Employee Gifts are Taxable

I was perusing the news a few weeks ago. The news headlines said, “Wal-Mart Slammed After Gifting Employees 55-Cent Ramen Noodles” for working during a blizzard. Needless to say, Wal-Mart was dragged on Social Media. While I agree, it’s a cheap “gift”, it also made me think of other headlines of similar disdain, like this one: A bus driver retired after 50 years, and ‘all’ they gave him was replica of a bus with his picture on it.

Did you know that most employee gifts are taxable?

De minimis Gifts are not taxable

A De minimis gift is a non-cash gift or award, considering its value and the frequency with which it is provided, is so small as to make accounting for it unreasonable or impractical. In the Wal-Mart example, 55-cent Ramen Noodles would definitely qualify as de minimis. It was a one-time inexpensive gift.

Internal Revenue Code 132(a)(4) excludes de minimis gifts from income (meaning not taxable to the receiver).

Examples of De minimis items not included in taxable income

- Controlled, occasional employee use of photocopier

- Occasional snacks, coffee, doughnuts, etc.

- Occasional tickets for entertainment events

- Holiday gifts

- Occasional meal money or transportation expense for working overtime

- Group-term life insurance for employee spouse or dependent with face value not more than $2,000

- Flowers, fruit, books, etc., provided under special circumstances

- Personal use of a cell phone provided by an employer primarily for business purpose

Cash gifts are taxable

Cash is considered wages, unless an exception applies. An example would be OCCASIONAL meals or transportation. If the meals or transportation becomes a regular occurrence, it will become taxable as wages.

Cash or cash equivalents, such as gift cards, are always taxable income. Gift cards/certificates for general merchandise are never excluded from taxable income. If Wal-Mart had given each employee a Wal-Mart Gift Card for 55 Cents instead of the Ramen Noodles, the 55 cents would have been added to their taxable income.

Achievement Awards can be taxable

Let’s look at the example of the bus received after 50 years of service. Working as a faithful employee for 50 years is DEFINITELY an achievement. Nothing could ever show someone how much they appreciate 50 years of service, but a dinky bus?

Internal Revenue Code 274(j) limits the deduction allowed for achievement awards equal to that of the max exclusion amount. The deduction is limited to $400 or $1600 depending on whether it is a qualified or non-qualified plan award, which means that the receiver can only exclude $400 or $1,600. If the value of the achievement award exceeds one of these two numbers, the overage would be taxable.

Internal Revenue Code 274(j)(3) states that achievement awards are tangible personal property awards and:

- Cannot be disguised wages

- Must be awarded as part of a meaningful presentation

- Cannot be cash, cash equivalent, vacation, meals, lodging, theater or sports tickets, or securities.

Imagine getting a vacation with a side of a tax bill

The achievement awards can't be any of the cool things one would like to receive as an achievement award. When all of social media is screaming that an employer should send the 50-year employee on a trip, instead of giving the employee the stupid bus, tax law says... NO!

Let’s assume the total value of that trip is $8,000. The final W-2 would include an $8,000 increase in income for which the employee paid no taxes. Can’t you just see it? “Congratulations on 50 years! Here’s a 2 week all-inclusive vacation to Jamaica for you and your family.”

The additional income would increase the tax liability or reduce a refund. It’s not like the employee received $8,000 in cash, so s/he could reserve cash funds. How NOT awesome would that be?

Can companies ‘afford’ to give employees ‘better’ gifts? Unequivocally yes! However, tax law says they can’t, unless the employee pays taxes on the value of the gift. Wal-Mart gave employees a pack of noodles worth 55 cents. One would think they could have at least sprung for two.

If back taxes or unpaid tax debt are keeping you up at night, click here to reach out to us! We’re here to help!

100% Bonus Depreciation Ends 12/31/22

Since we’re nearing the end of the year, business owners everywhere are looking for ways to save tax dollars. One of those ways is purchasing needed equipment or vehicles. If you NEED to replace equipment or a business vehicle, by all means, get it done before the end of 2022. Here’s why!

100% Bonus Depreciation is Ending

Since the Tax Cuts and Jobs Act of 2017, businesses have used bonus depreciation to deduct 100 percent of the cost of most types of property (other than real property). Starting January 1, 2023, bonus depreciation is scheduled to decline 20 percent each year until it reaches zero in 2027.

