All You Need to Know About Currently Not Collectible Status

When a taxpayer can’t afford to pay a delinquent tax bill, one of the first questions that cross their minds is: Am I going to jail? We don’t have a debtor’s prison in the United States. The only people who go to jail for not paying taxes are the ones who actively and illegally attempt to dodge their tax requirements. There are people who actually cannot afford to pay their tax liability. That taxpayer can be placed in Currently Not Collectible (CNC) status. While this can provide taxpayer relief, it’s not permanent and it’s not a guarantee.

What is Currently Not Collectible Status?

Currently Not Collectible (CNC) status temporarily delays the collection of an outstanding tax debt. The IRS can place a taxpayer in CNC status if it is determined that a taxpayer cannot afford to pay their delinquent tax bill. The taxpayer will remain in CNC status until the taxpayer’s financial situation improves. Currently Not Collectible status doesn’t remove the tax debt, it temporarily delays collection. The IRS will file a lien if you owe $10,000 or more, but the actual collection efforts will be delayed. Penalties and interest will continue to accrue during the CNC period, as well. The delay means that they won’t levy your income or seize your property. The Collection Statute Expiration Date (CSED) clock continues to run. The IRS has 10 years from the date of assessment to collect a debt. Currently Not Collectible status does NOT stop that clock from running.

Who is eligible for Currently Not Collectible Status?

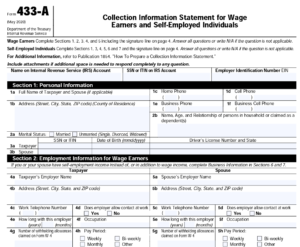

Just saying you can’t afford to pay your taxes isn’t enough to be placed in CNC status. A taxpayer who claims they can’t afford to pay their taxes will be asked to provide a Collection Information Statement (CIS) Form 433-A, 433-B, or 433-F. This Collection Information Statement details your financial situation – living expenses, assets, debts, and monthly income. Assets can include a wide variety of things – cryptocurrency, weapons, or a retirement account. The results of the CIS will determine if the taxpayer is eligible for CNC status.

National and Local Standards

As stated earlier, you can’t just ‘say’ you can’t afford to pay your taxes. You have to be able to prove that you can’t afford to pay your taxes, but this isn’t as easy it seems. The IRS has a guideline of allowable expenses, based on national and local standards. Items such as food, clothing and services, household supplies, and personal care products have a national standard for the allowable amount. There are national standards for healthcare and medical supplies. The amount of the standard takes into consideration the area of the country in which you live. The National Standard for housing in California is higher than in Virginia, for example. The standards also vary by county as well.

Monthly Disposable Income

The goal in completing the financial statement is to determine the taxpayer’s Monthly Disposable Income (MDI), which is the amount of money you have left after your allowable expenses are deducted from your income on a monthly basis. Your location and family size play a large part in calculating the amount of allowable expenses. If your MDI is zero or less, then you have a better chance to qualify for CNC. If your MDI is $1 or more, then you don’t qualify for CNC. Because you could actually be paying more for expenses than the IRS allowable amounts, your MDI may be different from the IRS’s calculations.

Let’s look at an example: Jerry owes the IRS $27,000. The IRS is asking for $250 per month for payment. Jerry says, ‘I don’t have that money.’ Jerry is single, living in Alexandria, VA. He reports his expenses as this:

Monthly income: $4600

Rent and utilities: $3000 ($2500 rent + $500 Utilities)

Car Payment: $533

Car Insurance: $300

Food: $800

Credit card payments: $400

____________________

-$133 (monthly deficit)

However, the IRS reviews their National and Local standards for expenses. The IRS’s CIS looks like this:

Monthly Income: $4,600

Rent and Utilities: IRS Allowable $2738

Car Ownership Allowable Expenses: $907

Food and supplies Allowable expense: $785

_______________________

$170 monthly disposable income

While Jerry doesn’t have the $250 the IRS was initially asking for, based on the IRS’s standards, he does have $170 monthly disposable income to pay toward his outstanding tax debt. This is when Jerry should contact us for assistance.

What about personal debt?

Personal debt tends to be a sticking point for taxpayers. As far as the IRS is concerned, they are your number one creditor. The IRS tends to ignore payments on personal debts such as credit cards or personal loans. There are some cases where the IRS will take those payments into consideration, but generally, payments on personal debt do not count toward your monthly expenses.

CNC is not permanent

The purpose of CNC is to provide relief to the taxpayer who is in a bad financial situation. The IRS will review the CNC status on an annual basis to see if your financial situation has changed. They may take refunds and apply them to the outstanding tax debt. It is important that the amount of tax debt does not continue to increase. The IRS may determine that you are not eligible for CNC status if your tax liability increases every year. You must remain current with your filings as well.

More Related Articles

February 15, 2024

BEWARE Military Disability Scam

My husband retired from the military in April 2022. It was an awesome occasion when it finally got here; however, getting there was slightly painful. He had to go through tons of briefings on his…

February 8, 2024

1099K Reporting 2024

There has been another delay in the change of the 1099K reporting. It has also caused more confusion for payors to know if they should issue a 1099K or a 1099-NEC to a provider. Let’s chat about how…

February 5, 2024

Employee Gifts are Taxable

I was perusing the news a few weeks ago. The news headlines said, “Wal-Mart Slammed After Gifting Employees 55-Cent Ramen Noodles” for working during a blizzard. Needless to say, Wal-Mart was…