Can Service Providers Issue a 1099-C for Unpaid Bills?

Social media never fails to provide the most false or misleading tax information. This post did not disappoint. The social media post said:

$130K in unpaid contracts over here.

I don’t argue. I have forgiven their debt on my end with a 1099-C.

Now it’s between them and the IRS beloveds. It’s above me now.

If you do B2B transactions do not argue. Make their debt to you taxable. They do not get to claim a tax break when they did not start or finish paying you.

Protect your business and your blood pressure 😊

The post was made by a service provider who had unpaid bills. The post had 20 comments and 597 likes. Almost 600 people saw this post, and thought 'this is really cool'. A few others commented that 'this was an education', and others stated that they were going to do this ASAP! Uhhh NO!!

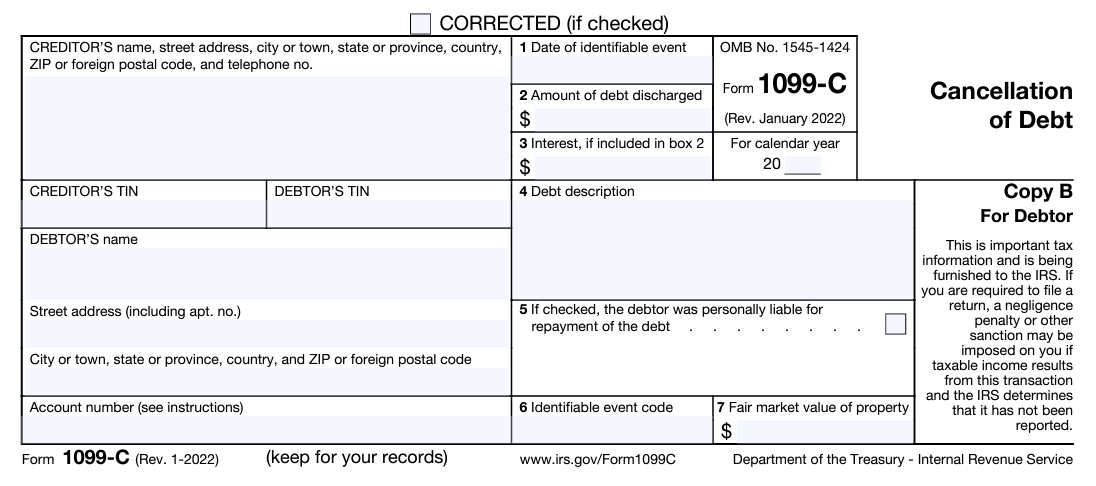

Purpose of a 1099-C Cancellation of Debt

The IRS form 1099-C, Cancellation of Debt, is designed for financial institutions (such as banks) to report a cancellation of debt [usually related to non-payment] of $600 or more. This cancellation of debt, most often, is treated as taxable income to the debtor, and must be claimed on the tax return. A creditor/debtor relationship is established. There is a loan amount, loan payment terms, interest rate, and methods of resolution in the event of default (non-payment).

Who Can File a 1099-C

Internal Revenue Code 6050P makes a specific list of entities who can file a 1099-C:

- A financial institution described in section 581 or 591(a) (such as a domestic bank, trust company, building and loan association, or savings and loan association).

- A credit union.

- Any of the following, its successor, or subunit of one of the following.

- Federal Deposit Insurance Corporation.

- National Credit Union Administration.

- Any other federal executive agency, including government corporations.

- Any military department.

- U.S. Postal Service.

- Postal Rate Commission.

- A corporation that is a subsidiary of a financial institution or credit union, but only if, because of your affiliation, you are subject to supervision and examination by a federal or state regulatory agency.

- A federal government agency including:

- A department,

- An agency,

- A court or court administrative office, or

- An instrumentality in the judicial or legislative branch of the government.

- Any organization whose significant trade or business is the lending of money, such as a finance company or credit card company (whether or not affiliated with a financial institution). The lending of money is a significant trade or business if money is lent on a regular and continuing basis.

