1099K Reporting 2024

There has been another delay in the change of the 1099K reporting. It has also caused more confusion for payors to know if they should issue a 1099K or a 1099-NEC to a provider. Let’s chat about how we got here.

Backstory on 1099K Reporting Change

In December 2020, the Treasury Inspector General of Tax Administration (TIGTA) released the results of a study and found that a lot of taxpayers, who did not meet the 1099K threshold, were not reporting their income. You can read more about the study here.

1099K Requirements

Prior to 2022, the requirements for a third party payment settlement entity (PSE) to file a 1099K were if a payee exceeded $20,000 AND 200 transactions ~ § 1.6050W-1(c)(4)(i)(ii). PayPal, Stripe, Amazon, or EBay are examples of PSEs. Here are a few examples of 1099K reporting.

Example 1: Business owner A used Stripe for payment processing. A earned $150,000 but only had 10 transactions. Stripe was not required to issue a 1099K.

Example 2: Business owner B sold on EBay. B had 250 transactions, but only earned $15,000. EBay was not required to issue a 1099K.

Example 3: Business owner C provided a service and used QuickBooks for invoicing. C earned $25,000 and had 201 transactions. QuickBooks was required to issue a 1099K.

Regardless of whether a taxpayer meets the threshold for 3rd parting reporting, the taxpayer is still required to report the income. All income is taxable unless it is specifically exempted by law. ~§61

Taxpayers became more savvy, and actively avoided 1099K reporting by using different PSEs to stay below the reporting threshold. The legal term for that is structuring, which is illegal.

To combat underreporting income, the IRS proposed lowering the reporting threshold to $600 to match the 1099-NEC threshold. PSEs (and the public) lost their minds. Suddenly it was viewed that the government was now coming to tax income that wasn’t previously taxed. That was NEVER the case. Taxpayers were not reporting their income as required.

States 1099K Reporting Requirements

Even though Federal Laws have not changed, some states have reduced their 1099K filing requirements. Washington DC, Virginia, Maryland, are a few states that have a $600 threshold for 1099K filing. You can review a complete list of state 1099K requirements here. That means if you live in one of the states with reduced requirements, you'll receive a 1099K, even though it's less than the Federal requirement.

1099K vs 1099-NEC

As the discussion raged about the 1099K, so did confusion about whether one should issue a 1099-NEC to service/product providers or if the 1099K would suffice. A 1099K covers digital payments like credit cards, debit cards, or on third party platforms like the ones listed above. A 1099-NEC is used for payments through cash, ACH, or paper checks.

Example: Let’s assume you pay a landscaper $650 by check, you may be required to issue a 1099-NEC. Note: 1099-NECs are not issued to corporations.

Let’s assume in the same example you paid the landscaper $650 by credit card. The payment processor is required to issue the 1099K when the user reaches 1099K thresholds. You would not be required to issue a 1099-NEC.

When people are confused about the law, they issue the 1099-NEC to be on the safe side. While that may seem like the best thing to do, it really isn’t. You create an issue of double-reporting when you issue a 1099-NEC that is not necessary.

The IRS looks at the amounts reported on 1099Ks and 1099-NECs and adds them up. If the reported gross income is less than the 3rd party amounts reported, the taxpayer will receive a notice of underreported income (CP2000).

Example: You paid a contractor $20,000 via credit card, and issued a 1099-NEC. The payment processor also issued a 1099K for $160,000 (that includes the $20,000 you paid by credit card). In the IRS’s view, the contractor earned $180,000, when in reality only $160,000 was earned.

If you have questions concerning the 1099K, check out the IRS updated 1099K FAQ.

If you have an issue with unreported income, click here to schedule an appointment with us!

BENEFICIAL OWNERSHIP INFORMATION REPORTING 2024

Phase 1 of the Corporate Transparency Act (CTA) went into effect on January 1, 2024. It imposes a new federal filing requirement for most corporations and limited liability companies (LLCs) formed in 2024 and later. It also applies to businesses formed before January 1, 2024, but the requirements are different. See the note at the bottom of the post.

What was the Corporate Transparency Act all about?

