BEWARE Military Disability Scam

My husband retired from the military in April 2022. It was an awesome occasion when it finally got here; however, getting there was slightly painful. He had to go through tons of briefings on his own. We also had to go through a finance briefing. Because I am who I am, I requested to visit finance several months prior. Nothing irks me more than being made to make financial decisions, before you’ve had a chance to digest the information. I’ll get off that soapbox, because that’s not what today’s post is about.

When a Servicemember Retires

When a servicemember retires, they can receive retirement income, as well as disability benefits. In the process of retiring, servicemembers have to go through a process to determine their disability rating, which can range from 0 - 100% disabled. Just for clarity, that disability rating does not mean there is necessarily a visible physical impairment.

The disability rating will determine if there is any portion of the retirement income that is not taxable. The service members receive two separate payments - retirement income (taxable), and disability income (non-taxable).

The Strickland Rule

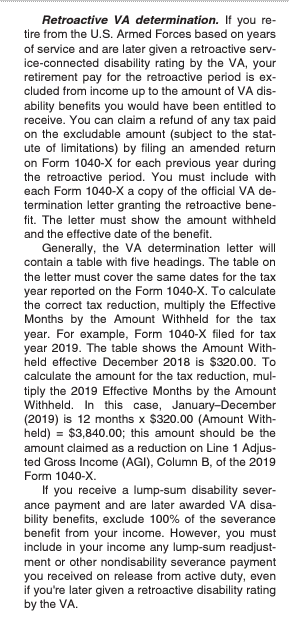

In current times, most service members receive their disability rating at the time they retire, so the payments are accurate. There are situations though, where a service member retires, and then receives a disability rating later on. If that disability rating is made retroactive, then the service member may be entitled to a refund of a portion of the taxes paid.

In Revenue Ruling 78-161, Zebulon Strickland, COL(RET) received a retroactive disability rating. In short, he argued, and it was held, that he was entitled to a refund of taxes paid on the retirement income previously paid during the retroactive time.

The scam that followed…

Your retirement income is not taxable

When my husband retired, a few of his friends sent him an email. It was the exact same email that was sent from different people saying that his retirement income is not taxable, because of his disability rating. Naturally, he sent the email to me.

- The attached memo says:

Dear DFAS,

In accordance with the attached IRS Publication 525, because I am 100% disabled, certain

Military and government disability pensions are not taxable. I am requesting to have the code

changed in DFAS to reflect me not paying taxes on my retirement pay.

Thanks for your prompt assistance in this matter.

Writing Exempt on the W-4

Let me tackle the easy one first. If you send a W-4 to payroll with ‘Exempt’ written on it, they will stop withholding federal taxes. That doesn’t mean you won’t owe taxes. It just means you instructed the payroll department to not withhold taxes. When you file your return, your 1099R will show both the distribution amount and the taxable amount, which will be the same. You will have tax liability when you file.