Please note that you do not see a service provider with an unpaid bill in the list.

Providing a Service does not create a Creditor/Debtor Relationship

When a service provider engages a client for services, It creates a provider/client relationship. A service provider agrees to perform a service in exchange for an agreed amount. There are remittance (payment terms), such as payment due in 15 days, due immediately upon completion, or due in advance. While this is a contract, it does not create a creditor/debtor relationship. The service provider is not lending money to the client.

Filing a False 1099-C Consequences

This service provider seemed really snappy and clappy, seemingly to believe that she will cause their client to have an unexpected tax bill. However, should she issue a 1099-C for an unpaid bill, there are consequences.

Internal Revenue Code 7434 states:

If any person willfully files a fraudulent information return with respect to payments purported to be made to any other person, such other person may bring a civil action for damages against the person so filing such return.

https://www.law.cornell.edu/uscode/text/26/7434

The person filing the false 1099-C can be liable for the GREATER of $5,000 or the sum of damages, costs of the action, and attorney's fees. A plaintiff (the one who received said 1099-C) has 6 years from the date the false 1099-C was filed or 1 year after the return would have been discovered with reasonable care. Oh yeah, the IRS wants a copy of the suit, as well.

It can be quite frustrating when you provide a service to your client, and they don't pay the bill. You can go through a collection agency to try to recoup your money. You cannot deduct the amount of unpaid funds, unless you're using the accrual method of accounting. The only reason it is a deduction for the accrual method is that you've already counted the income. Regardless, issuing a 1099-C is not the method for service providers to collect their unpaid funds.

If you are dealing with back taxes or unpaid tax debt, reach out to us! We're here to help!

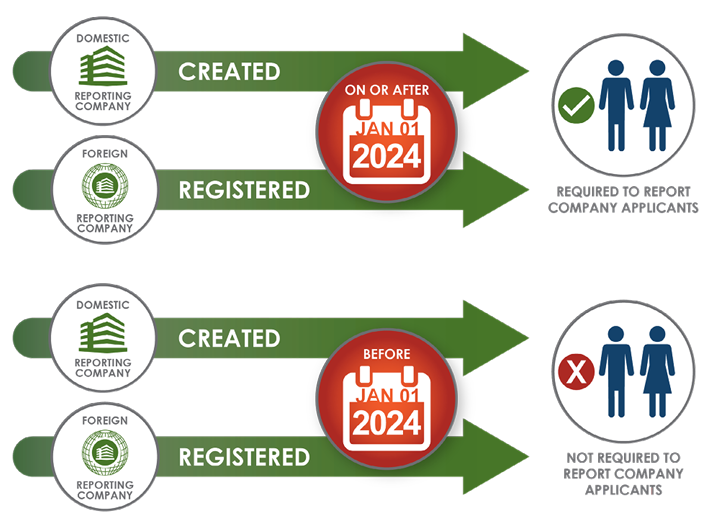

BENEFICIAL OWNERSHIP INFORMATION REPORTING 2024

Phase 1 of the Corporate Transparency Act (CTA) went into effect on January 1, 2024. It imposes a new federal filing requirement for most corporations and limited liability companies (LLCs) formed in 2024 and later. It also applies to businesses formed before January 1, 2024, but the requirements are different. See the note at the bottom of the post.

What was the Corporate Transparency Act all about?

Usually when the government creates new laws and requirements, it’s in an effort to curtail criminal activity. This is no different. The purpose of CTA is to attempt to prevent anonymous shell companies for money laundering, tax evasion, and other illegal purposes. As with everything else, the good get caught up with the bad, hence BOI Reporting. #ThanksCriminals

The BOI Report applies to businesses formed by filing with the Secretary of State, such as LLCs and Corporations. Some businesses are exempt. You can find the list of exemptions here. If you are unclear as to whether or not you are exempt, file the BOI report. One of my tax mentors told me once, ‘There is no such thing as over-reporting. When in doubt, REPORT!’

