BEWARE Military Disability Scam

My husband retired from the military in April 2022. It was an awesome occasion when it finally got here; however, getting there was slightly painful. He had to go through tons of briefings on his own. We also had to go through a finance briefing. Because I am who I am, I requested to visit finance several months prior. Nothing irks me more than being made to make financial decisions, before you’ve had a chance to digest the information. I’ll get off that soapbox, because that’s not what today’s post is about.

When a Servicemember Retires

When a servicemember retires, they can receive retirement income, as well as disability benefits. In the process of retiring, servicemembers have to go through a process to determine their disability rating, which can range from 0 - 100% disabled. Just for clarity, that disability rating does not mean there is necessarily a visible physical impairment.

The disability rating will determine if there is any portion of the retirement income that is not taxable. The service members receive two separate payments - retirement income (taxable), and disability income (non-taxable).

The Strickland Rule

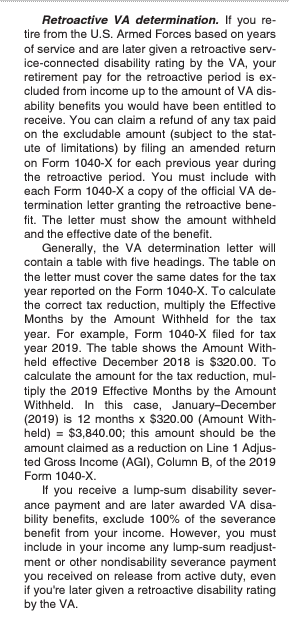

In current times, most service members receive their disability rating at the time they retire, so the payments are accurate. There are situations though, where a service member retires, and then receives a disability rating later on. If that disability rating is made retroactive, then the service member may be entitled to a refund of a portion of the taxes paid.

In Revenue Ruling 78-161, Zebulon Strickland, COL(RET) received a retroactive disability rating. In short, he argued, and it was held, that he was entitled to a refund of taxes paid on the retirement income previously paid during the retroactive time.

The scam that followed…

Your retirement income is not taxable

When my husband retired, a few of his friends sent him an email. It was the exact same email that was sent from different people saying that his retirement income is not taxable, because of his disability rating. Naturally, he sent the email to me.

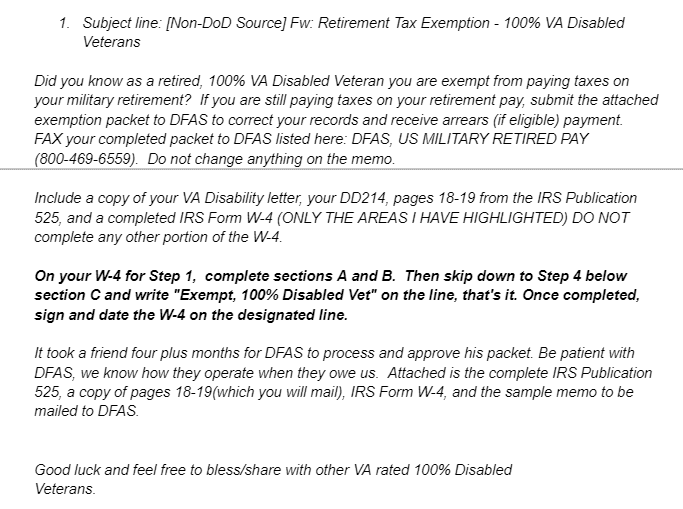

- The attached memo says:

Dear DFAS,

In accordance with the attached IRS Publication 525, because I am 100% disabled, certain

Military and government disability pensions are not taxable. I am requesting to have the code

changed in DFAS to reflect me not paying taxes on my retirement pay.

Thanks for your prompt assistance in this matter.

Writing Exempt on the W-4

Let me tackle the easy one first. If you send a W-4 to payroll with ‘Exempt’ written on it, they will stop withholding federal taxes. That doesn’t mean you won’t owe taxes. It just means you instructed the payroll department to not withhold taxes. When you file your return, your 1099R will show both the distribution amount and the taxable amount, which will be the same. You will have tax liability when you file.

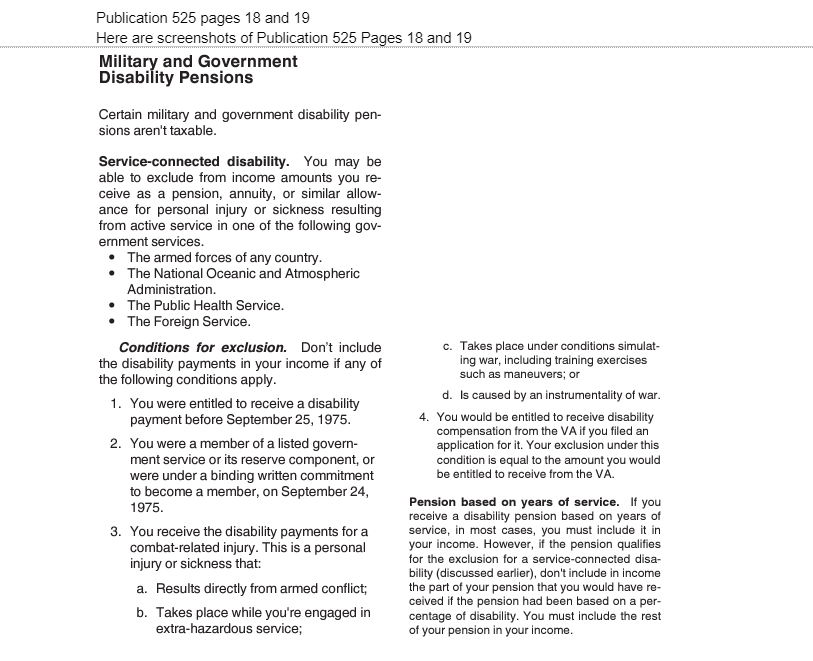

Publication 525

As you can see, Publication 525 does state that certain military and government disability pensions aren't taxable (VA disability), and it lists the terms and conditions. However, it goes on to say that if you receive a disability pension based on years of service (retirement income), in most cases, you must include it in your income (taxable). If the pension qualifies for the exclusion for a service-connected disability, don't include in income the part of your pension that you would have received if the pension had been based on a percentage of disability.