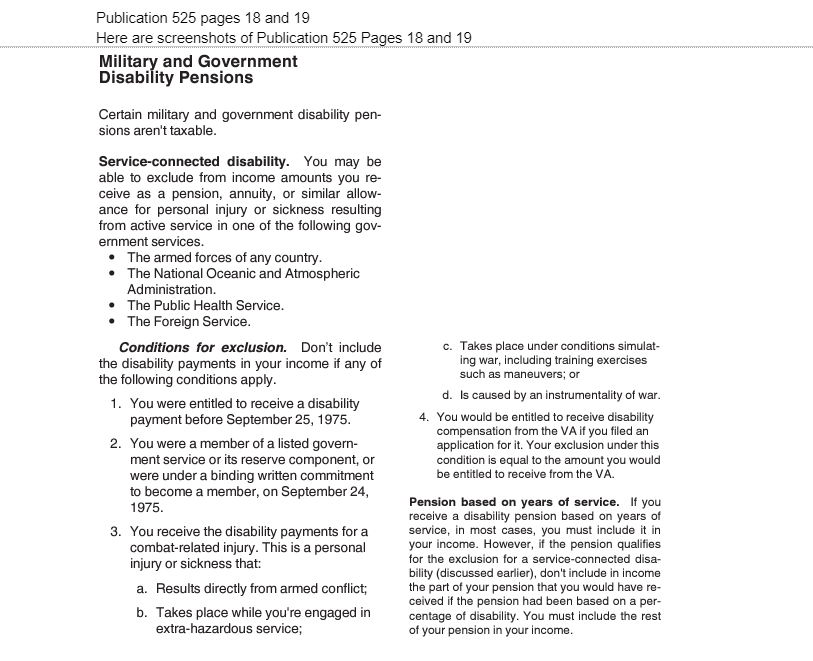

Publication 525

As you can see, Publication 525 does state that certain military and government disability pensions aren't taxable (VA disability), and it lists the terms and conditions. However, it goes on to say that if you receive a disability pension based on years of service (retirement income), in most cases, you must include it in your income (taxable). If the pension qualifies for the exclusion for a service-connected disability, don't include in income the part of your pension that you would have received if the pension had been based on a percentage of disability.

If you get your disability rating at the time you retire, barring any other administrative errors, your retirement pay and disability payments are accurate.

What the packet is attempting to convince you is that your retirement (pension based on years of service) is not taxable, and that is factually incorrect.

For people that actually attempted to amend previous returns to get taxes refunded, here’s what happened. Initially, the servicemember received a refund of the taxes. On audit (a year or 2 later) the government came back for their money, plus interest and penalties. There were several tax preparers pushing this scam, and were eventually barred from the tax preparation industry, and some incarcerated.

Here’s the bottom line:

Tax professionals, if a retired service member says they want to amend to get their taxes back, ask to see their VA Disability rating letter.

If you have back tax debt click here to contact us! We are here to help!

1099K Reporting 2024

There has been another delay in the change of the 1099K reporting. It has also caused more confusion for payors to know if they should issue a 1099K or a 1099-NEC to a provider. Let’s chat about how we got here.

Backstory on 1099K Reporting Change

In December 2020, the Treasury Inspector General of Tax Administration (TIGTA) released the results of a study and found that a lot of taxpayers, who did not meet the 1099K threshold, were not reporting their income. You can read more about the study here.

1099K Requirements

Prior to 2022, the requirements for a third party payment settlement entity (PSE) to file a 1099K were if a payee exceeded $20,000 AND 200 transactions ~ § 1.6050W-1(c)(4)(i)(ii). PayPal, Stripe, Amazon, or EBay are examples of PSEs. Here are a few examples of 1099K reporting.

Example 1: Business owner A used Stripe for payment processing. A earned $150,000 but only had 10 transactions. Stripe was not required to issue a 1099K.

Example 2: Business owner B sold on EBay. B had 250 transactions, but only earned $15,000. EBay was not required to issue a 1099K.

Example 3: Business owner C provided a service and used QuickBooks for invoicing. C earned $25,000 and had 201 transactions. QuickBooks was required to issue a 1099K.

Regardless of whether a taxpayer meets the threshold for 3rd parting reporting, the taxpayer is still required to report the income. All income is taxable unless it is specifically exempted by law. ~§61

Taxpayers became more savvy, and actively avoided 1099K reporting by using different PSEs to stay below the reporting threshold. The legal term for that is structuring, which is illegal.

To combat underreporting income, the IRS proposed lowering the reporting threshold to $600 to match the 1099-NEC threshold. PSEs (and the public) lost their minds. Suddenly it was viewed that the government was now coming to tax income that wasn’t previously taxed. That was NEVER the case. Taxpayers were not reporting their income as required.

States 1099K Reporting Requirements

Even though Federal Laws have not changed, some states have reduced their 1099K filing requirements. Washington DC, Virginia, Maryland, are a few states that have a $600 threshold for 1099K filing. You can review a complete list of state 1099K requirements here. That means if you live in one of the states with reduced requirements, you'll receive a 1099K, even though it's less than the Federal requirement.

1099K vs 1099-NEC

As the discussion raged about the 1099K, so did confusion about whether one should issue a 1099-NEC to service/product providers or if the 1099K would suffice. A 1099K covers digital payments like credit cards, debit cards, or on third party platforms like the ones listed above. A 1099-NEC is used for payments through cash, ACH, or paper checks.

Example: Let’s assume you pay a landscaper $650 by check, you may be required to issue a 1099-NEC. Note: 1099-NECs are not issued to corporations.

Let’s assume in the same example you paid the landscaper $650 by credit card. The payment processor is required to issue the 1099K when the user reaches 1099K thresholds. You would not be required to issue a 1099-NEC.

When people are confused about the law, they issue the 1099-NEC to be on the safe side. While that may seem like the best thing to do, it really isn’t. You create an issue of double-reporting when you issue a 1099-NEC that is not necessary.