Usually when the government creates new laws and requirements, it’s in an effort to curtail criminal activity. This is no different. The purpose of CTA is to attempt to prevent anonymous shell companies for money laundering, tax evasion, and other illegal purposes. As with everything else, the good get caught up with the bad, hence BOI Reporting. #ThanksCriminals

The BOI Report applies to businesses formed by filing with the Secretary of State, such as LLCs and Corporations. Some businesses are exempt. You can find the list of exemptions here. If you are unclear as to whether or not you are exempt, file the BOI report. One of my tax mentors told me once, ‘There is no such thing as over-reporting. When in doubt, REPORT!’

Deadline to file BOI Report

Applicable companies that were formed January 1, 2024 or after, have 90 days to file the BOI report. The report is filed at: https://www.fincen.gov/boi. The report contains specific information for each beneficial owner.

According to FINCEN, a beneficial owner is defined as “any individual who, directly or indirectly, exercises substantial control over a reporting company, or who owns or controls at least 25 percent of the ownership interests of a reporting company.”

Here is the information you’ll need for each Beneficial Owner to complete the BOI Report:

- Full legal name

- Date of birth

- Complete current residential street address

- A unique identifying number from a current U.S. passport, state or local ID document, driver’s license, or foreign passport

- An image of the document that contains the unique identifying number

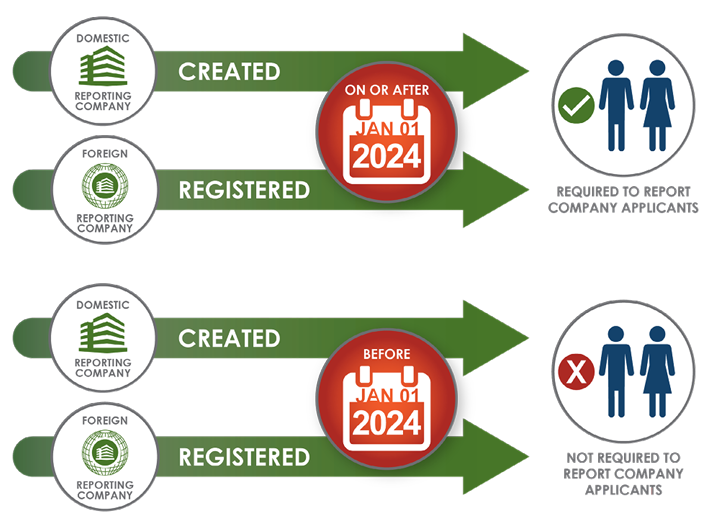

BOI Company Applicant

A company applicant is defined as either the "direct filer, or the individual who directs or controls the filing action". A reporting company is also required to report its company applicants if it is either a:

• domestic reporting company created on or after January 1, 2024; or

• foreign reporting company first registered to do business in the United States on or after January 1, 2024.

Each reporting company that is required to report company applicants will have to identify and report to FinCEN at least one company applicant, and at most two. All company applicants must be individuals. Companies or legal entities cannot be company applicants.

Who is responsible for filing the BOI report?

There is a lot of misinformation about who is actually responsible for filing the BOI Report. The responsibility belongs to the Beneficial Owner(s). The BOI Report is NOT a tax report, therefore your tax professional or accountant is not responsible for filing this report. Can they offer the service? Sure. However, it is not a part of tax preparation, just as filing your annual report with the state is not a tax preparation function. Attorneys are also available to assist you with filing the report. If you hire someone to provide this service for you, trust but verify. The ultimate responsibility lies with the Beneficial Owner(s), not the person you hired.

What if you don’t file the BOI Report?

There’s always someone who asks, “What if I don’t want to?” The willful failure to report may result in a civil or criminal penalties, including civil penalties of up to $500 for each day that the violation continues, or criminal penalties including imprisonment for up to two years and/or a fine of up to $10,000. Senior officers of an entity that fails to file a required BOI report may be held accountable for that failure. Responsible persons can also be penalized for providing false or incomplete information to a company, knowing that it is intended to be reported to FINCEN.

To be clear though, nobody is coming to your house to arrest you today for not filing your BOI Report. People are advertising in a way to frighten you to hire them. The earliest anyone has a report due is March 31, 2024.