Deadline to file BOI Report

Applicable companies that were formed January 1, 2024 or after, have 90 days to file the BOI report. The report is filed at: https://www.fincen.gov/boi. The report contains specific information for each beneficial owner.

According to FINCEN, a beneficial owner is defined as “any individual who, directly or indirectly, exercises substantial control over a reporting company, or who owns or controls at least 25 percent of the ownership interests of a reporting company.”

Here is the information you’ll need for each Beneficial Owner to complete the BOI Report:

- Full legal name

- Date of birth

- Complete current residential street address

- A unique identifying number from a current U.S. passport, state or local ID document, driver’s license, or foreign passport

- An image of the document that contains the unique identifying number

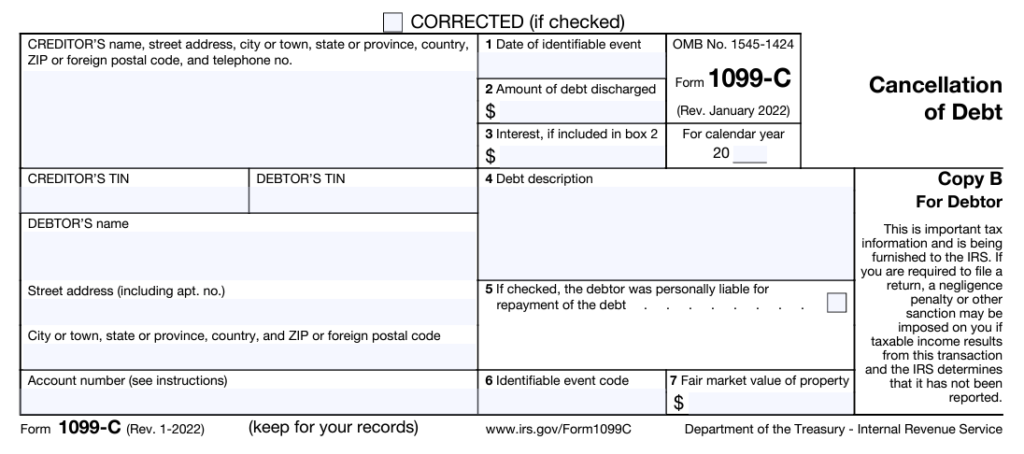

BOI Company Applicant

A company applicant is defined as either the "direct filer, or the individual who directs or controls the filing action". A reporting company is also required to report its company applicants if it is either a:

• domestic reporting company created on or after January 1, 2024; or

• foreign reporting company first registered to do business in the United States on or after January 1, 2024.

Each reporting company that is required to report company applicants will have to identify and report to FinCEN at least one company applicant, and at most two. All company applicants must be individuals. Companies or legal entities cannot be company applicants.

Who is responsible for filing the BOI report?

There is a lot of misinformation about who is actually responsible for filing the BOI Report. The responsibility belongs to the Beneficial Owner(s). The BOI Report is NOT a tax report, therefore your tax professional or accountant is not responsible for filing this report. Can they offer the service? Sure. However, it is not a part of tax preparation, just as filing your annual report with the state is not a tax preparation function. Attorneys are also available to assist you with filing the report. If you hire someone to provide this service for you, trust but verify. The ultimate responsibility lies with the Beneficial Owner(s), not the person you hired.

What if you don’t file the BOI Report?

There’s always someone who asks, “What if I don’t want to?” The willful failure to report may result in a civil or criminal penalties, including civil penalties of up to $500 for each day that the violation continues, or criminal penalties including imprisonment for up to two years and/or a fine of up to $10,000. Senior officers of an entity that fails to file a required BOI report may be held accountable for that failure. Responsible persons can also be penalized for providing false or incomplete information to a company, knowing that it is intended to be reported to FINCEN.

To be clear though, nobody is coming to your house to arrest you today for not filing your BOI Report. People are advertising in a way to frighten you to hire them. The earliest anyone has a report due is March 31, 2024.

