BEWARE Military Disability Scam

My husband retired from the military in April 2022. It was an awesome occasion when it finally got here; however, getting there was slightly painful. He had to go through tons of briefings on his own. We also had to go through a finance briefing. Because I am who I am, I requested to visit finance several months prior. Nothing irks me more than being made to make financial decisions, before you’ve had a chance to digest the information. I’ll get off that soapbox, because that’s not what today’s post is about.

When a Servicemember Retires

When a servicemember retires, they can receive retirement income, as well as disability benefits. In the process of retiring, servicemembers have to go through a process to determine their disability rating, which can range from 0 – 100% disabled. Just for clarity, that disability rating does not mean there is necessarily a visible physical impairment.

The disability rating will determine if there is any portion of the retirement income that is not taxable. The service members receive two separate payments – retirement income (taxable), and disability income (non-taxable).

The Strickland Rule

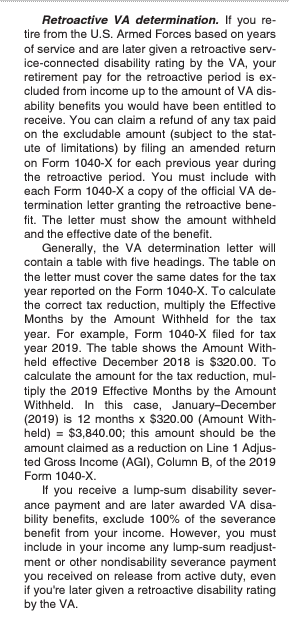

In current times, most service members receive their disability rating at the time they retire, so the payments are accurate. There are situations though, where a service member retires, and then receives a disability rating later on. If that disability rating is made retroactive, then the service member may be entitled to a refund of a portion of the taxes paid.

In Revenue Ruling 78-161, Zebulon Strickland, COL(RET) received a retroactive disability rating. In short, he argued, and it was held, that he was entitled to a refund of taxes paid on the retirement income previously paid during the retroactive time.

The scam that followed…

Your retirement income is not taxable

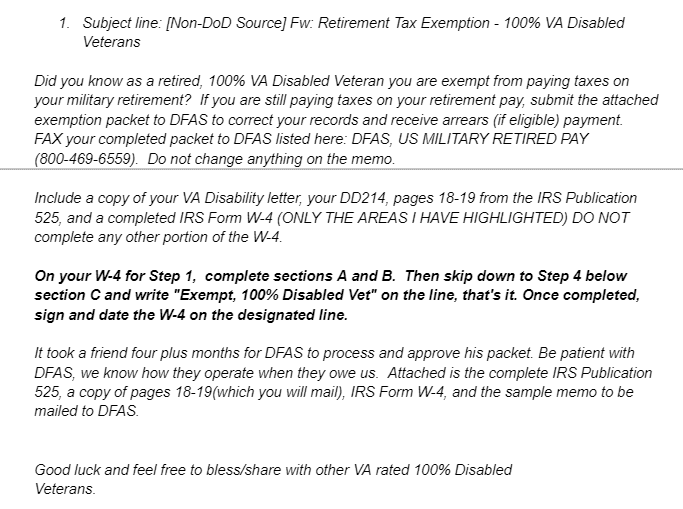

When my husband retired, a few of his friends sent him an email. It was the exact same email that was sent from different people saying that his retirement income is not taxable, because of his disability rating. Naturally, he sent the email to me.

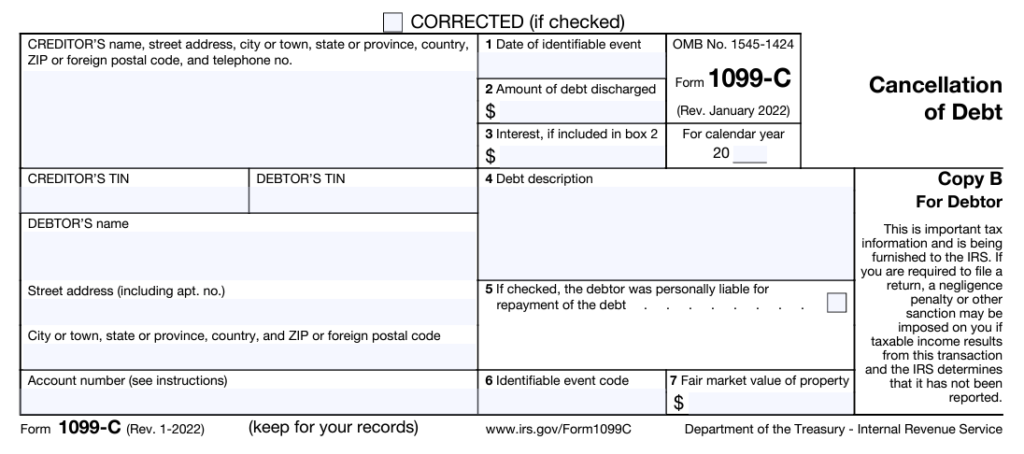

- The attached memo says:

Dear DFAS,

In accordance with the attached IRS Publication 525, because I am 100% disabled, certain

Military and government disability pensions are not taxable. I am requesting to have the code

changed in DFAS to reflect me not paying taxes on my retirement pay.

