BENEFICIAL OWNERSHIP INFORMATION REPORTING 2024

Phase 1 of the Corporate Transparency Act (CTA) went into effect on January 1, 2024. It imposes a new federal filing requirement for most corporations and limited liability companies (LLCs) formed in 2024 and later. It also applies to businesses formed before January 1, 2024, but the requirements are different. See the note at the bottom of the post.

What was the Corporate Transparency Act all about?

Usually when the government creates new laws and requirements, it’s in an effort to curtail criminal activity. This is no different. The purpose of CTA is to attempt to prevent anonymous shell companies for money laundering, tax evasion, and other illegal purposes. As with everything else, the good get caught up with the bad, hence BOI Reporting. #ThanksCriminals

The BOI Report applies to businesses formed by filing with the Secretary of State, such as LLCs and Corporations. Some businesses are exempt. You can find the list of exemptions here. If you are unclear as to whether or not you are exempt, file the BOI report. One of my tax mentors told me once, ‘There is no such thing as over-reporting. When in doubt, REPORT!’

Deadline to file BOI Report

Applicable companies that were formed January 1, 2024 or after, have 90 days to file the BOI report. The report is filed at: https://www.fincen.gov/boi. The report contains specific information for each beneficial owner.

According to FINCEN, a beneficial owner is defined as “any individual who, directly or indirectly, exercises substantial control over a reporting company, or who owns or controls at least 25 percent of the ownership interests of a reporting company.”

Here is the information you’ll need for each Beneficial Owner to complete the BOI Report:

- Full legal name

- Date of birth

- Complete current residential street address

- A unique identifying number from a current U.S. passport, state or local ID document, driver’s license, or foreign passport

- An image of the document that contains the unique identifying number

BOI Company Applicant

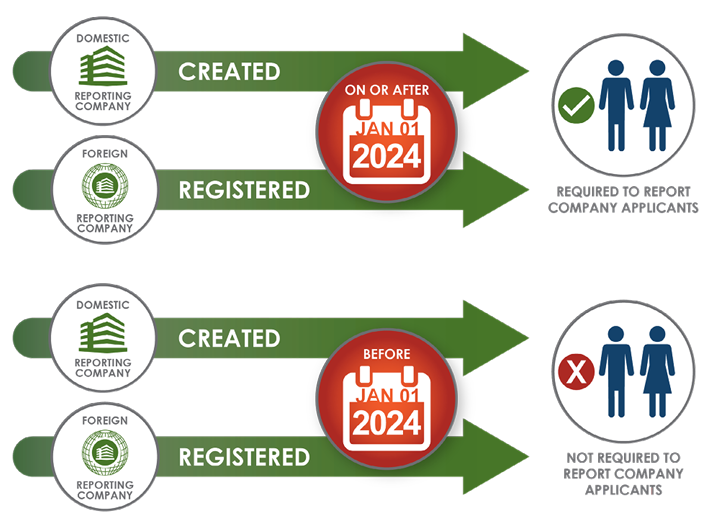

A company applicant is defined as either the “direct filer, or the individual who directs or controls the filing action”. A reporting company is also required to report its company applicants if it is either a:

• domestic reporting company created on or after January 1, 2024; or

• foreign reporting company first registered to do business in the United States on or after January 1, 2024.

Each reporting company that is required to report company applicants will have to identify and report to FinCEN at least one company applicant, and at most two. All company applicants must be individuals. Companies or legal entities cannot be company applicants.

Who is responsible for filing the BOI report?

There is a lot of misinformation about who is actually responsible for filing the BOI Report. The responsibility belongs to the Beneficial Owner(s). The BOI Report is NOT a tax report, therefore your tax professional or accountant is not responsible for filing this report. Can they offer the service? Sure. However, it is not a part of tax preparation, just as filing your annual report with the state is not a tax preparation function. Attorneys are also available to assist you with filing the report. If you hire someone to provide this service for you, trust but verify. The ultimate responsibility lies with the Beneficial Owner(s), not the person you hired.

What if you don’t file the BOI Report?

There’s always someone who asks, “What if I don’t want to?” The willful failure to report may result in a civil or criminal penalties, including civil penalties of up to $500 for each day that the violation continues, or criminal penalties including imprisonment for up to two years and/or a fine of up to $10,000. Senior officers of an entity that fails to file a required BOI report may be held accountable for that failure. Responsible persons can also be penalized for providing false or incomplete information to a company, knowing that it is intended to be reported to FINCEN.

To be clear though, nobody is coming to your house to arrest you today for not filing your BOI Report. People are advertising in a way to frighten you to hire them. The earliest anyone has a report due is March 31, 2024.

30 Days to update the BOI Report

Once the initial report is filed, a Beneficial Owner has 30 days to report any changes to Beneficial Ownership. If a Beneficial Owner moves, you must update the BOI report within 30 days. If a company adds an owner, you must update the BOI report within 30 days.

Note: If you formed your business before 1/1/2024, you have until 1/1/2025 to file your report, and you are NOT required to report your company applicant. If your company is created or registered on or after January 1, 2025, it will have 30 calendar days to file its initial BOI report.

BOI Small Entity Compliance Guide

FINCEN created the Small Entity Compliance Guide to answer your questions. Grab a copy here!

More Related Articles

February 15, 2024

BEWARE Military Disability Scam

My husband retired from the military in April 2022. It was an awesome occasion when it finally got here; however, getting there was slightly painful. He had to go through tons of briefings on his…

February 8, 2024

1099K Reporting 2024

There has been another delay in the change of the 1099K reporting. It has also caused more confusion for payors to know if they should issue a 1099K or a 1099-NEC to a provider. Let’s chat about how…

February 5, 2024

Employee Gifts are Taxable

I was perusing the news a few weeks ago. The news headlines said, “Wal-Mart Slammed After Gifting Employees 55-Cent Ramen Noodles” for working during a blizzard. Needless to say, Wal-Mart was…