Key Elements of a Proper Invoice

Question: When is an invoice, not an invoice?

Answer: When it’s not a proper invoice.

What are the elements of a proper invoice?

A proper invoice is a key component to deducting a business expense. A proper invoice contains the following key elements:

- The Word ‘Invoice’ - which specifies you are requesting payment vs providing a quote.

- Name and address of your company - Must be stated clearly to show who is requesting payment.

- Name and address of the client - The company required to make the payment.

- Date of invoice -When the invoice was generated.

- Payment terms - How long the client have to satisfy the invoice

- Date of service - Shows the date the product or service was rendered.

- Summary of Service - a description of the product offered or service performed

- Amount of the invoice - Sum of the invoice to be paid.

You can also add items such as a PO number to make the invoice more detailed, but the above elements are critical to create a proper invoice. If any one of the above elements are missing, the invoice is no longer an invoice.

Why is it important to have a proper invoice?

Businesses receive invoices for products or services. These expenses are deducted as ordinary and necessary business expenses. So far, so good!

Deductions are not entitlements

Supreme Court Case White v United States (1938) held that “Every deduction from gross income is allowed as a matter of legislative grace, and only as there is clear provision therefore can any particular deduction be allowed, and a taxpayer seeking a deduction must be able to point to an applicable statute and show that he comes within its terms.”

In other words, you can claim the deduction; however, you also have to be able to prove you are qualified to take the deduction and maintain proof that you are allowed to take the deduction. If you do that, you will continue to be able to take the deduction, as long as it is an ordinary and necessary expense for your business. Otherwise, the courts will remove said legislative grace and disallow the expense.

How to prove an expense

The IRS term for proving the existence of an expense is called substantiation. How does one substantiate (prove or provide evidence) an expense happened? One could use receipts, canceled checks, or bills. For the documentation to be deemed adequate, it must contain the date, amount, place, and description of the expense.

A canceled check alone does not substantiate an expense. A line item on your bank or credit card statement does not substantiate an expense. An invoice alone does not substantiate an expense. Each of these items, on their own, do not substantiate that an expense was incurred AND that it was paid.

A canceled check along with a bill would substantiate the expense. The bill shows there was an expense charged, and the canceled check shows the bill was paid. Both of those items together substantiate a complete cycle of the expense.

Remember when I started this post, I asked when is an invoice not an invoice?

In a recent tax court case, whose name escapes me at this time, an expense was disallowed, because the invoice was not complete.

Was there an invoice? Yes.

Was the invoice paid? Yes.

Was the expense ordinary or necessary? Yes. [Based on the what the plaintiff explained the expense was for]. BUT...

The invoice, however, did not show the date and description of the service rendered. The court explained that there was no way to tell what the payment was for based on the evidence provided. There was no way to determine if it was an ordinary or necessary business expense (other than the plaintiff's testimony). Therefore, the tax court disallowed the expense. The person who issued the invoice, did claim the income and pay tax as they should have. The plaintiff in the case also ended up paying tax on this money, because the expense was ultimately disallowed.

Business owners ensure that you are receiving proper invoices from your vendors and maintain those records FOREVER. When you file your taxes, store the tax return and all of the documentation together. In the event you are audited, you have everything already in one spot! If you've been selected for audit, reach out to us at ETS Tax Relief 877.482.9411.

IRS Taxing Fraudulent PPP Loan Forgiveness

On September 16, 2022, The Office of Chief Counsel of the IRS issued a memorandum regarding fraudulently forgiven PPP Loans. It seems that fraudulent PPP loan issues will never die. The short story: If you received PPP loan forgiveness under false pretenses, you must claim that amount as taxable income.

PPP Loan History

When the Coronavirus (Covid-19) pandemic struck in the United States, everyone was sent to a collective timeout. Businesses had to shut down. Citizens were warned to stay away from populated places. Covid-19 devastated many businesses. The government responded with the Paycheck Protection Program (PPP) Loans to assist small businesses with paying payroll and other eligible expenses. These loans were processed by lenders and guaranteed by the Small Business Administration (SBA).

There were two rounds of PPP Loans. The first was issued under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The second was issued under the Economic Aid Act, which amended previous PPP Loan provisions. For both rounds, lenders made these loans to “eligible recipients under specified terms, conditions and processes of the program”. The lenders could forgive the loans based on certain criteria and be reimbursed from the SBA.

Who was eligible to receive a PPP Loan?

According to the internet, EVERYBODY was eligible to receive a PPP Loan. [Insert the biggest eyeroll possible].

The actual requirements to be eligible to receive a PPP Loan were:

- Be a small business (as determined by the SBA), independent contractor, eligible self-employed individual, sole proprietor, business concern, or a certain type of tax-exempt organization.

- In business on February 15, 2020

- Either had employees or was an eligible self-employed individual, sole proprietor or independent contractor.

What were eligible PPP Loan expenses?

Paycheck Protection Program loans were issued to cover specific, eligible expenses. These expenses include payroll costs, rent, interest on the business’s mortgage, utilities, and other operational expenses; SUBJECT TO REPAYMENT and additional liability if the funds were misused. You were not eligible to take PPP loan funds and start a business.

PPP Loan forgiveness qualifications

Loan forgiveness was truly the selling point of PPP Loans. To receive PPP Loan forgiveness one had to meet the following:

- At least 60% of the loan must be used for payroll

- Up to 40% of the PPP loan could be used for other operational expenses.