For example, if you purchase $150,000 in equipment for your business and place it in service [key detail] in 2022, you can deduct $150,000 using 100 percent bonus depreciation. If you wait until January 1, 2023, you’ll be able to deduct only $120,000 (80 percent). Don’t get me wrong, 80% bonus depreciation ain’t a bad deal. It’s just not 100%.

Cue the music for buying the G-Wagon! *insert smirk here* If there is any piece of influencer tax advice that irks my soul, it’s the ‘buy the G-Wagon’ advice.

It’s incomplete advice. Here’s how it works:

Let’s assume that on or before December 31, 2022, your business buys and places in service a new or used SUV or crossover vehicle that the manufacturer classifies as a truck, and has a gross vehicle weight rating (GVWR) of 6,001 pounds or more. This new, or new to you, purchased vehicle gives you four benefits:

- The ability to elect bonus depreciation of 100 percent

- The ability to select Section 179 expensing of up to $27,000

- MACRS depreciation using the five-year table

- No luxury limits on vehicle depreciation deductions

Example. On or before December 31, 2022, you buy your coveted G Wagon, a qualifying vehicle, and place it in service (use it for business purposes). The “cheap” G-Wagon SUV is $131,000, for which you can claim 100 percent business use. Your business cost is $131,000. Your maximum write-off for 2022 is $131,000.

And the crowd goes wiiiilllldddd!!!

Bonus Depreciation doesn’t mean free

When people hear this way cool tax advice, they make two unfortunate assumptions.

- The government is giving you a ‘free’ car.

- People also assume that the value of the car is a dollar-for-dollar reduction of the tax liability.

Neither of these is true.

You still gotta pay for the car.

No matter how you slice it, you must still pay for the car. It doesn’t matter if you pay cash for it, or if you have a loan. You may have been able to deduct the total cost on your tax return, which sounds sexy. You still have to settle up with whoever you’re purchasing the car from. The loan payments aren’t tax deductible either, only the interest paid on the loan.

Bonus Depreciation is not a tax credit

Story: I had a client call me and tell me she was going to buy a vehicle that qualified for bonus depreciation. The vehicle was $90,000. She assumed that her tax bill ($123,000) would be reduced by $90,000, consistent with being a tax credit. I explained that purchasing the vehicle would reduce her profit by $90,000, which reduced her taxable income. The purchase would reduce her tax bill by approximately $30,000.

If she had gone through with the purchase, she would have had to pay $90,000 for the vehicle, and still have to pay the remaining $93,000 tax bill ($183,000 out of pocket).

In the G-Wagon example, the vehicle would save you approximately $39,000 in taxes. You would end up paying $131,000 to save $39.000. That math ain’t mathin’ for me. You should purchase a vehicle or any business equipment, because when you need it, with the tax break being the bonus, not just to get a tax break.

Bonus Depreciation Fine Print

Since I know someone is going to be rushing out to buy a vehicle by the end of the year just to save on taxes, here’s the fine print you need to know.

-If you sell or trade the car before the end of its useful life (5 years), you have to pay tax on the depreciated amount (recapture), and it’s taxed as ordinary income.

-There is this teeny issue with the vehicle being an ordinary and necessary expense. Deductions are a matter of legislative grace. That means the government can disallow the deduction of an expense they deem is not ordinary or necessary.

-You can’t depreciate the vehicle AND take the standard mileage

-Vehicle must be used for at least 50% of business purpose

End-of-Year Tax Savings

By all means, do what you can to benefit your business and life, and as a result, lower your tax bill. That doesn’t mean you need to buy unnecessary things just because bonus depreciation is going away.

IRS Use of Private Collection Agencies

I received a frantic call from a new client. "HELP! I got a letter saying that the IRS referred my debt to a collection agency." The first question I had was why hadn’t they told me about the past tax debt. Actually, that was the only question I had, but anywho… While I totally get that collection agencies can be scary, I promise no collection agency is scarier than the IRS. If that’s the case, why does the IRS use outside collection agencies?

Use of Private Collection Agencies is Law

Congress passed a law requiring the IRS to use private collection agencies (PCAs) to help collect overdue taxes.