The IRS looks at the amounts reported on 1099Ks and 1099-NECs and adds them up. If the reported gross income is less than the 3rd party amounts reported, the taxpayer will receive a notice of underreported income (CP2000).

Example: You paid a contractor $20,000 via credit card, and issued a 1099-NEC. The payment processor also issued a 1099K for $160,000 (that includes the $20,000 you paid by credit card). In the IRS’s view, the contractor earned $180,000, when in reality only $160,000 was earned.

If you have questions concerning the 1099K, check out the IRS updated 1099K FAQ.

If you have an issue with unreported income, click here to schedule an appointment with us!

Employee Gifts are Taxable

I was perusing the news a few weeks ago. The news headlines said, “Wal-Mart Slammed After Gifting Employees 55-Cent Ramen Noodles” for working during a blizzard. Needless to say, Wal-Mart was dragged on Social Media. While I agree, it’s a cheap “gift”, it also made me think of other headlines of similar disdain, like this one: A bus driver retired after 50 years, and ‘all’ they gave him was replica of a bus with his picture on it.

Did you know that most employee gifts are taxable?

De minimis Gifts are not taxable

A De minimis gift is a non-cash gift or award, considering its value and the frequency with which it is provided, is so small as to make accounting for it unreasonable or impractical. In the Wal-Mart example, 55-cent Ramen Noodles would definitely qualify as de minimis. It was a one-time inexpensive gift.

Internal Revenue Code 132(a)(4) excludes de minimis gifts from income (meaning not taxable to the receiver).

Examples of De minimis items not included in taxable income

- Controlled, occasional employee use of photocopier

- Occasional snacks, coffee, doughnuts, etc.

- Occasional tickets for entertainment events

- Holiday gifts

- Occasional meal money or transportation expense for working overtime

- Group-term life insurance for employee spouse or dependent with face value not more than $2,000

- Flowers, fruit, books, etc., provided under special circumstances

- Personal use of a cell phone provided by an employer primarily for business purpose

Cash gifts are taxable

Cash is considered wages, unless an exception applies. An example would be OCCASIONAL meals or transportation. If the meals or transportation becomes a regular occurrence, it will become taxable as wages.

Cash or cash equivalents, such as gift cards, are always taxable income. Gift cards/certificates for general merchandise are never excluded from taxable income. If Wal-Mart had given each employee a Wal-Mart Gift Card for 55 Cents instead of the Ramen Noodles, the 55 cents would have been added to their taxable income.

Achievement Awards can be taxable

Let’s look at the example of the bus received after 50 years of service. Working as a faithful employee for 50 years is DEFINITELY an achievement. Nothing could ever show someone how much they appreciate 50 years of service, but a dinky bus?

Internal Revenue Code 274(j) limits the deduction allowed for achievement awards equal to that of the max exclusion amount. The deduction is limited to $400 or $1600 depending on whether it is a qualified or non-qualified plan award, which means that the receiver can only exclude $400 or $1,600. If the value of the achievement award exceeds one of these two numbers, the overage would be taxable.

Internal Revenue Code 274(j)(3) states that achievement awards are tangible personal property awards and:

- Cannot be disguised wages

- Must be awarded as part of a meaningful presentation

- Cannot be cash, cash equivalent, vacation, meals, lodging, theater or sports tickets, or securities.

Imagine getting a vacation with a side of a tax bill

The achievement awards can't be any of the cool things one would like to receive as an achievement award. When all of social media is screaming that an employer should send the 50-year employee on a trip, instead of giving the employee the stupid bus, tax law says... NO!

Let’s assume the total value of that trip is $8,000. The final W-2 would include an $8,000 increase in income for which the employee paid no taxes. Can’t you just see it? “Congratulations on 50 years! Here’s a 2 week all-inclusive vacation to Jamaica for you and your family.”

The additional income would increase the tax liability or reduce a refund. It’s not like the employee received $8,000 in cash, so s/he could reserve cash funds. How NOT awesome would that be?

Can companies ‘afford’ to give employees ‘better’ gifts? Unequivocally yes! However, tax law says they can’t, unless the employee pays taxes on the value of the gift. Wal-Mart gave employees a pack of noodles worth 55 cents. One would think they could have at least sprung for two.

If back taxes or unpaid tax debt are keeping you up at night, click here to reach out to us! We’re here to help!