If a recipient used 100% of their PPP Loan to cover payroll costs, then the loan qualified for loan forgiveness. Forgiven PPP loan funds were excluded from taxable income. This was truly free money from the government!

Fraudulent PPP Loan Forgiveness

If you receive PPP loan forgiveness based on false statements, your loan does not actually qualify for forgiveness and must be included in taxable income. For example, let’s assume you were an eligible recipient and received a $20,000 PPP loan. Your documentation said that you used 100% of the PPP loan proceeds to pay payroll expenses (eligible expense), and the loan was forgiven. In reality, you actually used the funds to buy a car (ineligible expense). You must include the $20,000 as taxable income.

Fraudulent PPP Loan Recipients

If you received a PPP Loan, and you were not an eligible recipient, your loan does not qualify for forgiveness. If you submitted your loan and received forgiveness, you must include the forgiven amount as taxable income.

Let’s assume you received a $50,000 PPP loan based on false representation that you had a business with employees and received the loan disbursement. Later on, you submitted false documentation representing that you spent the loan funds on payroll for non-existent employees. You must claim the $50,000 on your tax return as taxable income.

Forgiven PPP Loans - Income or Nah?

Internal Revenue Code Section 61(a) states that “gross income means ALL income from whatever source [legal or illegal] derived.” This applies to all payments that are “undeniable accessions to wealth, clearly realized, over which the taxpayers have complete dominion” constitute taxable income - Commissioner v. Glenshaw Glass Co. (1955). Internal Revenue Code section 636m(i) of the Covid Tenant Relief Act provides the exclusion of forgiven PPP Loan funds from gross income.

Once PPP Loans are forgiven, the funds provide for an “undeniable ascension to wealth”, especially when you flex for the ‘gram and post your ill-gotten gains. However, if your loan was forgiven based on lies - spent on ineligible expenses or you were an ineligible recipient - your loan was not forgiven based on the specific terms of the program and you must claim it as income.

Forgiven loan funds are not taxable income unless the forgiveness was based on fraud. Let's assume that you obtained a PPP Loan fraudulently, and received forgiveness, but don't claim it on the return. Should you get caught in your illegal dealings, you should look for a charge of tax evasion to be added to the fraud charges you'll get.

Statute of Limitations

The Statute of Limitations is critical in the fight against the IRS. It is important to know which statute of limitations applies to your situation.

Definition

In general, the Statute of Limitations refers to the amount of time a party can take action from the time a situation occurred. The IRS has different statutes of limitations by which to abide. The date the statute of limitations ends is called the Statute Expiration Date.

3-year Audit Rule Statute of Limitations

The IRS generally has three years to audit your return. They can add more years if they find a substantial error, but usually no more than 6 years. The IRS can go back FOREVA if they suspect fraud or criminal activity.

Substantial Understatement of Income

The statute of limitations for audit is extended to six years if you omit (leave off) more than 25% of your gross income.

In tax year 2021, Jane earned $150,000, but only reported $110,000. The difference is $40,000 (~27% of $150,000). Since the difference is greater than 25%, the six year statute applies. Jack also earned $150,000, but reported $114,000, a difference of $36,000 (~24% of $150,000). The three year assessment would apply to Jack's situation since the difference is less than 25%.

Basis Overstatement

Congress decided in 2015 that basis overstatement produces an understatement of income, and extended the statute of limitations to six years vs. three years.

Example: Let’s assume you sell an investment property for $1 million. You claim your basis (the amount you invested) is $800,000, but it’s actually much lower at $250,000. The impact of your overstatement of basis is that you paid tax on $200,000, when you should have paid tax on $750,000. The IRS has 6 years to figure that out.

Refund Statute of Limitations

The Refund Statute Expiration Date (RSED) refers to the amount of time a taxpayer has to claim a refund. Generally, the refund statute of limitations is three years from the date a tax return is due OR within 2 years after the overpayment of tax.

Let’s assume you have not filed your 2017 tax return and you were due a refund. The 2017 tax return filing deadline was April 17, 2018. The last day to claim your 2017 tax refund was April 18, 2021. If the refund wasn't claimed by April 18, 2021, the statute of limitations has expired. You can no longer claim the refund. #Ewwww

Assessment Statute Expiration Date (ASED)

The IRS has three years from the time a return is filed to assess a tax. A tax assessment is the statutorily (by law) required recording of the tax liability. According to §6203, the assessment is made by recording the taxpayer’s name, address, and tax liability. In other words, the IRS has a required statute of limitations to record your tax within three years of the due date of your return, or from the time the return is filed (whichever is later). The Assessment Statute Expiration Date (ASED) on a tax return timely filed by Apr 15, 2022 is April 15, 2025.

Collections Statute of Limitations

The IRS generally has a statute of limitations of 10 years from the date the tax is assessed to collect a federal tax debt. The IRS has to write off any tax debt that's not paid by the end of the 10-year statute. It disappears like it never existed. There are situations that can toll (extend) the Collection Statute Expiration Date (CSED) - bankruptcy proceedings, for example.

Statute of Limitations on Unfiled or Fraudulent Returns

There is no statute of limitations on fraud. If you filed a fraudulent return, it’s as if you never filed a return at all.