Your account is sent to a PCA if:

- The IRS was unable to locate you or didn’t have the resources available to locate you.

- A year has passed and you or your representative haven’t interacted with the IRS on your account.

- More than 2 years have passed since the assessment and the account was not assigned for collection.

Private Collection Agencies Used by the IRS

Effective September 23, 2021, when the IRS assigns your account to a private collection agency, one of these three agencies will contact you on the government's behalf:

CBE Group Inc. P.O. Box 2217, Waterloo, IA 50704 Phone: 800-910-5837

Coast Professional, Inc. P.O. Box 425, Geneseo, NY 14454 Phone: 888-928-0510

ConServe P.O. Box 307, Fairport, NY 14450 Phone: 844-853-4875

What's the process when your account is sent to a Private Collection Agency?

You will receive two letters before you are contacted by a private collection agency.

First, the IRS will send Notice CP40 and Publication 4518. As with any other letter you receive from the IRS, open the envelope and read the Notice CP40 carefully. It will tell you that your overdue account was assigned to a PCA. It will also contain important information on what you can expect to happen next.

Secondly, the private collection agency will send their initial contact letter. It has information on how to resolve your overdue taxes.

Both letters contain a Taxpayer Authentication Number. It’s used to confirm your identity. It’s also for you to verify that the caller is legitimate. Keep this number in a safe place.

Private Debt Collection Agencies Call

Unlike the IRS, PCAs will call you, but only AFTER they have sent their initial contact letter. Here’s what you should do when a PCA calls you.

- Validate that the caller is representing one of the private collection agencies listed above.

- The private collection agency will ask you a series of questions to verify that they’re talking to the right person.

- You will be asked for the Taxpayer Authentication Number with the private collection agency to validate each other’s identity.

- The private collection agency will be courteous, and professional and respect your taxpayer rights while following the laws.

- The private collection agency will work with you to resolve your overdue taxes. They will NOT threaten you. If you feel the private collection agency acted inappropriately, here’s how to report it.

How do you make payments to a Collection Agency?

YOU DON’T! Even though your account has been turned over to a PCA, you only make payments to the IRS.

You can use irs.gov/payments for electronic payment options. You can use IRS Direct Pay to use direct debit (from your checking or savings account), preauthorized Direct Debit, the Electronic Federal Tax Payment System (EFTPS), or you can pay by check/money order payable to the United States Treasury.

If you use a check or money order, write your name, Social Security number, and tax year on your payment. The private collection agency will provide the appropriate IRS mailing address for the payment, or you can find it here. Even though you can mail a payment to the IRS, only use it as a last resort. Paying online is faster and more secure.

Private Collection Agencies have no enforcement authority

Private collection agencies cannot take any type of enforcement action against you to collect your debt. However, the IRS does have the legal authority to file a Notice of Federal Tax Lien (against any property) or issue a levy (take money from your bank account) to collect an overdue account.

Don’t want to deal with the PCA?

If you don’t want to deal with the collection agency, you can have your account moved back to the IRS. You must submit this request in writing to the PCA.

Takeaways -

Having your account sent to a PCA isn’t the worst thing in the world. It just means that the IRS couldn’t find you. The IRS will mail letters to your last known address. If you’ve moved and haven't filed past due returns, the IRS may not have a good address for you. They aren’t gonna hunt you down. They will simply turn your account over to a PCA.

If you have unfiled returns or unresolved tax debt, reach out to us at ETS Tax Relief: 877.482.9411.

Key Elements of a Proper Invoice

Question: When is an invoice, not an invoice?

Answer: When it’s not a proper invoice.

What are the elements of a proper invoice?

A proper invoice is a key component to deducting a business expense. A proper invoice contains the following key elements:

- The Word ‘Invoice’ - which specifies you are requesting payment vs providing a quote.

- Name and address of your company - Must be stated clearly to show who is requesting payment.

- Name and address of the client - The company required to make the payment.

- Date of invoice -When the invoice was generated.

- Payment terms - How long the client have to satisfy the invoice

- Date of service - Shows the date the product or service was rendered.

- Summary of Service - a description of the product offered or service performed

- Amount of the invoice - Sum of the invoice to be paid.