30 Days to update the BOI Report

Once the initial report is filed, a Beneficial Owner has 30 days to report any changes to Beneficial Ownership. If a Beneficial Owner moves, you must update the BOI report within 30 days. If a company adds an owner, you must update the BOI report within 30 days.

Note: If you formed your business before 1/1/2024, you have until 1/1/2025 to file your report, and you are NOT required to report your company applicant. If your company is created or registered on or after January 1, 2025, it will have 30 calendar days to file its initial BOI report.

BOI Small Entity Compliance Guide

FINCEN created the Small Entity Compliance Guide to answer your questions. Grab a copy here!

The New Self Employed Covid Credit

Ahhh… Have you seen the ads?

“1099 Gig Workers Claim up to $32,000 with the ‘New’ Covid Self Employed Tax Credit (SETC).

Oy! I decided to write this blog post once I got a few inquiries from my clients. Quite frankly, these companies make my skin crawl. I’ve even seen influencers, who have ZERO experience with tax, telling their audiences to go ‘get this money’, BUT ... ‘check with your CPA first’. [Insert my best side-eye.]

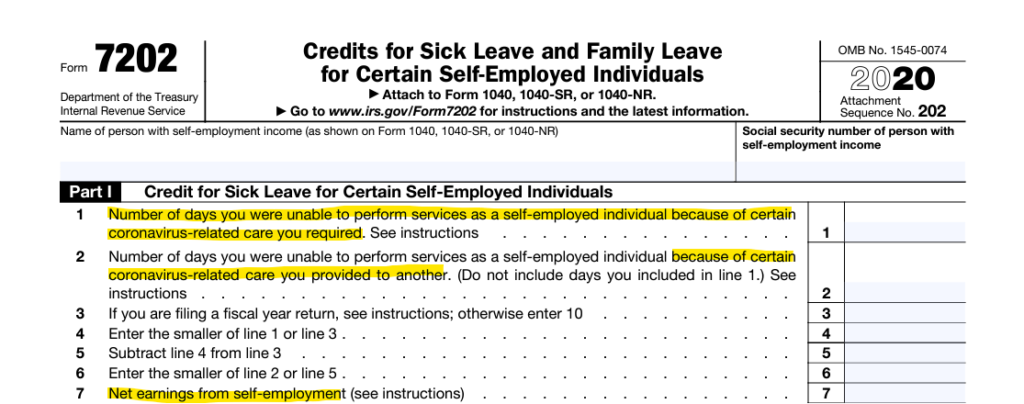

The actual name of the credit is the Self-Employed Sick and Family Leave Credit. SETC is not a thing. If you ask a tax professional about the SETC, they’ll probably be confused, because that’s not the name of the credit. However, to gain understanding about this credit, I will use the Street Committee Name - SETC. Let’s talk about how we got here.

Employee Retention Credit Claims - FROZEN

In September 2023, the IRS ordered the immediate stop to Employee Retention Credit (ERC) processing. They received several millions of ERC claims, many of them fraudulent. Employers could still submit claims, but they would not be processed. FYI, Tax Year 2020 ERC claims need to be submitted no later than April 15, 2024. The credit is claimed on Form 7202.

ERC claims were lucrative, and these companies made a BOATLOAD of money, charging 20% of the credit received. If a client received a claim for $60,000, the companies would be paid $12,000. That's a heck of an incentive to submit fraudulent claims. Should the IRS come knocking, it would be at the employers' doors, not the company that fabricated the information on the claim. The IRS pumped all the brakes on that.

SETC is the new ERC

Since the ERC well dried up, these companies shifted their sights to the Self-Employed Sick and Family Leave Credit. Now Self-Employed individuals are being bombarded with advertisements of being able to get ‘up to’ $32,000 from the SETC. It only takes a few minutes to apply (insert affiliate link). You didn't think people were posting about it just to help - right? I'm not mad at anyone earning affiliate commissions. I do it all the time. I AM annoyed at promoting something that has serious consequences if the person doesn't get all the information. A tax credit is not the same as promoting the latest email marketing tool.

Under the 2020 rules, a self-employed individual could claim up to $15,110. For 2021, they could claim up to $17,110; hence the total $32,000. The clock is ticking on claiming the 2020 tax credit, so the ads are on fire.