Examples

- Tax preparers go to jail regularly for filing fraudulent returns on behalf of their clients. Sometimes the clients are aware. Sometimes they are not. Assume you are a victim of a preparer who filed a tax return containing fraudulent business losses to get you a bigger refund. Even though you may not have known the return contained fraudulent information, there is still no statute of limitations on the tax return. Theoretically, the IRS can find out about the return 10 years later, and still require the taxpayer to pay back any refund they were not entitled to receive.

- The statute of limitations never starts on a return that is never filed. The IRS may file a Substitute for Return (SFR), but that doesn’t count as a filed return either. The SFR doesn’t take into account any tax credits or deductions to which you may be entitled. The IRS uses the income reported by third parties and assesses the tax based on that. It’s important to note that filing an incomplete return, such as an unsigned return, does not count as filing a return.

The statute of limitations listed above are the most common statutes taxpayers experience. It’s important to know the statutes of limitations that apply to your situation. If you have received a letter from the IRS or have unresolved tax debt, reach out to us at 877.4TAX411 (877.482.9411).

How PPP Loan Fraud Gets Caught

Let me start by saying that I’m neither a detective, nor an attorney. I’m a tax professional. However, you don’t really need to be anything special to know how government systems work, especially when it comes to money. As it pertains to the Paycheck Protection Program, the Department of Justice immediately established a fraud detection unit when the CARES Act was passed in March 2020. The Inflation Reduction Act of 2022 increased the time to prosecute PPP Loan Fraud to 10 years. That has some people shaking in their boots. With this post, I’m going to share how PPP Loan Fraud is getting caught.

Loan amount over $2 million

When the Payroll Protection Program (PPP) was created, then Secretary of the Treasury Steve Mnuchin announced that ALL PPP loans $2 million or more WILL be audited. There was no flexibility in that statement. That’s where they started, not where they stayed. People and companies that received loans in the millions were audited. If they received loans based on fraudulent information or misused funds… #Busted!

Mismatch Schedule C

In my opinion, this is the most common way PPP scammers will get caught. PPP Loans required Sole Proprietors, Independent Contractors and Single Member LLC owners to submit the Schedule C in the loan application. In the initial round of PPP disbursements, your loan amount was based on the amount of profit you earned. The rules changed once President Biden was elected. The loan was based on the amount of gross revenue shown on the Schedule C. In either case, the max amount of the loan was based on $100,000, so that the max loan amount one could receive is $20,833.

People were submitting Schedule Cs to the bank that had not actually been filed. Because the banks were under pressure to get the money out quickly, there just wasn’t time to verify the information at the time of the loan application. An applicant could submit a Schedule C even if they had not filed their taxes yet. PPP scammers received loans of approximately $20,000 because they claimed they earned $100,000 in income.

One of the forms you signed to get the PPP loan was a 4506-T. This form allows certain entities to pull your transcripts from the IRS. If your Schedule C doesn't match your application, or you don’t file a Schedule C at all… #Busted.

Mismatch Employment Tax Returns (Form 941)

The purpose of the PPP Loan was to assist small businesses in continuing to pay their employees during the Covid Emergency. The loan was based on the amount of your payroll. People claimed fraudulent employees and created fraudulent employment tax returns (Form 941) showing employees and payroll amounts that didn’t exist. I had a caller tell me that someone on Clubhouse was advertising that they would create the fraudulent 941s for you to use to support your loan.

Employment Tax Returns (form 941 filed quarterly) detail: wages you paid, income taxes, social security tax, and Medicare tax withheld. This report determines how much money your business should have paid to the government (Federal and State). The government compares what you claim on your 941s to what they have in their records. They look to see if they have records of 941s AND the money you claim to have paid to the government. Once the government determines that you have neither filed the returns, nor paid the withheld taxes… #Busted!

Social Media

Social Media has to be my favorite method of the government catching thieves. These days, people can’t keep ANYTHING to themselves. They gotta flex for the ‘Gram. Oy! The government will use your Social Media posts to convict you. People were using their fraudulent PPP loan money to buy ridiculous things - expensive cars and jewelry, homes, and clothes, then posting about it on social media. There was even a guy who posted about how he was committing fraud on YouTube. What?!?! … #Busted!

Bank Secrecy Act

One of the things that PPP Loan Ballers did was take out large sums of money. The Bank Secrecy Act “requires U.S. financial institutions to assist U.S. government agencies to detect and prevent money laundering. Specifically, the act requires financial institutions to keep records of cash purchases of negotiable instruments, file reports of cash transactions exceeding $10,000 (daily aggregate amount), and to report suspicious activity that might signify money laundering, tax evasion, or other criminal activities.”

PPP Loan fraudsters were quick to withdraw money. Any time you withdraw $10,000 or more in cash, the bank reports it to the IRS. Banks were looking at accounts getting PPP loan money and then watching the activity afterward. Guess what… #Busted!

Look, lying on loan forms or any federal form is a felony. If you have to lie on a loan form, then you really don't qualify for the loan. You can go to prison. Many people thought that the government wouldn't prosecute loan scammers. They also thought that if they got caught, they would just have to pay the loan back under favorable terms. Yeah... No. Just don't lie. It's that simple.

IRS Gets $80 Billion For What?

You’ve seen the news. You’ve seen the lightning flashing, and thunder roaring. You’ve heard the cries in the street!

“Oh my God! The IRS is hiring 87,000 people to come get us!”

“They’re coming for the poor and middle class!”

“Audits are going to increase!”

Lions, tigers, and bears! Oh MY!