30 Days to update the BOI Report

Once the initial report is filed, a Beneficial Owner has 30 days to report any changes to Beneficial Ownership. If a Beneficial Owner moves, you must update the BOI report within 30 days. If a company adds an owner, you must update the BOI report within 30 days.

Note: If you formed your business before 1/1/2024, you have until 1/1/2025 to file your report, and you are NOT required to report your company applicant. If your company is created or registered on or after January 1, 2025, it will have 30 calendar days to file its initial BOI report.

BOI Small Entity Compliance Guide

FINCEN created the Small Entity Compliance Guide to answer your questions. Grab a copy here!

The New Self Employed Covid Credit

Ahhh… Have you seen the ads?

“1099 Gig Workers Claim up to $32,000 with the ‘New’ Covid Self Employed Tax Credit (SETC).

Oy! I decided to write this blog post once I got a few inquiries from my clients. Quite frankly, these companies make my skin crawl. I’ve even seen influencers, who have ZERO experience with tax, telling their audiences to go ‘get this money’, BUT ... ‘check with your CPA first’. [Insert my best side-eye.]

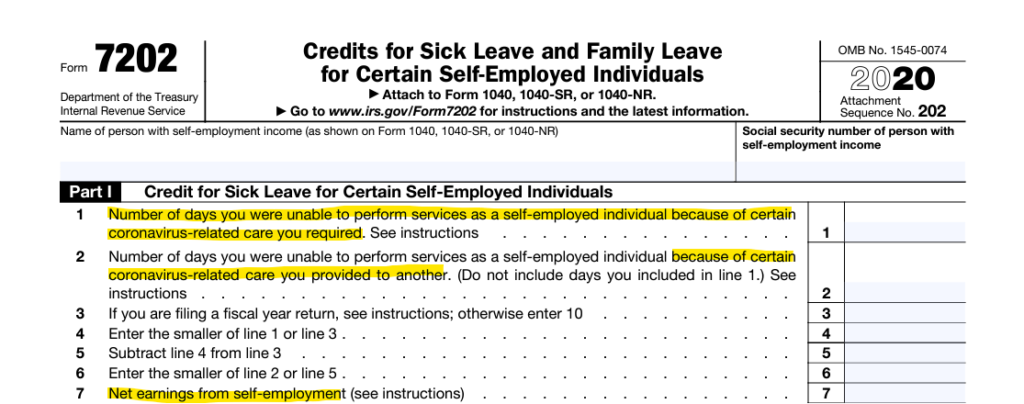

The actual name of the credit is the Self-Employed Sick and Family Leave Credit. SETC is not a thing. If you ask a tax professional about the SETC, they’ll probably be confused, because that’s not the name of the credit. However, to gain understanding about this credit, I will use the Street Committee Name - SETC. Let’s talk about how we got here.

Employee Retention Credit Claims - FROZEN

In September 2023, the IRS ordered the immediate stop to Employee Retention Credit (ERC) processing. They received several millions of ERC claims, many of them fraudulent. Employers could still submit claims, but they would not be processed. FYI, Tax Year 2020 ERC claims need to be submitted no later than April 15, 2024. The credit is claimed on Form 7202.

ERC claims were lucrative, and these companies made a BOATLOAD of money, charging 20% of the credit received. If a client received a claim for $60,000, the companies would be paid $12,000. That's a heck of an incentive to submit fraudulent claims. Should the IRS come knocking, it would be at the employers' doors, not the company that fabricated the information on the claim. The IRS pumped all the brakes on that.

SETC is the new ERC

Since the ERC well dried up, these companies shifted their sights to the Self-Employed Sick and Family Leave Credit. Now Self-Employed individuals are being bombarded with advertisements of being able to get ‘up to’ $32,000 from the SETC. It only takes a few minutes to apply (insert affiliate link). You didn't think people were posting about it just to help - right? I'm not mad at anyone earning affiliate commissions. I do it all the time. I AM annoyed at promoting something that has serious consequences if the person doesn't get all the information. A tax credit is not the same as promoting the latest email marketing tool.