You can also add items such as a PO number to make the invoice more detailed, but the above elements are critical to create a proper invoice. If any one of the above elements are missing, the invoice is no longer an invoice.

Why is it important to have a proper invoice?

Businesses receive invoices for products or services. These expenses are deducted as ordinary and necessary business expenses. So far, so good!

Deductions are not entitlements

Supreme Court Case White v United States (1938) held that “Every deduction from gross income is allowed as a matter of legislative grace, and only as there is clear provision therefore can any particular deduction be allowed, and a taxpayer seeking a deduction must be able to point to an applicable statute and show that he comes within its terms.”

In other words, you can claim the deduction; however, you also have to be able to prove you are qualified to take the deduction and maintain proof that you are allowed to take the deduction. If you do that, you will continue to be able to take the deduction, as long as it is an ordinary and necessary expense for your business. Otherwise, the courts will remove said legislative grace and disallow the expense.

How to prove an expense

The IRS term for proving the existence of an expense is called substantiation. How does one substantiate (prove or provide evidence) an expense happened? One could use receipts, canceled checks, or bills. For the documentation to be deemed adequate, it must contain the date, amount, place, and description of the expense.

A canceled check alone does not substantiate an expense. A line item on your bank or credit card statement does not substantiate an expense. An invoice alone does not substantiate an expense. Each of these items, on their own, do not substantiate that an expense was incurred AND that it was paid.

A canceled check along with a bill would substantiate the expense. The bill shows there was an expense charged, and the canceled check shows the bill was paid. Both of those items together substantiate a complete cycle of the expense.

Remember when I started this post, I asked when is an invoice not an invoice?

In a recent tax court case, whose name escapes me at this time, an expense was disallowed, because the invoice was not complete.

Was there an invoice? Yes.

Was the invoice paid? Yes.

Was the expense ordinary or necessary? Yes. [Based on the what the plaintiff explained the expense was for]. BUT...

The invoice, however, did not show the date and description of the service rendered. The court explained that there was no way to tell what the payment was for based on the evidence provided. There was no way to determine if it was an ordinary or necessary business expense (other than the plaintiff's testimony). Therefore, the tax court disallowed the expense. The person who issued the invoice, did claim the income and pay tax as they should have. The plaintiff in the case also ended up paying tax on this money, because the expense was ultimately disallowed.

Business owners ensure that you are receiving proper invoices from your vendors and maintain those records FOREVER. When you file your taxes, store the tax return and all of the documentation together. In the event you are audited, you have everything already in one spot! If you've been selected for audit, reach out to us at ETS Tax Relief 877.482.9411.

Injured Spouse or Innocent Spouse

Marriage is not a business, but there is business in marriage. Taxes have an impact on marriage. Outstanding tax debt definitely impacts a marriage. I recommend any couple contemplating marriage to swap credit reports and IRS account transcripts. Anywho, married couples have two options for filing - Married Filing Jointly or Married Filing Separately. Each has its pros and cons.

Married Filing Jointly

For married couples, filing jointly is usually the best way to go. The couple gets access to all the tax credits, and normally has a lower tax liability than filing separately. The downside of Married Filing Jointly is that each spouse is responsible for a tax liability, even if one spouse created it. The responsibility is attached to the tax year. It doesn’t matter if the couple divorces. Each person remains responsible for the tax debt until it is paid. For example: You were married in 2019 and filed jointly, but the tax bill was never paid. You got a divorce in 2021. Both spouses are still responsible for the tax debt for tax year 2019, even though you are no longer married.

Let’s assume that your spouse owes back taxes. When you and your spouse file your taxes, you’re due a refund. Yay! Then a few weeks later, you check the status of your refund to find that it had been applied to your spouse’s past tax debt.

Married Filing Separately

The benefit of filing separately is that each spouse is responsible for their own tax bill. While that is a great benefit, the cumulative tax bill is generally higher. Married Filing Separate couples are not eligible for certain tax credits: earned income credit or American Opportunity Credit for example. The only thing really gained from filing separately is that neither spouse is responsible for the other spouse’s tax liability.