The IRS is getting $80 Billion

Yes, the IRS is getting $80,000,000,000. That’s what $80 Billion actually looks like numerically. Anywho, this $80 Billion will be dispersed over 10 years. Here is a breakdown of the funding: Enforcement $45.6 Billion, $25.3 Billion for Operational support, $4.8 Billion to modernize IRS business systems (administration of taxpayer services, operations, and cybersecurity).

Backstory: The IRS has been underfunded for DECADES. They have antiquated systems that rival MS DOS. The irony is not lost in that systems received the least amount of funding. The IRS is also dealing with the Great Resignation.

The IRS is hiring 87,000 new Agents

Cool your jets! 1. These are not all going to be auditors. 2. They aren’t being hired Tuh-Day!

The IRS is facing the normal attrition of retiring individuals. They are also facing the same hiring struggles as every other business.

“It’s hard to hire for the IRS, when Target is paying $20 per hour”. ~Chuck Rettig, Commissioner of the IRS

There isn’t going to be a formation of an Army of Revenue Agents looking like the First Order in Star Wars, at least not TUH-DAY!

More Audits?

In the IRS’s strategic plan from a few years back, they told us they were going to be targeting high income non-filers. That plan has not changed.

The headline of the Treasury Inspector General for Tax Administration (TIGTA) report from May 2020 was: “High-Income Nonfilers Owing Billions of Dollars Are Not Being Worked by the Internal Revenue Service”. Guess what’s going to be happening now?

The headline of TIGTA’s December 2020 report was: “Billions in Potential Taxes Went Unaddressed From Unfiled Returns and Underreported Income by Taxpayers That Received Form 1099-K Income”.

The enforcement initiatives are not a surprise. Now, everyone is yelling, “Get your documentation in order”. If you prepare your return as if the IRS will show up tomorrow, they could hire a million revenue agents, which wouldn't matter to you.

Enforcement

The lion's share of the funding is going to enforcement. The goal of enforcement is to close the tax gap. According to the Treasury Department, the tax gap was $554 Billion in 2019. Approximately 84% percent of taxes owed in tax-year 2019 were actually paid or collected.

During the pandemic, the government stopped collection action. Since the pandemic is ‘over’, collection actions have resumed. If you have an outstanding tax liability, the IRS is pressed to get some sort of resolution - whether it’s an installment agreement or Offer in Compromise. Your goal as the taxpayer is to pay the least amount possible. The IRS's job is to collect as much as possible.

PPP Loan Fraud

Ahhh, we can’t talk about enforcement without talking about PPP Loan fraud! What types of PPP loan applications do you believe dominated the fraud? It was the Schedule C application. People were promoting PPP loans like they were an MLM like this case. People with absolutely NO financial background were out in these streets selling PPP loan application assistance like candy, helping people apply for fraudulent loans in exchange for a cut of the proceeds. The thieves submitted fraudulent Schedule Cs and false employee tax returns (941s) to obtain money they weren’t entitled to receive. Now the chickens are coming home to roost. A New York Times article (Aug 16, 2022), states:

There are currently 500 people working on pandemic-fraud cases across the offices of 21 inspectors general, plus investigators from the F.B.I., the Secret Service, the Postal Inspection Service and the Internal Revenue Service.

It also states:

The federal government has already charged 1,500 people with defrauding pandemic-aid programs, and more than 450 people have been convicted so far.

The Inflation Reduction Act increased the time for the government to prosecute PPP Loan thieves to 10 years. They stole taxpayer money. Should the government not work to get it back?

Status of the IRS

The image above is of the cafeteria in the Austin Tx processing center. According to the Washington Post, as of July 29, the IRS had a backlog of 10.2 million unprocessed individual returns. The IRS has severely outdated systems - paper-people based systems, fax machines, and the lack of ability to scan documents in the computer. Paper returns have to be manually keyed in. The pandemic only exacerbated the situation.

You may not like it, but the IRS needs this funding. It's that simple. The changes will not happen overnight. You have time to get your documentation life together, so that in the event you are audited, you'll be ready.

All You Need to Know About Currently Not Collectible Status

When a taxpayer can’t afford to pay a delinquent tax bill, one of the first questions that cross their minds is: Am I going to jail? We don’t have a debtor’s prison in the United States. The only people who go to jail for not paying taxes are the ones who actively and illegally attempt to dodge their tax requirements. There are people who actually cannot afford to pay their tax liability. That taxpayer can be placed in Currently Not Collectible (CNC) status. While this can provide taxpayer relief, it’s not permanent and it’s not a guarantee.

What is Currently Not Collectible Status?

Currently Not Collectible (CNC) status temporarily delays the collection of an outstanding tax debt. The IRS can place a taxpayer in CNC status if it is determined that a taxpayer cannot afford to pay their delinquent tax bill. The taxpayer will remain in CNC status until the taxpayer’s financial situation improves. Currently Not Collectible status doesn’t remove the tax debt, it temporarily delays collection. The IRS will file a lien if you owe $10,000 or more, but the actual collection efforts will be delayed. Penalties and interest will continue to accrue during the CNC period, as well. The delay means that they won't levy your income or seize your property. The Collection Statute Expiration Date (CSED) clock continues to run. The IRS has 10 years from the date of assessment to collect a debt. Currently Not Collectible status does NOT stop that clock from running.

Who is eligible for Currently Not Collectible Status?

