible for their own tax bill. While that is a great benefit, the cumulative tax bill is generally higher. Married Filing Separate couples are not eligible for certain tax credits: earned income credit or American Opportunity Credit for example. The only thing really gained from filing separately is that neither spouse is responsible for the other spouse’s tax liability.

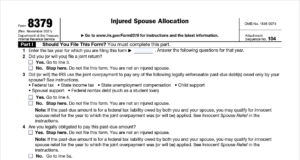

Married Filing Jointly Injured Spouse

If a spouse owes a tax debt that was in place prior to the marriage, the current spouse won’t be held liable for the debt; HOWEVER any refund due to the couple will be applied to the owing spouse’s tax debt. The Injured Spouse provision in the tax code allows married couples to take advantage of filing jointly without having to be financially responsible for past tax debt. Here’s how it works:

Jack and Sue were recently married. Jack discovered that Sue owed back child support. When Jack and Sue prepared their tax return, they were due a refund of $1500. Since Jack did not want to be responsible for paying Sue’s back child support, Jack filed the Injured Spouse Form 8379 with the tax return. Jack will receive his portion of the refund back. Sue’s portion of the tax refund will get held and applied to back child support.

What is Innocent Spouse Relief?

An Innocent Spouse claim is related to a tax bill. Essentially, one spouse is saying, “yes, there is a tax bill, but I should not be responsible to pay it.” It can be a real challenge to prove an innocent spouse claim.

Since a joint return requires both signatures, it would be difficult to prove that one spouse didn’t know about the tax bill or only one spouse should be responsible. The first question anyone will ask is: If you were not responsible for the tax liability or believed the return to be incorrect, why did you sign the return?

There are cases of domestic and financial abuse, in which one spouse controls access to the finances, to include taxes. Innocent spouse claims are filed on Form 8857, separate from the tax return.

The issue with an innocent spouse claim is that Spouse 1 is arguing that Spouse 2 created the tax bill and Spouse 1 shouldn’t be held responsible to pay it. Spouse 2 is claiming that Spouse 1 should be responsible to pay the tax bill as well.

The IRS looks at different variables such as your age, educational level, and the type of job you have, or if there was documented abuse involved. If the IRS determines that you were intelligent enough that you should have known about the tax bill, and abuse can’t be proven, then an innocent spouse claim will probably get denied.

Facts and circumstances will determine the success of the Injured Spouse or Innocent Spouse claim. Please note: The IRS also does not follow divorce decrees. If your divorce decree says your spouse is supposed to pay the tax bill, and they don't, you're still responsible in the eyes of the IRS.

If you require assistance with either of these claims, reach out to us to schedule a call.

IRS Taxing Fraudulent PPP Loan Forgiveness

On September 16, 2022, The Office of Chief Counsel of the IRS issued a memorandum regarding fraudulently forgiven PPP Loans. It seems that fraudulent PPP loan issues will never die. The short story: If you received PPP loan forgiveness under false pretenses, you must claim that amount as taxable income.

PPP Loan History

When the Coronavirus (Covid-19) pandemic struck in the United States, everyone was sent to a collective timeout. Businesses had to shut down. Citizens were warned to stay away from populated places. Covid-19 devastated many businesses. The government responded with the Paycheck Protection Program (PPP) Loans to assist small businesses with paying payroll and other eligible expenses. These loans were processed by lenders and guaranteed by the Small Business Administration (SBA).

There were two rounds of PPP Loans. The first was issued under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The second was issued under the Economic Aid Act, which amended previous PPP Loan provisions. For both rounds, lenders made these loans to “eligible recipients under specified terms, conditions and processes of the program”. The lenders could forgive the loans based on certain criteria and be reimbursed from the SBA.

Who was eligible to receive a PPP Loan?

According to the internet, EVERYBODY was eligible to receive a PPP Loan. [Insert the biggest eyeroll possible].

The actual requirements to be eligible to receive a PPP Loan were:

- Be a small business (as determined by the SBA), independent contractor, eligible self-employed individual, sole proprietor, business concern, or a certain type of tax-exempt organization.

- In business on February 15, 2020

- Either had employees or was an eligible self-employed individual, sole proprietor or independent contractor.