Qualifications for Self-Employed Tax Credit

There are three main questions you have to answer to determine if you qualify for the credit.

- Were you unable to work because you had Covid?

- Were you unable to work because you had to care for someone with Covid?

- Did you earn a profit?

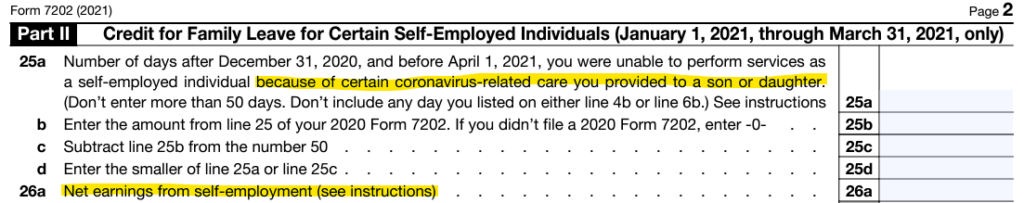

In 2021, the qualifications were tweaked a bit. In part II of the form below, Form 7202 specifies “January 1- March 31, 2021”, and also specifies caring for a son or daughter (see instructions). The instructions say: “because of certain coronavirus-related care you provided to a son or daughter whose school or place of care is closed or whose childcare provider is unavailable for reasons related to COVID-19 or for any reason you may claim sick leave equivalent credits.

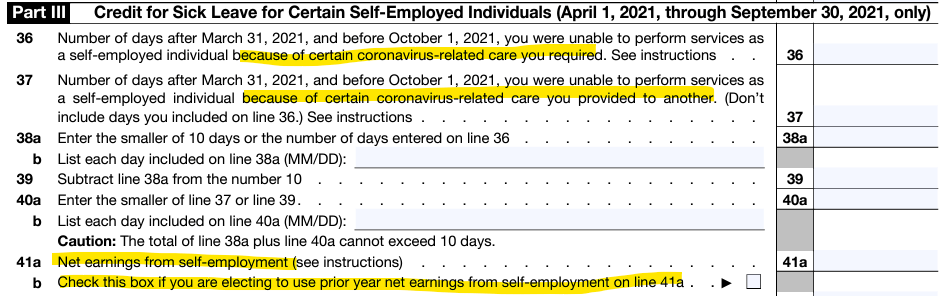

Part III of the 2021 version of Form 7202 specifies April 1 through September 30, 2021, for yourself or care you provided to another. The section specifically for children was removed. The great thing about the credit is that you could separate the time you needed to care for yourself or another from the time you needed to care for your children.

Part III 2021 Form 7202

Plenty of Self-Employed individuals were impacted by Covid. I don’t know any that were not; however, being impacted by Covid did not automatically mean you qualified for the credit. Millions of self-employed individuals lost money in their businesses during Covid. If you look at both the 2020 and 2021 Form 7202, it asks for ‘net earnings’ from self-employment (amount of profit). If you claimed a loss, you did not qualify for the credit. The advantage of the 2021 version of the credit is that you could use net earnings from 2020. If you posted a loss in 2020, then you still did not qualify for the credit.

Be prepared for an audit

If you qualify for the credit and didn’t claim it, by all means, amend your return to claim your credit; however, I also caution you to be ready for an audit. The auditor will ask for bank statements to confirm revenue and expenses. They may also ask for proof that you had Covid, a family member had Covid, or that your childcare facility or school was closed. Closed daycare and schools won’t be hard, for sure. While your health information may be protected, your banking information is not. You have to be able to prove anything you claim on your return.

Don’t be duped into claiming false credits. The false claims are why there is a moratorium on the Employee Retention Credit. If the IRS or State comes knocking on your door (figuratively, they’re not coming to your house right now), but if you get the letter being notified of an audit, reach out to us at ETS Tax Relief to help you!

1099K Change for 2023

The IRS issued a press release on October 24, 2022 reminding service providers and other business owners that they may receive a form 1099-K for sales in excess of $600. Third-party payment processors such as PayPal and Stripe will issue 1099-Ks to their customers in early 2023 for sales that exceed $600, regardless of the number of transactions. This will impact tax returns filed in 2023 for Tax Year 2022.