Married Filing Jointly Injured Spouse

If a spouse owes a tax debt that was in place prior to the marriage, the current spouse won’t be held liable for the debt; HOWEVER any refund due to the couple will be applied to the owing spouse’s tax debt. The Injured Spouse provision in the tax code allows married couples to take advantage of filing jointly without having to be financially responsible for past tax debt. Here’s how it works:

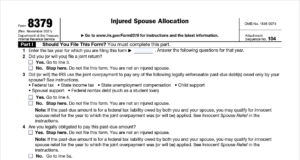

Jack and Sue were recently married. Jack discovered that Sue owed back child support. When Jack and Sue prepared their tax return, they were due a refund of $1500. Since Jack did not want to be responsible for paying Sue’s back child support, Jack filed the Injured Spouse Form 8379 with the tax return. Jack will receive his portion of the refund back. Sue’s portion of the tax refund will get held and applied to back child support.

What is Innocent Spouse Relief?

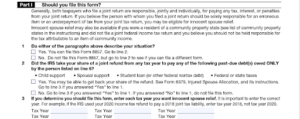

An Innocent Spouse claim is related to a tax bill. Essentially, one spouse is saying, “yes, there is a tax bill, but I should not be responsible to pay it.” It can be a real challenge to prove an innocent spouse claim.

Since a joint return requires both signatures, it would be difficult to prove that one spouse didn’t know about the tax bill or only one spouse should be responsible. The first question anyone will ask is: If you were not responsible for the tax liability or believed the return to be incorrect, why did you sign the return?

There are cases of domestic and financial abuse, in which one spouse controls access to the finances, to include taxes. Innocent spouse claims are filed on Form 8857, separate from the tax return.

The issue with an innocent spouse claim is that Spouse 1 is arguing that Spouse 2 created the tax bill and Spouse 1 shouldn’t be held responsible to pay it. Spouse 2 is claiming that Spouse 1 should be responsible to pay the tax bill as well.

The IRS looks at different variables such as your age, educational level, and the type of job you have, or if there was documented abuse involved. If the IRS determines that you were intelligent enough that you should have known about the tax bill, and abuse can’t be proven, then an innocent spouse claim will probably get denied.

Facts and circumstances will determine the success of the Injured Spouse or Innocent Spouse claim. Please note: The IRS also does not follow divorce decrees. If your divorce decree says your spouse is supposed to pay the tax bill, and they don't, you're still responsible in the eyes of the IRS.

If you require assistance with either of these claims, reach out to us to schedule a call.

How long do you have to claim a Refund?

I was watching a video, and the creator erroneously claimed that you have three years to file your taxes. I reviewed the comments and watched all of the people cyber high-fiving at this false information. It was painful. I’m here to set the record straight.

When do you have to file?

You are required to file your tax return generally by April 15th every year. If you cannot file your return, you must request an extension of time to file, which provides an additional 6 months to file your return. Filing the extension is requesting additional time to file your paperwork. It does not extend the payment deadline. There are no penalties for late filing when there is a refund. But this blog post isn’t about a tax bill, it’s about a refund.

Refund Statute Expiration Date

As I stated, the inspiration for this post came from a YouTube video. You are required to file your return on time every year (to include extension). If you don’t, you have three years to claim a refund. If you file an extension, the deadline is the extended due date. What does this look like?

Let’s assume you have not filed your 2021 tax return. The original due date for filing the 2021 tax return was Monday, April 18, 2022. One had to file the return or request an extension. Assuming you are due a refund on your 2021 tax return, the FINAL deadline to file your return to request a refund is April 15, 2025. If you file an extension, then the FINAL deadline would be October 15, 2025.

What happens if you don’t file within 3 years?

Let’s look at an actual example. A taxpayer filed his 2017 tax return late, and was due a refund. The original filing deadline for tax year 2017 was April 17, 2018. The taxpayer did not file an extension. The FINAL deadline for requesting the refund was May 17, 2021. Note: The normal deadline of April 15, 2021 was extended a month for Covid relief. The taxpayer did not file the return until November 30, 2021.

Once the Refund Statute expires (RSED), the IRS gets to keep your money. That’s it! Your refund becomes property of the Department of Treasury. There are generally no take-backs on this rule, unless there are extenuating circumstances. You have to be able to prove those circumstances. Even if you have past tax debt, you still do not get access to the refund to reduce the tax debt. This taxpayer 'donated' $3,141 to the Department of Treasury.