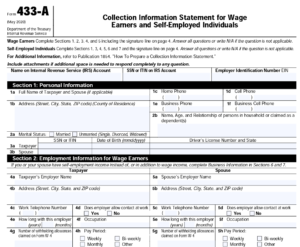

Just saying you can’t afford to pay your taxes isn’t enough to be placed in CNC status. A taxpayer who claims they can’t afford to pay their taxes will be asked to provide a Collection Information Statement (CIS) Form 433-A, 433-B, or 433-F. This Collection Information Statement details your financial situation - living expenses, assets, debts, and monthly income. Assets can include a wide variety of things - cryptocurrency, weapons, or a retirement account. The results of the CIS will determine if the taxpayer is eligible for CNC status.

National and Local Standards

As stated earlier, you can’t just ‘say’ you can’t afford to pay your taxes. You have to be able to prove that you can’t afford to pay your taxes, but this isn’t as easy it seems. The IRS has a guideline of allowable expenses, based on national and local standards. Items such as food, clothing and services, household supplies, and personal care products have a national standard for the allowable amount. There are national standards for healthcare and medical supplies. The amount of the standard takes into consideration the area of the country in which you live. The National Standard for housing in California is higher than in Virginia, for example. The standards also vary by county as well.

Monthly Disposable Income

The goal in completing the financial statement is to determine the taxpayer’s Monthly Disposable Income (MDI), which is the amount of money you have left after your allowable expenses are deducted from your income on a monthly basis. Your location and family size play a large part in calculating the amount of allowable expenses. If your MDI is zero or less, then you have a better chance to qualify for CNC. If your MDI is $1 or more, then you don’t qualify for CNC. Because you could actually be paying more for expenses than the IRS allowable amounts, your MDI may be different from the IRS's calculations.

Let’s look at an example: Jerry owes the IRS $27,000. The IRS is asking for $250 per month for payment. Jerry says, ‘I don’t have that money.’ Jerry is single, living in Alexandria, VA. He reports his expenses as this:

Monthly income: $4600

Rent and utilities: $3000 ($2500 rent + $500 Utilities)

Car Payment: $533

Car Insurance: $300

Food: $800

Credit card payments: $400

____________________

-$133 (monthly deficit)

However, the IRS reviews their National and Local standards for expenses. The IRS's CIS looks like this:

Monthly Income: $4,600

Rent and Utilities: IRS Allowable $2738

Car Ownership Allowable Expenses: $907

Food and supplies Allowable expense: $785

_______________________

$170 monthly disposable income

While Jerry doesn't have the $250 the IRS was initially asking for, based on the IRS's standards, he does have $170 monthly disposable income to pay toward his outstanding tax debt. This is when Jerry should contact us for assistance.

What about personal debt?

Personal debt tends to be a sticking point for taxpayers. As far as the IRS is concerned, they are your number one creditor. The IRS tends to ignore payments on personal debts such as credit cards or personal loans. There are some cases where the IRS will take those payments into consideration, but generally, payments on personal debt do not count toward your monthly expenses.

CNC is not permanent

The purpose of CNC is to provide relief to the taxpayer who is in a bad financial situation. The IRS will review the CNC status on an annual basis to see if your financial situation has changed. They may take refunds and apply them to the outstanding tax debt. It is important that the amount of tax debt does not continue to increase. The IRS may determine that you are not eligible for CNC status if your tax liability increases every year. You must remain current with your filings as well.

Penalty Abatement Tax Relief

One thing that is for certain with the IRS is that there is a penalty for everything! Penalties are meant to encourage compliance with tax laws. What if you try to comply with the tax law, but you can't? That's where penalty abatements come in.

Penalty Abatement

A penalty abatement is when the IRS removes penalties after the penalties have been assessed to the taxpayer. There are two main types of penalty abatements - First Time Penalty Abatement and Reasonable Cause Penalty Abatement.

First-Time Penalty Abatement

The IRS may provide administrative relief from a penalty that would otherwise be applicable under its First Time Penalty Abatement policy.

You may qualify for administrative relief from penalties for failing to file a tax return, pay on time, and/or to deposit taxes when due under the IRS's First Time Penalty Abatement policy if the following are true:

- You didn’t previously have to file a return or you have no penalties for the 3 tax years prior to the tax year in which you received a penalty.

- You filed all currently required returns or filed an extension of time to file.

- You have paid, or arranged to pay, any tax due.

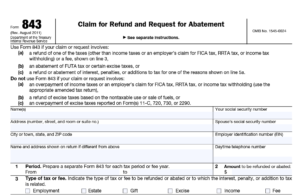

A First Time Penalty Abatement can be requested using form 843.

Case Study

Imagine $7 standing between you and $259,000 of penalty relief. That’s exactly what happened to Erik and Aspasia Oosterwijk.

Short story: For the 2017 tax year, the Oosterwijks reached out to their CPA to file an extension on their tax return and arrange a payment of approximately $1.8 million in taxes owed. The CPA made an error and did not actually file the extension, and the payment never came out. OOPS!

What about that First Time Penalty Abatement? For tax year 2014, the Oosterwijks received a $7 late payment penalty. That $7 late payment penalty made them ineligible for the First Time Penalty Abatement because the $7 penalty occurred within the 3 years prior to tax year 2017. Ouch!

If you don’t qualify for a First Time Penalty Abatement, you may qualify for a Reasonable Cause Penalty Abatement.