Under the 2020 rules, a self-employed individual could claim up to $15,110. For 2021, they could claim up to $17,110; hence the total $32,000. The clock is ticking on claiming the 2020 tax credit, so the ads are on fire.

Qualifications for Self-Employed Tax Credit

There are three main questions you have to answer to determine if you qualify for the credit.

- Were you unable to work because you had Covid?

- Were you unable to work because you had to care for someone with Covid?

- Did you earn a profit?

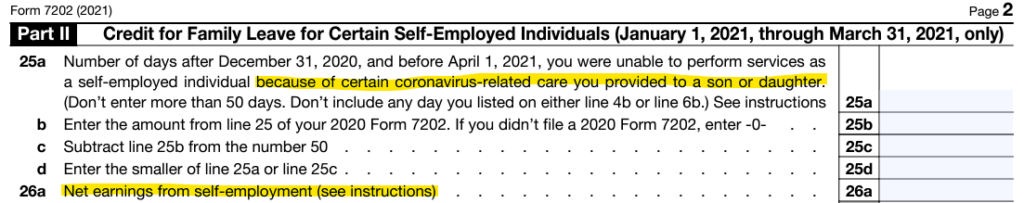

In 2021, the qualifications were tweaked a bit. In part II of the form below, Form 7202 specifies “January 1- March 31, 2021”, and also specifies caring for a son or daughter (see instructions). The instructions say: “because of certain coronavirus-related care you provided to a son or daughter whose school or place of care is closed or whose childcare provider is unavailable for reasons related to COVID-19 or for any reason you may claim sick leave equivalent credits.

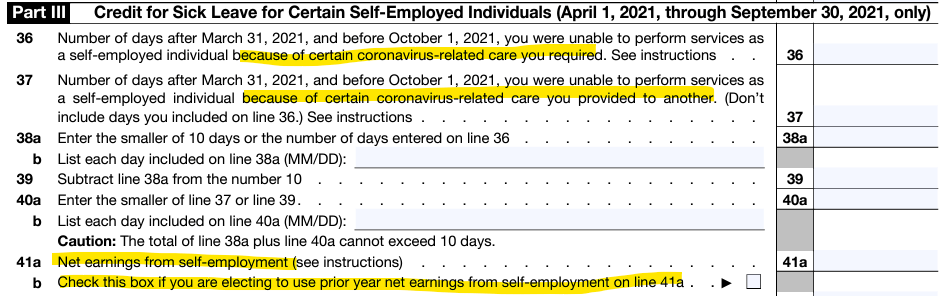

Part III of the 2021 version of Form 7202 specifies April 1 through September 30, 2021, for yourself or care you provided to another. The section specifically for children was removed. The great thing about the credit is that you could separate the time you needed to care for yourself or another from the time you needed to care for your children.

Part III 2021 Form 7202

Plenty of Self-Employed individuals were impacted by Covid. I don’t know any that were not; however, being impacted by Covid did not automatically mean you qualified for the credit. Millions of self-employed individuals lost money in their businesses during Covid. If you look at both the 2020 and 2021 Form 7202, it asks for ‘net earnings’ from self-employment (amount of profit). If you claimed a loss, you did not qualify for the credit. The advantage of the 2021 version of the credit is that you could use net earnings from 2020. If you posted a loss in 2020, then you still did not qualify for the credit.

Be prepared for an audit

If you qualify for the credit and didn’t claim it, by all means, amend your return to claim your credit; however, I also caution you to be ready for an audit. The auditor will ask for bank statements to confirm revenue and expenses. They may also ask for proof that you had Covid, a family member had Covid, or that your childcare facility or school was closed. Closed daycare and schools won’t be hard, for sure. While your health information may be protected, your banking information is not. You have to be able to prove anything you claim on your return.

Don’t be duped into claiming false credits. The false claims are why there is a moratorium on the Employee Retention Credit. If the IRS or State comes knocking on your door (figuratively, they’re not coming to your house right now), but if you get the letter being notified of an audit, reach out to us at ETS Tax Relief to help you!