Prior to 2022, third-party payment processors issued form 1099-K if the total number of transactions exceeded 200 AND the total amount of the transactions exceeded $20,000 for businesses. Here are some examples.

Scenario 1: A provider had 3 transactions totaling $25,000. A 1099-K was not issued, because the number of transactions did not exceed 200.

Scenario 2: A provider had 1000 transactions, but the total sales amount was $19,000. A 1099-K was not issued, because even though the number of transactions exceeded 200, the amount of sales was less than $20,000.

As taxpayers became aware of the reporting requirements, many did not report the income on their taxes. There were also taxpayers that used more than one third party processor in order to avoid reporting requirements. This act is called structuring, and it’s illegal.

The American Rescue Plan Act of 2021 (ARPA) lowered the reporting threshold for third-party networks that process payments for those doing business. Now a single transaction exceeding $600 can trigger a 1099-K. But, why?

Who is TIGTA?

While the media will have you believe that all of this happened because of a President and his administration, this change in reporting was coming regardless of who was in office. Here’s why:

On December 30, 2020, The Treasury Inspector General for Tax Administration (TIGTA) released a report: Billions in Potential Taxes Went Unaddressed From Unfiled Returns and Underreported Income by Taxpayers That Received Form 1099-K Income. TIGTA is an independent organization that provides oversight of the IRS.

TIGTA reviewed 2017 tax returns to compile their report. The report states, “TIGTA identified 314,586 business taxpayers with $335.5 billion in Form 1099-K income that appeared to have a filing obligation, but were not identified as nonfilers by the IRS.” …”TIGTA identified a significant number (325,060 business non-filers and 103,991 individual non-filers with $203 billion and $3 billion in Form 1099-K income, respectively) that were not selected to be worked.”

Essentially TIGTA revealed the abuse of 1099-K reporting requirements and recommended the IRS fix it. That’s why the law changed. It had nothing to do with the President.

What about the Zelle “Loophole”?

After ARPA 2021 was released, there were several social media posts created about the ‘Zelle Loophole’. Zelle is a money transfer application that allows you to transfer money directly from one bank to another. It is not a third-party payment processor. Because of that, Zelle currently has no reporting requirements.

Social media influencers were suggesting that using the “Zelle Loophole” was a legal way to circumvent the 1099-K reporting requirements. This is absolutely and unequivocally FALSE.

Using Zelle to earn income and not report it is tax evasion - the illegal non-payment or under-payment of taxes, such as by declaring less income, profits or gains than the amounts actually earned, or by overstating deductions. Zelle’s terms of service also states: “We only grant you a limited revocable license to use the Site for your own non-commercial use subject to rules and limitations.” In other words, you’re not supposed to use it to receive business payments.

Reputable sites were purporting the myth that the IRS was going to “start” taxing money that wasn’t previously taxable. That is inherently false. Do not confuse ‘third party reporting requirements’ with your responsibility to report your income. Section 61(a) of the Internal Revenue Code defines gross income as income from whatever source derived, including (but not limited to) “compensation for services, including fees, commissions, fringe benefits, and similar items.” I.R.C. § 61(a)(1). All income is taxable unless there is a specific provision that says it’s not. You’re even required to report stolen money!

Prior to 2022, you were required to report your income, even though third party processors were not required to issue 1099-Ks. The requirement for the taxpayer to report their income is not new. The change in third party reporting requirements is what’s new.

States were already making the change

There were a few states that already lowered the threshold for reporting. Maryland, Massachusetts, Virginia, Vermont, and District of Columbia had already reduced their reporting requirement to $600 in previous years. There are other states that had lower reporting requirements, as well. Now it will be reported uniformly in all states.

If you have previously avoided reporting your income, we highly encourage you to amend those returns to accurately reflect what you earned. Give us a call if you need help: 877.482.9411.

IRS Taxing Fraudulent PPP Loan Forgiveness

On September 16, 2022, The Office of Chief Counsel of the IRS issued a memorandum regarding fraudulently forgiven PPP Loans. It seems that fraudulent PPP loan issues will never die. The short story: If you received PPP loan forgiveness under false pretenses, you must claim that amount as taxable income.