Thanks for your prompt assistance in this matter.

Writing Exempt on the W-4

Let me tackle the easy one first. If you send a W-4 to payroll with ‘Exempt’ written on it, they will stop withholding federal taxes. That doesn’t mean you won’t owe taxes. It just means you instructed the payroll department to not withhold taxes. When you file your return, your 1099R will show both the distribution amount and the taxable amount, which will be the same. You will have tax liability when you file.

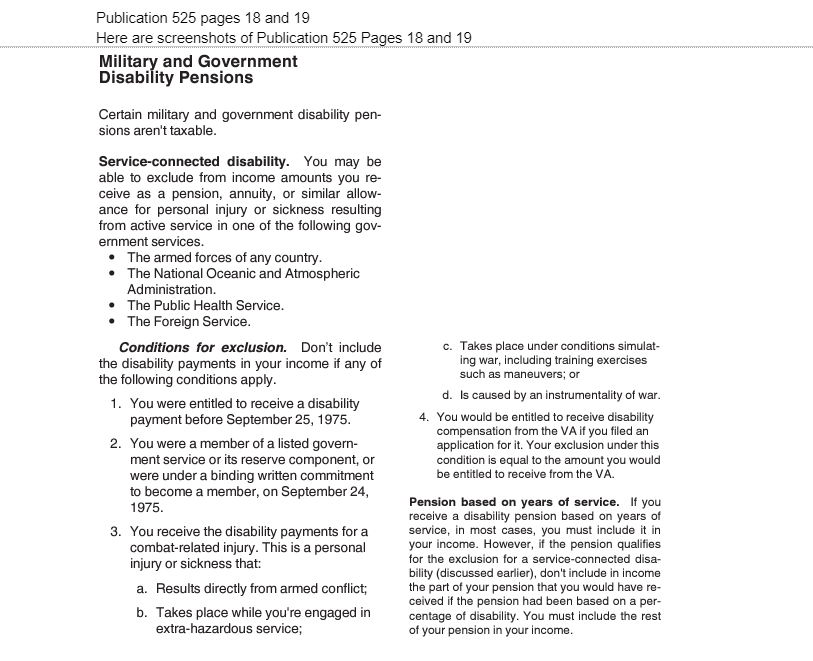

Publication 525

As you can see, Publication 525 does state that certain military and government disability pensions aren’t taxable (VA disability), and it lists the terms and conditions. However, it goes on to say that if you receive a disability pension based on years of service (retirement income), in most cases, you must include it in your income (taxable). If the pension qualifies for the exclusion for a service-connected disability, don’t include in income the part of your pension that you would have received if the pension had been based on a percentage of disability.

If you get your disability rating at the time you retire, barring any other administrative errors, your retirement pay and disability payments are accurate.

What the packet is attempting to convince you is that your retirement (pension based on years of service) is not taxable, and that is factually incorrect.

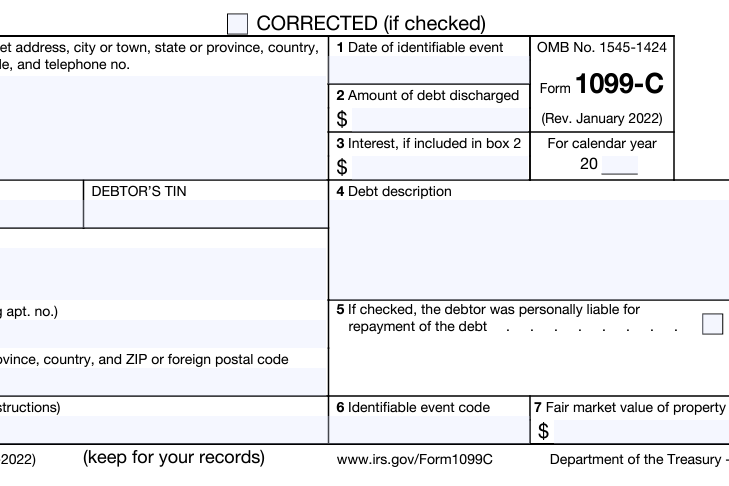

For people that actually attempted to amend previous returns to get taxes refunded, here’s what happened. Initially, the servicemember received a refund of the taxes. On audit (a year or 2 later) the government came back for their money, plus interest and penalties. There were several tax preparers pushing this scam, and were eventually barred from the tax preparation industry, and some incarcerated.

Here’s the bottom line:

Tax professionals, if a retired service member says they want to amend to get their taxes back, ask to see their VA Disability rating letter.

If you have back tax debt click here to contact us! We are here to help!

More Related Articles

February 8, 2024

1099K Reporting 2024

There has been another delay in the change of the 1099K reporting. It has also caused more confusion for payors to know if they should issue a 1099K or a 1099-NEC to a provider. Let’s chat about how…

February 5, 2024

Employee Gifts are Taxable

I was perusing the news a few weeks ago. The news headlines said, “Wal-Mart Slammed After Gifting Employees 55-Cent Ramen Noodles” for working during a blizzard. Needless to say, Wal-Mart was…