REASONABLE CAUSE PENALTY ABATEMENT

Reasonable Cause is based on all the facts and circumstances in your situation. The IRS will "consider any reason which establishes that you used all ordinary business care and prudence to meet your Federal tax obligations but were nevertheless unable to do so". Please note that the word ‘consider’ is underlined. The IRS will consider the circumstances, but that doesn’t mean they will accept your reasoning.

Here is a list of “sound reasons” IRS has listed on its website for failing to file a tax return, make a deposit or pay tax when due.

- Fire, casualty, natural disaster or other disturbances

- Inability to obtain records

- Death, serious illness, incapacitation or unavoidable absence of the taxpayer or a member of the taxpayer’s immediate family

- Other reason which establishes that you used all ordinary business care and prudence to meet your Federal tax obligations but were nevertheless unable to do so

The IRS also notes that a lack of funds, in and of itself, is NOT reasonable cause for failure to file or pay on time. However, the reasons for the lack of funds may meet reasonable cause criteria for the failure-to-pay penalty.

Facts necessary to establish reasonable cause

When trying to establish reasonable cause, there are certain facts one must be able to present:

- What happened and when?

- What exactly prevented you from meeting your tax obligation of filing and paying?

- Once the circumstances changed, how did you attempt to rectify the situation?

- You have to be able to provide documentation to support your claim. In the case of serious illness for example, one would provide hospital or medical records.

In the case of the Oosterwijks, one might believe that the CPA failing to file the extension would constitute reasonable cause. One would also believe that Oosterwijks “all ordinary business care and prudence to meet your Federal tax obligations but were nevertheless unable to do so”.

Uh. No.

In US v Boyle (1985), the Supreme Court decided that the failure to make a timely filing of a tax return is not excused by the taxpayer's reliance on an agent, and such reliance is not "reasonable cause" for a late filing under § 6651(a)(1).

The courts noted that the Oosterijks previously filed a paper extension in 2018. In the court’s eyes, they could have filed their own extension instead of relying on the CPA. The court ruled that the failure on the CPA’s part was not a reasonable cause for abatement.

My First Reasonable Cause Penalty Abatement case

When I first started my tax career, I had a client who was eligible for Reasonable Cause Penalty Abatement.

The client, we’ll call him Jim, came to the office the year prior (tax year 2014) to file his tax return. The office, at that time, was owned by someone else. Jim filed an extension. When he came back to file his return prior to the extension deadline, the office was SHUT DOWN! There was no warning. The previous owner did not notify anyone. What made it worse is that Jim had given the previous owner original documents!

NOTE: **Never give original documents to a tax professional.**

When we opened up the office in February 2016, Jim came to the office. We had to dig out Jim’s files from the old owner to assist him with completing his returns. Jim owed approximately $11,000 on his 2014, and another $9,000 on his 2015 tax return.

We drafted a Reasonable Cause Letter for Jim providing the timeline of events, including the approximate date of closure from the previous owner. The letter also noted that the office opened under new ownership in January 2016. Jim filed both the 2014 and 2015 taxes in February 2016, when he had all of his documents available. The IRS abated his failure to file penalties, but not the failure to pay since he had a history of owing (even though he normally paid on time). The IRS asserted that he should have paid something towards his tax bill because he normally owes.

Penalty Abatements are not guaranteed

Penalty abatements are a privilege, not a right. When requesting a Reasonable Cause Penalty Abatement, one must be able to document the reasonable cause. Remember, relying on your tax professional won’t necessarily get you off the hook either.

Trust Fund Recovery Penalty

Storytime: I was perusing my daily news and came across a story of a business owner who was sent to jail for not paying employment taxes. On June 30, 2022, Frank Morrison, former owner of Thirsty’s Bar was sentenced to 13 months in Federal Prison for Failure to Withhold, Properly to Account for, and Pay over Tax.

What did he do?

Mr. Morrison withheld Federal Income, Social Security, and Medicare taxes from his employees’ paychecks, but FAILED to send the money to the government. Let's not call it a failure. That sounds like a mistake. He just didn't do it.

Anywho, Mr. Morrison withheld the money from the paychecks. Instead of paying it to the government the way he was supposed to, he decided to use the tax money for his personal expenses.

He stole from the government and his employees

We already know that not turning the money over to the government is wrong, but what EXACTLY is the problem? When employees file their tax returns, they will either be due a refund or they will have a tax liability reduced by the amount of tax paid through withholdings. The government will issue a refund on tax money they never received. In the case of a tax liability, the Treasury Department is assuming they have a certain amount already in the treasury from withholdings. The taxpayer to pays the balance, and the government is short. We pay into the Social Security system and expect to be able to withdraw from it when we reach retirement age. Imagine submitting for Social Security only to find that you have no credits. Either way, the math ain’t mathing!

Trust Fund Taxes

Taxes withheld from an employee’s paycheck are called Trust Fund Taxes. Trust Fund Taxes consist of Federal Income Tax, Social Security Tax, and Medicare Tax - what we commonly call payroll taxes. An employer has the added responsibility of withholding taxes from the employee’s paycheck and sending the money to the Treasury at the prescribed time. The taxes are called Trust Fund Taxes, because they are held “in trust” until they are paid to the Treasury. Both the government and the employee are trusting the employer to do that.

Employers must pay the employee’s Trust Fund Taxes, along with the employer’s portion of Social Security and Medicare taxes to the Treasury through the Federal Deposit System.