PPP Loan History

When the Coronavirus (Covid-19) pandemic struck in the United States, everyone was sent to a collective timeout. Businesses had to shut down. Citizens were warned to stay away from populated places. Covid-19 devastated many businesses. The government responded with the Paycheck Protection Program (PPP) Loans to assist small businesses with paying payroll and other eligible expenses. These loans were processed by lenders and guaranteed by the Small Business Administration (SBA).

There were two rounds of PPP Loans. The first was issued under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The second was issued under the Economic Aid Act, which amended previous PPP Loan provisions. For both rounds, lenders made these loans to “eligible recipients under specified terms, conditions and processes of the program”. The lenders could forgive the loans based on certain criteria and be reimbursed from the SBA.

Who was eligible to receive a PPP Loan?

According to the internet, EVERYBODY was eligible to receive a PPP Loan. [Insert the biggest eyeroll possible].

The actual requirements to be eligible to receive a PPP Loan were:

- Be a small business (as determined by the SBA), independent contractor, eligible self-employed individual, sole proprietor, business concern, or a certain type of tax-exempt organization.

- In business on February 15, 2020

- Either had employees or was an eligible self-employed individual, sole proprietor or independent contractor.

What were eligible PPP Loan expenses?

Paycheck Protection Program loans were issued to cover specific, eligible expenses. These expenses include payroll costs, rent, interest on the business’s mortgage, utilities, and other operational expenses; SUBJECT TO REPAYMENT and additional liability if the funds were misused. You were not eligible to take PPP loan funds and start a business.

PPP Loan forgiveness qualifications

Loan forgiveness was truly the selling point of PPP Loans. To receive PPP Loan forgiveness one had to meet the following:

- At least 60% of the loan must be used for payroll

- Up to 40% of the PPP loan could be used for other operational expenses.

If a recipient used 100% of their PPP Loan to cover payroll costs, then the loan qualified for loan forgiveness. Forgiven PPP loan funds were excluded from taxable income. This was truly free money from the government!

Fraudulent PPP Loan Forgiveness

If you receive PPP loan forgiveness based on false statements, your loan does not actually qualify for forgiveness and must be included in taxable income. For example, let’s assume you were an eligible recipient and received a $20,000 PPP loan. Your documentation said that you used 100% of the PPP loan proceeds to pay payroll expenses (eligible expense), and the loan was forgiven. In reality, you actually used the funds to buy a car (ineligible expense). You must include the $20,000 as taxable income.

Fraudulent PPP Loan Recipients

If you received a PPP Loan, and you were not an eligible recipient, your loan does not qualify for forgiveness. If you submitted your loan and received forgiveness, you must include the forgiven amount as taxable income.

Let’s assume you received a $50,000 PPP loan based on false representation that you had a business with employees and received the loan disbursement. Later on, you submitted false documentation representing that you spent the loan funds on payroll for non-existent employees. You must claim the $50,000 on your tax return as taxable income.

Forgiven PPP Loans - Income or Nah?

Internal Revenue Code Section 61(a) states that “gross income means ALL income from whatever source [legal or illegal] derived.” This applies to all payments that are “undeniable accessions to wealth, clearly realized, over which the taxpayers have complete dominion” constitute taxable income - Commissioner v. Glenshaw Glass Co. (1955). Internal Revenue Code section 636m(i) of the Covid Tenant Relief Act provides the exclusion of forgiven PPP Loan funds from gross income.

Once PPP Loans are forgiven, the funds provide for an “undeniable ascension to wealth”, especially when you flex for the ‘gram and post your ill-gotten gains. However, if your loan was forgiven based on lies - spent on ineligible expenses or you were an ineligible recipient - your loan was not forgiven based on the specific terms of the program and you must claim it as income.

Forgiven loan funds are not taxable income unless the forgiveness was based on fraud. Let's assume that you obtained a PPP Loan fraudulently, and received forgiveness, but don't claim it on the return. Should you get caught in your illegal dealings, you should look for a charge of tax evasion to be added to the fraud charges you'll get.

IRS Gets $80 Billion For What?

You’ve seen the news. You’ve seen the lightning flashing, and thunder roaring. You’ve heard the cries in the street!

“Oh my God! The IRS is hiring 87,000 people to come get us!”