Here’s an example. This taxpayer had several unfiled years, and owed taxes for tax year 2015. They would have been due a refund for the 2017 tax return, which was filed in November 2021. The Refund Statute expired in May 2021, so the 2017 refund was NOT be applied to the 2015 tax debt.

I know what you may be thinking. If you OWE the government, they have 10 years to collect and there are penalties and interest! Yes, you are correct! You, however, only have 3 years to claim a refund.

If you learn nothing else from this post, file on time, even if you think you’re going to owe. If you have unfiled tax returns, reach out to us! We’re here to help!

The #1 Way to Avoid an Audit

Someone asked me, “LuSundra, what is the number one tip you would give to help a business owner avoid an audit?”

My answer: Don’t invite one.

The IRS decides to audit.

The decision to audit lies strictly with the IRS. There really is nothing you can do to avoid an audit. No tax professional can ever tell you that you will or won’t get audited. We don’t make that decision.

Are there red flags that may trigger an audit? Yes!

However, you can also file a perfect tax return and still get audited. That’s just the nature of filing taxes. That’s why I always recommend preparing your return as if you knew that the IRS was going to show up tomorrow. Tomorrow may come one day.

Red flags that can trigger an audit

There are some things that can trigger an audit. The sad thing is that these audit triggers are common knowledge, yet people seem to keep doing them and expect to NOT get audited. Talk about the definition of insanity! Anywho, here are a few audit triggers that send an engraved invitation to the IRS to audit you.

Excessive business losses:

The most publicized fraudulent activity is with Schedule C business losses. If you have losses 3 out of 5 years, you might get audited. (In my best ‘You might be a redneck’ voice).

Does having business losses automatically mean you will get audited? No.

However, if you have years of business losses, and those losses consistently produce a large refund, that’s going to make the IRS pause and dig a little deeper. How can one stay in business if you’re consistently losing large amounts of money.

All round numbers:

As tax professionals, we see it all the time. If all your income and expenses are even rounded numbers, you might get audited!

Income - $25,000

Utilities - $1,000

Advertising - $5,000

Commissions and fees - $7,000

Really?? All your income and expenses were these nice round numbers? No change? Have you ever seen a utility bill that was rounded to the nearest $10?

All those round numbers tell the IRS that you are making up the numbers versus providing actual expenses.

Cash Heavy Businesses:

Businesses like barber shops, hair salons, car washes, vending machines, etc. are cash heavy businesses. Cash, for the most part, isn’t traceable, which tempts people to under-report their income. It also leads to the round figure reporting, discussed in the previous paragraph. Listen, don’t let the smooth taste fool you. The IRS has a Criminal Investigative division. Your audit may start out as the IRS requesting receipts or invoices to prove the information on your tax return. If you can’t provide what they ask for, the auditor will make an adjustment on your return. Make no mistake, a ‘simple’ audit can turn into a criminal investigation.

Excessive Itemized Deductions:

The Tax Cuts and Jobs Act of 2017 removed the majority of itemized deductions and limited others. There are very few people who itemize their deductions these days. When taxpayers have excessive tax deductions, that may cause the IRS to pause and take a look. For example, if a taxpayer takes an excessive amount of mortgage interest deduction or has a disproportionately high amount of charitable deductions, an audit will be invited, because the numbers don’t make sense.

If you received an audit notice, reach out to us! We're here to help!

Statute of Limitations

The Statute of Limitations is critical in the fight against the IRS. It is important to know which statute of limitations applies to your situation.

Definition

In general, the Statute of Limitations refers to the amount of time a party can take action from the time a situation occurred. The IRS has different statutes of limitations by which to abide. The date the statute of limitations ends is called the Statute Expiration Date.

3-year Audit Rule Statute of Limitations

The IRS generally has three years to audit your return. They can add more years if they find a substantial error, but usually no more than 6 years. The IRS can go back FOREVA if they suspect fraud or criminal activity.

Substantial Understatement of Income

The statute of limitations for audit is extended to six years if you omit (leave off) more than 25% of your gross income.