Trust Fund Recovery Penalty

Through Internal Revenue Code (IRC) 6672, Congress established Trust Fund Recovery Penalties. The penalty was designed to encourage business owners to promptly pay Trust Fund Taxes. The Trust Fund Recovery Penalty is a “pecuniary penalty’, which means the government is penalizing the offender for actual monetary loss for unpaid trust fund taxes.

The Trust Fund Recovery Penalty is equivalent to the amount of the unpaid balance of the Trust Fund Tax, which is based on unpaid income taxes withheld and the employer portion of withheld FICA Tax. In other words, you're going to pay double. Let's assume you owe $1,000 in Trust Fund Taxes and don't pay. You will then have to pay $2,000 - the $1,000 you owe + $1,000 in penalties.

Who can be assessed the Trust Fund Recovery Penalty?

This will throw you for a loop! The Trust Fund Recovery Penalty can be assessed against anyone who is responsible for collecting or paying trust fund taxes but willfully fails to do so. That could include officers of a corporation, employees or contractors with signature authority over bank accounts, bookkeepers, or accountants.

Willfully is defined as voluntarily and intentionally doing something that is against the law. It means the person knew or should have known the requirements of trust fund taxes, but ignores the law. In Mr. Morrison's case, he committed this offense from 2008 to 2020. If willful was a person, he's it.

What happens when the Trust Fund Recovery Penalty is assessed?

The person(s), against whom the Trust Fund Recovery penalty is assessed, will receive a letter from the IRS. After waking up from passing out, one has 60 days from the date of the letter to appeal (75 if outside the US). If one does NOT respond, the tax will be assessed and a Notice and Demand for Payment will be sent.

Once the penalty is assessed, the IRS will start collection action against the responsible person(s). This could be business or personal assets, including filing a tax lien or seizing said assets. Please note that Trust Fund Recovery Penalties generally can NOT be discharged in bankruptcy.

Back to Mr. Morrison

Not only is Mr. Morrison going to prison for 13 years, he must also pay a fine of $200,000, $684,927.56 in restitution to the IRS, and $100 assessment to the Federal Crime Victims Fund. Going to jail does NOT remove the debt. It will be waiting for him when he gets out. Because of his age, it is possible Mr. Morrison may die in prison. The debt isn't automatically forgiven. The IRS can pursue his estate.

At this point, you may be wondering if all Trust Fund Recovery Penalty cases result in jail time. The answer is no. Generally speaking, when small business owners don't pay over trust fund taxes, they are usually using the money to keep the business going - whether in operations or payroll. The belief is 'I'll just do it this one time, and then I'll pay it back'. That normally doesn't happen. For situations like this, the responsible persons generally aren't prosecuted, but the money still has to be paid. The IRS usually reserves prosecution for those special folks like Mr. Morrison, who use the money for personal gain.

What’s the takeaway?

Don’t steal the employees' or the government’s money! Easy enough. But seriously, if the IRS is going to pounce on you and show you no mercy, it would be with Trust Fund Recovery. They are aggressive in their trust fund efforts. The best way to stay out of trouble is to not get in it in the first place.

TIP: Keep your payroll funds separate from your operating expenses to keep you from spending money that isn’t yours to spend.

What's the solution?

If you're having issues with owing back payroll taxes, the best thing to do is tackle it immediately. There are options for resolving the penalty issue, but it can be complex. If you’ve got one of those letters, don’t pass out. Schedule a call with us to help you!

Mileage Rate Change July 1, 2022

The IRS announced they will increase the mileage rate the latter half of 2022. Starting July 1, 2022, the mileage rate has increased to 62.5 center per mile to help ease the strain of the rise in gasoline prices. Business owners will need to report mileage from January 1, 2022 through June 30, 2022, and then from July 1, 2022 through December 31, 2022 to be able to properly deduct business mileage when they file their 2022 tax returns.

With that out of the way, let's talk about the mileage deduction!

Mileage is one of the most audited items in a business, as it is one of the highest paying and most abused deductions. It is imperative for business owners to accurately report business mileage. Guessing or using ‘same as last year’ just ain't it.

Vehicle Expense Deduction

Business vehicles are cars, SUVS, and pickup trucks that are used for business activities. There are other restrictions to vehicles that qualify for the business use of vehicle deduction. Today’s post is about mileage and expenses.

There are two ways to deduct vehicle expenses - the actual expense method or standard mileage rate. Here is a brief summary of each method.

Actual Expense Method

The actual expense method allows a business owner to deduct a portion of actual expenses. This deductible portion is in relation to the amount of business miles to overall miles.

The expenses included in this method are:

Vehicle loan interest

Insurance

Maintenance and repairs

Tires

Licenses

Registration Fees and taxes

Garage Rent

Parking and tolls

Gas and oil

Rental or Lease payments

Depreciation

With this method, the taxpayer needs to know the total number of miles driven for business and personal use. The deduction amount is the ratio of business miles to total miles driven.

Example

Jack drove a total of 15,000 miles during the taxable year. He reported 8,500 business miles. Jack reported $10,000 of vehicle expenses. What is the amount of his deduction?

8500/15000 = 56.6% - rounded to 57%.

57% of $10,000 (vehicle expenses) = $5700 (not including the depreciation amount).

Standard Mileage rate

Every year Congress sets a standard mileage rate for business miles. For 2022, the rate was originally 58.5 cents per mile for business travel. Because gas prices are higher than Snoop Dogg, Congress increased the mileage rate by 4 cents per mile to 62.5 cents per mile to offset the steep increase in prices. Of those amounts, 26 cents per mile is allocated to depreciation.