What were eligible PPP Loan expenses?

Paycheck Protection Program loans were issued to cover specific, eligible expenses. These expenses include payroll costs, rent, interest on the business’s mortgage, utilities, and other operational expenses; SUBJECT TO REPAYMENT and additional liability if the funds were misused. You were not eligible to take PPP loan funds and start a business.

PPP Loan forgiveness qualifications

Loan forgiveness was truly the selling point of PPP Loans. To receive PPP Loan forgiveness one had to meet the following:

- At least 60% of the loan must be used for payroll

- Up to 40% of the PPP loan could be used for other operational expenses.

If a recipient used 100% of their PPP Loan to cover payroll costs, then the loan qualified for loan forgiveness. Forgiven PPP loan funds were excluded from taxable income. This was truly free money from the government!

Fraudulent PPP Loan Forgiveness

If you receive PPP loan forgiveness based on false statements, your loan does not actually qualify for forgiveness and must be included in taxable income. For example, let’s assume you were an eligible recipient and received a $20,000 PPP loan. Your documentation said that you used 100% of the PPP loan proceeds to pay payroll expenses (eligible expense), and the loan was forgiven. In reality, you actually used the funds to buy a car (ineligible expense). You must include the $20,000 as taxable income.

Fraudulent PPP Loan Recipients

If you received a PPP Loan, and you were not an eligible recipient, your loan does not qualify for forgiveness. If you submitted your loan and received forgiveness, you must include the forgiven amount as taxable income.

Let’s assume you received a $50,000 PPP loan based on false representation that you had a business with employees and received the loan disbursement. Later on, you submitted false documentation representing that you spent the loan funds on payroll for non-existent employees. You must claim the $50,000 on your tax return as taxable income.

Forgiven PPP Loans - Income or Nah?

Internal Revenue Code Section 61(a) states that “gross income means ALL income from whatever source [legal or illegal] derived.” This applies to all payments that are “undeniable accessions to wealth, clearly realized, over which the taxpayers have complete dominion” constitute taxable income - Commissioner v. Glenshaw Glass Co. (1955). Internal Revenue Code section 636m(i) of the Covid Tenant Relief Act provides the exclusion of forgiven PPP Loan funds from gross income.

Once PPP Loans are forgiven, the funds provide for an “undeniable ascension to wealth”, especially when you flex for the ‘gram and post your ill-gotten gains. However, if your loan was forgiven based on lies - spent on ineligible expenses or you were an ineligible recipient - your loan was not forgiven based on the specific terms of the program and you must claim it as income.

Forgiven loan funds are not taxable income unless the forgiveness was based on fraud. Let's assume that you obtained a PPP Loan fraudulently, and received forgiveness, but don't claim it on the return. Should you get caught in your illegal dealings, you should look for a charge of tax evasion to be added to the fraud charges you'll get.

How long do you have to claim a Refund?

I was watching a video, and the creator erroneously claimed that you have three years to file your taxes. I reviewed the comments and watched all of the people cyber high-fiving at this false information. It was painful. I’m here to set the record straight.

When do you have to file?

You are required to file your tax return generally by April 15th every year. If you cannot file your return, you must request an extension of time to file, which provides an additional 6 months to file your return. Filing the extension is requesting additional time to file your paperwork. It does not extend the payment deadline. There are no penalties for late filing when there is a refund. But this blog post isn’t about a tax bill, it’s about a refund.

Refund Statute Expiration Date

As I stated, the inspiration for this post came from a YouTube video. You are required to file your return on time every year (to include extension). If you don’t, you have three years to claim a refund. If you file an extension, the deadline is the extended due date. What does this look like?

Let’s assume you have not filed your 2021 tax return. The original due date for filing the 2021 tax return was Monday, April 18, 2022. One had to file the return or request an extension. Assuming you are due a refund on your 2021 tax return, the FINAL deadline to file your return to request a refund is April 15, 2025. If you file an extension, then the FINAL deadline would be October 15, 2025.