“They’re coming for the poor and middle class!”

“Audits are going to increase!”

Lions, tigers, and bears! Oh MY!

The IRS is getting $80 Billion

Yes, the IRS is getting $80,000,000,000. That’s what $80 Billion actually looks like numerically. Anywho, this $80 Billion will be dispersed over 10 years. Here is a breakdown of the funding: Enforcement $45.6 Billion, $25.3 Billion for Operational support, $4.8 Billion to modernize IRS business systems (administration of taxpayer services, operations, and cybersecurity).

Backstory: The IRS has been underfunded for DECADES. They have antiquated systems that rival MS DOS. The irony is not lost in that systems received the least amount of funding. The IRS is also dealing with the Great Resignation.

The IRS is hiring 87,000 new Agents

Cool your jets! 1. These are not all going to be auditors. 2. They aren’t being hired Tuh-Day!

The IRS is facing the normal attrition of retiring individuals. They are also facing the same hiring struggles as every other business.

“It’s hard to hire for the IRS, when Target is paying $20 per hour”. ~Chuck Rettig, Commissioner of the IRS

There isn’t going to be a formation of an Army of Revenue Agents looking like the First Order in Star Wars, at least not TUH-DAY!

More Audits?

In the IRS’s strategic plan from a few years back, they told us they were going to be targeting high income non-filers. That plan has not changed.

The headline of the Treasury Inspector General for Tax Administration (TIGTA) report from May 2020 was: “High-Income Nonfilers Owing Billions of Dollars Are Not Being Worked by the Internal Revenue Service”. Guess what’s going to be happening now?

The headline of TIGTA’s December 2020 report was: “Billions in Potential Taxes Went Unaddressed From Unfiled Returns and Underreported Income by Taxpayers That Received Form 1099-K Income”.

The enforcement initiatives are not a surprise. Now, everyone is yelling, “Get your documentation in order”. If you prepare your return as if the IRS will show up tomorrow, they could hire a million revenue agents, which wouldn't matter to you.

Enforcement

The lion's share of the funding is going to enforcement. The goal of enforcement is to close the tax gap. According to the Treasury Department, the tax gap was $554 Billion in 2019. Approximately 84% percent of taxes owed in tax-year 2019 were actually paid or collected.

During the pandemic, the government stopped collection action. Since the pandemic is ‘over’, collection actions have resumed. If you have an outstanding tax liability, the IRS is pressed to get some sort of resolution - whether it’s an installment agreement or Offer in Compromise. Your goal as the taxpayer is to pay the least amount possible. The IRS's job is to collect as much as possible.

PPP Loan Fraud

Ahhh, we can’t talk about enforcement without talking about PPP Loan fraud! What types of PPP loan applications do you believe dominated the fraud? It was the Schedule C application. People were promoting PPP loans like they were an MLM like this case. People with absolutely NO financial background were out in these streets selling PPP loan application assistance like candy, helping people apply for fraudulent loans in exchange for a cut of the proceeds. The thieves submitted fraudulent Schedule Cs and false employee tax returns (941s) to obtain money they weren’t entitled to receive. Now the chickens are coming home to roost. A New York Times article (Aug 16, 2022), states:

There are currently 500 people working on pandemic-fraud cases across the offices of 21 inspectors general, plus investigators from the F.B.I., the Secret Service, the Postal Inspection Service and the Internal Revenue Service.

It also states:

The federal government has already charged 1,500 people with defrauding pandemic-aid programs, and more than 450 people have been convicted so far.

The Inflation Reduction Act increased the time for the government to prosecute PPP Loan thieves to 10 years. They stole taxpayer money. Should the government not work to get it back?

Status of the IRS

The image above is of the cafeteria in the Austin Tx processing center. According to the Washington Post, as of July 29, the IRS had a backlog of 10.2 million unprocessed individual returns. The IRS has severely outdated systems - paper-people based systems, fax machines, and the lack of ability to scan documents in the computer. Paper returns have to be manually keyed in. The pandemic only exacerbated the situation.

You may not like it, but the IRS needs this funding. It's that simple. The changes will not happen overnight. You have time to get your documentation life together, so that in the event you are audited, you'll be ready.