Accurate Mileage Log

The lack of an accurate mileage log gets business owners every time! Regardless of the method you choose, you must have an accurate, detailed mileage log. An accurate mileage log contains the following information:

Date the trip was taken: (self-explanatory)

Origin: The address where you started.

Destination: The address of where the trip stopped.

Number of miles: total miles between the two points

Purpose: List the business purpose.

Your mileage log will also contain the total miles driven for business in a tax period.

Why It's Important

In a recent opinion issued by the Tax Court, a taxpayer’s deduction was denied because of a lack of sufficient records. In Pedersen v. Commissioner, the taxpayer claimed a mileage expense as part of Unreimbursed Employee Expenses on his 2016 tax return. Although the case was related to Unreimbursed Employee Expenses, the principles are still the same as they relate to a business.

The opinion states: “For expenses relating to passenger automobiles, a taxpayer must substantiate with adequate records or sufficient evidence corroborating his statement (1) the amount of each separate expense using either actual costs or the standard mileage rate; (2) the mileage for each business use of the passenger automobile and the total mileage for all purposes during the taxable period; (3) the date of the business use; and (4) the business purpose of the use. See Treas. Reg. § 1.274-5(j)(2); Temp. Treas. Reg. § 1.274-5T(b)(6).”

While the Internal Revenue Code does not specifically state that one has to list odometer readings, it certainly helps “substantiate with adequate records”. In the end, Mr. Pedersen had to pay back approximately $1000 for disallowed mileage + penalties + interest (which gets compounded daily).

I’m willing to bet lunch money that the 2022 tax year mileage will be watched closely. It will be very easy for someone to overlook the change in mileage rate change mid-year. On audit, some or all of the mileage could be disallowed, and the difference will have to be paid back to the government. Tax professionals will have to ensure their clients show mileage from January 1 - June 30, 2022 and then July 1 - December 31, 2022.

The mileage rate increase, as of this writing, is temporary. Congress may choose to extend the increased rate through 2023. That remains to be determined.

If you are being audited, and are in need of assistance, schedule a call with us.

If You Don't Have Money to Pay Your Taxes, You Have Legitimate Options

If you don't have money to pay what you owe the IRS, you have a few options to work with. Whatever you do, don’t ignore the letters from the IRS, and don’t let your back tax problem go unattended. The IRS has a great deal of power when it comes to recovering money they think is theirs.

When you owe the IRS money, they can garnish your wages, levy your bank accounts, put a lien on your home, and seize other assets.

Here's what you can do if you find yourself not being able to pay your taxes. Note, that we always recommend getting in touch with a specialized tax resolution professional to help avoid the harsh penalties and interest that accrued on your back taxes. It’s far easier to navigate towards tax resolution if you have a professional working with you. If you’d like to schedule a no-cost confidential tax relief consultation, contact us here.

First, make sure that you file your returns

Even if you have no hope of being able to pay your taxes, you should at least file your income tax returns. Whatever the penalties are for not paying your taxes, the penalties for not filing are much larger. The IRS will remove penalties for not filing and not paying but you have to have a good reason. We can request to have your penalties removed or reduced. It's also important to remember that when you file for an extension, it only gives you more time to file. Your payment date remains unchanged.

Revisit your W-4 withholdings

If your employer withholds money from your salary to pay your taxes, you shouldn't have to worry about paying anything extra from that income source. If you do owe more, it's a sign that your withholding exemptions are incorrectly reported on your W-4 form. To make sure that you don't get into tax trouble repeatedly, you should make sure your W-4 form is correct and get advice from a tax professional about the kind of withholdings necessary exemptions.

Make a partial payment

If you can't afford to pay all that you owe, you should pay whatever you can. While you will still be hit with interest and penalty charges, they will be smaller than they would be if you paid nothing. These charges are proportional to what you owe the IRS.

Try to work with the IRS

If you can't pay, there are resolution options available to you if you qualify for them. They include a payment plan or an offer in compromise to name a few. You need to first step up and admit to your inability to pay, though.

When the IRS grants you a payment plan, you get to pay your back taxes in installments each month. Applying for a payment plan is easy if you owe less than $10,000 - you simply need to fill out the form online. It can be more difficult to get the IRS to accept a monthly payment plan if you owe $10,000 to $50,000. If you owe more than $50,000, you need to complete IRS form 433-A. Generally, once you hit the $50,000 threshold it’s advisable that you hire the services of a competent experienced tax professional. If your repayment plan is approved, they can give you up to 72 months to finish paying. You need to pay interest and processing fees for the plan, though.

If your financial hardship is serious enough to preclude the possibility of repayment in the future, the IRS has a program called the Offer in Compromise. You need to prove to the IRS that you will never be able to pay the full amount back even over time.

Contact us if you’d like assistance in resolving your tax problem. Schedule a free confidential consultation here.

Be sure to not fall for false promises

Scammy so-called tax professionals and other con artists know how desperate things can get for people who are unable to afford their taxes. They sometimes advertise on television and radio, promising to negotiate with the IRS to bring your taxes down in return for a large fee without first seeing what IRS programs you are eligible for. You should be very careful before engaging these types of companies. Going to a local, experienced tax resolution professional may be in your best interest.

If you need an expert tax resolution provider who knows how to navigate the IRS maze, reach out to our firm and we’ll schedule a no-obligation confidential consultation to explain your options to permanently resolve your tax problem.