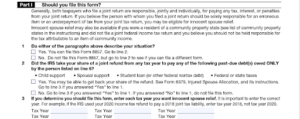

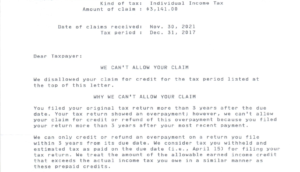

What happens if you don’t file within 3 years?

Let’s look at an actual example. A taxpayer filed his 2017 tax return late, and was due a refund. The original filing deadline for tax year 2017 was April 17, 2018. The taxpayer did not file an extension. The FINAL deadline for requesting the refund was May 17, 2021. Note: The normal deadline of April 15, 2021 was extended a month for Covid relief. The taxpayer did not file the return until November 30, 2021.

Once the Refund Statute expires (RSED), the IRS gets to keep your money. That’s it! Your refund becomes property of the Department of Treasury. There are generally no take-backs on this rule, unless there are extenuating circumstances. You have to be able to prove those circumstances. Even if you have past tax debt, you still do not get access to the refund to reduce the tax debt. This taxpayer 'donated' $3,141 to the Department of Treasury.

Here’s an example. This taxpayer had several unfiled years, and owed taxes for tax year 2015. They would have been due a refund for the 2017 tax return, which was filed in November 2021. The Refund Statute expired in May 2021, so the 2017 refund was NOT be applied to the 2015 tax debt.

I know what you may be thinking. If you OWE the government, they have 10 years to collect and there are penalties and interest! Yes, you are correct! You, however, only have 3 years to claim a refund.

If you learn nothing else from this post, file on time, even if you think you’re going to owe. If you have unfiled tax returns, reach out to us! We’re here to help!

The #1 Way to Avoid an Audit

Someone asked me, “LuSundra, what is the number one tip you would give to help a business owner avoid an audit?”

My answer: Don’t invite one.

The IRS decides to audit.

The decision to audit lies strictly with the IRS. There really is nothing you can do to avoid an audit. No tax professional can ever tell you that you will or won’t get audited. We don’t make that decision.

Are there red flags that may trigger an audit? Yes!

However, you can also file a perfect tax return and still get audited. That’s just the nature of filing taxes. That’s why I always recommend preparing your return as if you knew that the IRS was going to show up tomorrow. Tomorrow may come one day.

Red flags that can trigger an audit

There are some things that can trigger an audit. The sad thing is that these audit triggers are common knowledge, yet people seem to keep doing them and expect to NOT get audited. Talk about the definition of insanity! Anywho, here are a few audit triggers that send an engraved invitation to the IRS to audit you.

Excessive business losses:

The most publicized fraudulent activity is with Schedule C business losses. If you have losses 3 out of 5 years, you might get audited. (In my best ‘You might be a redneck’ voice).

Does having business losses automatically mean you will get audited? No.

However, if you have years of business losses, and those losses consistently produce a large refund, that’s going to make the IRS pause and dig a little deeper. How can one stay in business if you’re consistently losing large amounts of money.

All round numbers:

As tax professionals, we see it all the time. If all your income and expenses are even rounded numbers, you might get audited!

Income - $25,000

Utilities - $1,000

Advertising - $5,000

Commissions and fees - $7,000

Really?? All your income and expenses were these nice round numbers? No change? Have you ever seen a utility bill that was rounded to the nearest $10?

All those round numbers tell the IRS that you are making up the numbers versus providing actual expenses.

Cash Heavy Businesses:

Businesses like barber shops, hair salons, car washes, vending machines, etc. are cash heavy businesses. Cash, for the most part, isn’t traceable, which tempts people to under-report their income. It also leads to the round figure reporting, discussed in the previous paragraph. Listen, don’t let the smooth taste fool you. The IRS has a Criminal Investigative division. Your audit may start out as the IRS requesting receipts or invoices to prove the information on your tax return. If you can’t provide what they ask for, the auditor will make an adjustment on your return. Make no mistake, a ‘simple’ audit can turn into a criminal investigation.

Excessive Itemized Deductions:

The Tax Cuts and Jobs Act of 2017 removed the majority of itemized deductions and limited others. There are very few people who itemize their deductions these days. When taxpayers have excessive tax deductions, that may cause the IRS to pause and take a look. For example, if a taxpayer takes an excessive amount of mortgage interest deduction or has a disproportionately high amount of charitable deductions, an audit will be invited, because the numbers don’t make sense.