Mileage Rate Change July 1, 2022

The IRS announced they will increase the mileage rate the latter half of 2022. Starting July 1, 2022, the mileage rate has increased to 62.5 center per mile to help ease the strain of the rise in gasoline prices. Business owners will need to report mileage from January 1, 2022 through June 30, 2022, and then from July 1, 2022 through December 31, 2022 to be able to properly deduct business mileage when they file their 2022 tax returns.

With that out of the way, let's talk about the mileage deduction!

Mileage is one of the most audited items in a business, as it is one of the highest paying and most abused deductions. It is imperative for business owners to accurately report business mileage. Guessing or using ‘same as last year’ just ain't it.

Vehicle Expense Deduction

Business vehicles are cars, SUVS, and pickup trucks that are used for business activities. There are other restrictions to vehicles that qualify for the business use of vehicle deduction. Today’s post is about mileage and expenses.

There are two ways to deduct vehicle expenses - the actual expense method or standard mileage rate. Here is a brief summary of each method.

Actual Expense Method

The actual expense method allows a business owner to deduct a portion of actual expenses. This deductible portion is in relation to the amount of business miles to overall miles.

The expenses included in this method are:

Vehicle loan interest

Insurance

Maintenance and repairs

Tires

Licenses

Registration Fees and taxes

Garage Rent

Parking and tolls

Gas and oil

Rental or Lease payments

Depreciation

With this method, the taxpayer needs to know the total number of miles driven for business and personal use. The deduction amount is the ratio of business miles to total miles driven.

Example

Jack drove a total of 15,000 miles during the taxable year. He reported 8,500 business miles. Jack reported $10,000 of vehicle expenses. What is the amount of his deduction?

8500/15000 = 56.6% - rounded to 57%.

57% of $10,000 (vehicle expenses) = $5700 (not including the depreciation amount).

Standard Mileage rate

Every year Congress sets a standard mileage rate for business miles. For 2022, the rate was originally 58.5 cents per mile for business travel. Because gas prices are higher than Snoop Dogg, Congress increased the mileage rate by 4 cents per mile to 62.5 cents per mile to offset the steep increase in prices. Of those amounts, 26 cents per mile is allocated to depreciation.

Accurate Mileage Log

The lack of an accurate mileage log gets business owners every time! Regardless of the method you choose, you must have an accurate, detailed mileage log. An accurate mileage log contains the following information:

Date the trip was taken: (self-explanatory)

Origin: The address where you started.

Destination: The address of where the trip stopped.

Number of miles: total miles between the two points

Purpose: List the business purpose.

Your mileage log will also contain the total miles driven for business in a tax period.

Why It's Important

In a recent opinion issued by the Tax Court, a taxpayer’s deduction was denied because of a lack of sufficient records. In Pedersen v. Commissioner, the taxpayer claimed a mileage expense as part of Unreimbursed Employee Expenses on his 2016 tax return. Although the case was related to Unreimbursed Employee Expenses, the principles are still the same as they relate to a business.

The opinion states: “For expenses relating to passenger automobiles, a taxpayer must substantiate with adequate records or sufficient evidence corroborating his statement (1) the amount of each separate expense using either actual costs or the standard mileage rate; (2) the mileage for each business use of the passenger automobile and the total mileage for all purposes during the taxable period; (3) the date of the business use; and (4) the business purpose of the use. See Treas. Reg. § 1.274-5(j)(2); Temp. Treas. Reg. § 1.274-5T(b)(6).”

While the Internal Revenue Code does not specifically state that one has to list odometer readings, it certainly helps “substantiate with adequate records”. In the end, Mr. Pedersen had to pay back approximately $1000 for disallowed mileage + penalties + interest (which gets compounded daily).

I’m willing to bet lunch money that the 2022 tax year mileage will be watched closely. It will be very easy for someone to overlook the change in mileage rate change mid-year. On audit, some or all of the mileage could be disallowed, and the difference will have to be paid back to the government. Tax professionals will have to ensure their clients show mileage from January 1 - June 30, 2022 and then July 1 - December 31, 2022.

The mileage rate increase, as of this writing, is temporary. Congress may choose to extend the increased rate through 2023. That remains to be determined.

If you are being audited, and are in need of assistance, schedule a call with us.