If you get your disability rating at the time you retire, barring any other administrative errors, your retirement pay and disability payments are accurate.

What the packet is attempting to convince you is that your retirement (pension based on years of service) is not taxable, and that is factually incorrect.

For people that actually attempted to amend previous returns to get taxes refunded, here’s what happened. Initially, the servicemember received a refund of the taxes. On audit (a year or 2 later) the government came back for their money, plus interest and penalties. There were several tax preparers pushing this scam, and were eventually barred from the tax preparation industry, and some incarcerated.

Here’s the bottom line:

Tax professionals, if a retired service member says they want to amend to get their taxes back, ask to see their VA Disability rating letter.

If you have back tax debt click here to contact us! We are here to help!

Kanye West Says He Owes $50 Million in Taxes

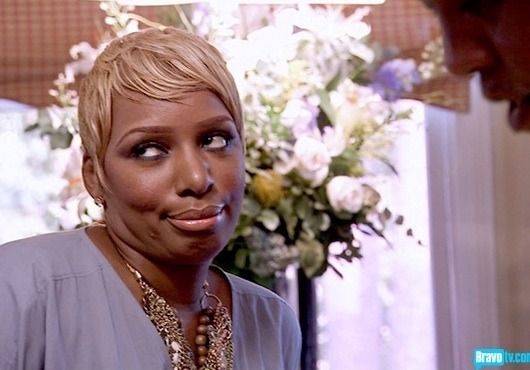

Kanye West claims he owes $50,000,000 in taxes. Here we are again, with yet another celebrity that seems to be in tax trouble. I’m side-eyeing his claims though. Kanye West appeared on the Timcast IRL podcast Kanye, or should I say “Ye, the artist formerly known as Kanye West”? Ye told Tim Pool: "I'm talking about literally finding out that they were trying to put me in prison this morning. But I found out — okay, so they froze, they put a $75 million hold on four of my accounts. And then they said, you owe a lot of taxes. Took me like six hours to find out how much. A lot — was it — well, around $50 million. “ I want to dissect these statements to share with you why I’m giving him the side-eye.

The Collections Process

When you owe a tax debt, there is a process the IRS follows to collect the debt. First, you’ll get a bill in the form of a CP14 Letter. Next, you’ll get a reminder, a CP501 letter. Then you’ll receive a reminder about the reminder, a CP503 letter. If you haven't responded to any of those letters, you'll receive a CP504 Letter - a Notice of Intent to Seize (Levy) your property. There are at least 4 letters that Kanye West should have received at his last known address. Notice of Intent to Levy Once the taxpayer doesn’t respond to those letters, then the notices of Intent to Levy are sent. As mentioned above, the first letter is the CP504 Notice of Intent to Levy. The Notice of Intent to Levy explains that the IRS intends to levy (seize funds) if the amount owed is not paid within 30 days. At some point, the taxpayer will receive the letter 1058. That's when the IRS has finally counted to three and decided to put their foot down and will levy your property. If you’ve been counting, from the time the tax is owed to the time the IRS even announces they are intending to levy your bank account can be upwards of 6 months. Please note that there is no mention of putting anyone in jail. By the IRSs' own processes, they didn’t ‘suddenly’ freeze $75,000,000. There has been ample opportunity to pay.

Ye said it took him 6 hours to find out how much he owes.

Sir, What? If Ye filed his taxes, he only needed to look at the tax return (s). I don’t care how you slice it, he had to have put his eyeballs on a tax return in order to sign it. We can only assume that he has a competent accountant. If that’s the case, it would have taken a phone call. He could have also logged into his IRS account. We’re going to just assume he doesn’t have an account, since many people do not. Him taking ‘6 hours to find out’ is ridiculous. Unless he was waiting for someone to get to work, it should not have taken him 6 hours to find out how much he owed in taxes. It may have taken him that long to find the letters and open them.

The IRS doesn’t resort to prison first

Now, back to Ye stating they were looking for him to put him in jail. While I was not there; I have a hard time believing this. I listened to the podcast, and he never specified exactly who was looking to put him in jail. He specifically said no one up to his house, but 'they' wanted to put him in jail. The IRS does not automatically put you in jail for owing taxes. If you owe, and you try to evade paying, then they will arrest you. Tax evasion is when you illegally don’t pay what you owe by hiding money, for example, or you try to flee the country without paying. That’s when the government puts you in jail. The only time the IRS will jump any of this process is if they believe they are dealing with someone who is a flight risk, or are concerned the taxpayer will try to dispose of assets to avoid paying taxes. Otherwise, they follow the process. My favorite part: After revealing he attempted to find out, “would this be tax evasion?” Kanye West then admitted, “I’m obviously not the most financially literate person on the planet.” Even the most financially illiterate person knows to pay taxes. #StopIt What’s the Take Away There is a collections process the IRS follows. It doesn’t go from you owing directly to levying wages and bank accounts. When you don’t respond to IRS letters, you force the IRS to enforce the law. Those laws are written by Congress, not the IRS. The IRS is the longest reaching arm of the law. If you have received letters from the IRS, open them, and then call us - 877.482.9411. We can help!