If you received an audit notice, reach out to us! We're here to help!

Statute of Limitations

The Statute of Limitations is critical in the fight against the IRS. It is important to know which statute of limitations applies to your situation.

Definition

In general, the Statute of Limitations refers to the amount of time a party can take action from the time a situation occurred. The IRS has different statutes of limitations by which to abide. The date the statute of limitations ends is called the Statute Expiration Date.

3-year Audit Rule Statute of Limitations

The IRS generally has three years to audit your return. They can add more years if they find a substantial error, but usually no more than 6 years. The IRS can go back FOREVA if they suspect fraud or criminal activity.

Substantial Understatement of Income

The statute of limitations for audit is extended to six years if you omit (leave off) more than 25% of your gross income.

In tax year 2021, Jane earned $150,000, but only reported $110,000. The difference is $40,000 (~27% of $150,000). Since the difference is greater than 25%, the six year statute applies. Jack also earned $150,000, but reported $114,000, a difference of $36,000 (~24% of $150,000). The three year assessment would apply to Jack's situation since the difference is less than 25%.

Basis Overstatement

Congress decided in 2015 that basis overstatement produces an understatement of income, and extended the statute of limitations to six years vs. three years.

Example: Let’s assume you sell an investment property for $1 million. You claim your basis (the amount you invested) is $800,000, but it’s actually much lower at $250,000. The impact of your overstatement of basis is that you paid tax on $200,000, when you should have paid tax on $750,000. The IRS has 6 years to figure that out.

Refund Statute of Limitations

The Refund Statute Expiration Date (RSED) refers to the amount of time a taxpayer has to claim a refund. Generally, the refund statute of limitations is three years from the date a tax return is due OR within 2 years after the overpayment of tax.

Let’s assume you have not filed your 2017 tax return and you were due a refund. The 2017 tax return filing deadline was April 17, 2018. The last day to claim your 2017 tax refund was April 18, 2021. If the refund wasn't claimed by April 18, 2021, the statute of limitations has expired. You can no longer claim the refund. #Ewwww

Assessment Statute Expiration Date (ASED)

The IRS has three years from the time a return is filed to assess a tax. A tax assessment is the statutorily (by law) required recording of the tax liability. According to §6203, the assessment is made by recording the taxpayer’s name, address, and tax liability. In other words, the IRS has a required statute of limitations to record your tax within three years of the due date of your return, or from the time the return is filed (whichever is later). The Assessment Statute Expiration Date (ASED) on a tax return timely filed by Apr 15, 2022 is April 15, 2025.

Collections Statute of Limitations

The IRS generally has a statute of limitations of 10 years from the date the tax is assessed to collect a federal tax debt. The IRS has to write off any tax debt that's not paid by the end of the 10-year statute. It disappears like it never existed. There are situations that can toll (extend) the Collection Statute Expiration Date (CSED) - bankruptcy proceedings, for example.

Statute of Limitations on Unfiled or Fraudulent Returns

There is no statute of limitations on fraud. If you filed a fraudulent return, it’s as if you never filed a return at all.

Examples

- Tax preparers go to jail regularly for filing fraudulent returns on behalf of their clients. Sometimes the clients are aware. Sometimes they are not. Assume you are a victim of a preparer who filed a tax return containing fraudulent business losses to get you a bigger refund. Even though you may not have known the return contained fraudulent information, there is still no statute of limitations on the tax return. Theoretically, the IRS can find out about the return 10 years later, and still require the taxpayer to pay back any refund they were not entitled to receive.

- The statute of limitations never starts on a return that is never filed. The IRS may file a Substitute for Return (SFR), but that doesn’t count as a filed return either. The SFR doesn’t take into account any tax credits or deductions to which you may be entitled. The IRS uses the income reported by third parties and assesses the tax based on that. It’s important to note that filing an incomplete return, such as an unsigned return, does not count as filing a return.

The statute of limitations listed above are the most common statutes taxpayers experience. It’s important to know the statutes of limitations that apply to your situation. If you have received a letter from the IRS or have unresolved tax debt, reach out to us at 877.4TAX411 (877.482.9411).