In tax year 2021, Jane earned $150,000, but only reported $110,000. The difference is $40,000 (~27% of $150,000). Since the difference is greater than 25%, the six year statute applies. Jack also earned $150,000, but reported $114,000, a difference of $36,000 (~24% of $150,000). The three year assessment would apply to Jack's situation since the difference is less than 25%.

Basis Overstatement

Congress decided in 2015 that basis overstatement produces an understatement of income, and extended the statute of limitations to six years vs. three years.

Example: Let’s assume you sell an investment property for $1 million. You claim your basis (the amount you invested) is $800,000, but it’s actually much lower at $250,000. The impact of your overstatement of basis is that you paid tax on $200,000, when you should have paid tax on $750,000. The IRS has 6 years to figure that out.

Refund Statute of Limitations

The Refund Statute Expiration Date (RSED) refers to the amount of time a taxpayer has to claim a refund. Generally, the refund statute of limitations is three years from the date a tax return is due OR within 2 years after the overpayment of tax.

Let’s assume you have not filed your 2017 tax return and you were due a refund. The 2017 tax return filing deadline was April 17, 2018. The last day to claim your 2017 tax refund was April 18, 2021. If the refund wasn't claimed by April 18, 2021, the statute of limitations has expired. You can no longer claim the refund. #Ewwww

Assessment Statute Expiration Date (ASED)

The IRS has three years from the time a return is filed to assess a tax. A tax assessment is the statutorily (by law) required recording of the tax liability. According to §6203, the assessment is made by recording the taxpayer’s name, address, and tax liability. In other words, the IRS has a required statute of limitations to record your tax within three years of the due date of your return, or from the time the return is filed (whichever is later). The Assessment Statute Expiration Date (ASED) on a tax return timely filed by Apr 15, 2022 is April 15, 2025.

Collections Statute of Limitations

The IRS generally has a statute of limitations of 10 years from the date the tax is assessed to collect a federal tax debt. The IRS has to write off any tax debt that's not paid by the end of the 10-year statute. It disappears like it never existed. There are situations that can toll (extend) the Collection Statute Expiration Date (CSED) - bankruptcy proceedings, for example.

Statute of Limitations on Unfiled or Fraudulent Returns

There is no statute of limitations on fraud. If you filed a fraudulent return, it’s as if you never filed a return at all.

Examples

- Tax preparers go to jail regularly for filing fraudulent returns on behalf of their clients. Sometimes the clients are aware. Sometimes they are not. Assume you are a victim of a preparer who filed a tax return containing fraudulent business losses to get you a bigger refund. Even though you may not have known the return contained fraudulent information, there is still no statute of limitations on the tax return. Theoretically, the IRS can find out about the return 10 years later, and still require the taxpayer to pay back any refund they were not entitled to receive.

- The statute of limitations never starts on a return that is never filed. The IRS may file a Substitute for Return (SFR), but that doesn’t count as a filed return either. The SFR doesn’t take into account any tax credits or deductions to which you may be entitled. The IRS uses the income reported by third parties and assesses the tax based on that. It’s important to note that filing an incomplete return, such as an unsigned return, does not count as filing a return.

The statute of limitations listed above are the most common statutes taxpayers experience. It’s important to know the statutes of limitations that apply to your situation. If you have received a letter from the IRS or have unresolved tax debt, reach out to us at 877.4TAX411 (877.482.9411).

All You Need to Know About Currently Not Collectible Status

When a taxpayer can’t afford to pay a delinquent tax bill, one of the first questions that cross their minds is: Am I going to jail? We don’t have a debtor’s prison in the United States. The only people who go to jail for not paying taxes are the ones who actively and illegally attempt to dodge their tax requirements. There are people who actually cannot afford to pay their tax liability. That taxpayer can be placed in Currently Not Collectible (CNC) status. While this can provide taxpayer relief, it’s not permanent and it’s not a guarantee.

What is Currently Not Collectible Status?

Currently Not Collectible (CNC) status temporarily delays the collection of an outstanding tax debt. The IRS can place a taxpayer in CNC status if it is determined that a taxpayer cannot afford to pay their delinquent tax bill. The taxpayer will remain in CNC status until the taxpayer’s financial situation improves. Currently Not Collectible status doesn’t remove the tax debt, it temporarily delays collection. The IRS will file a lien if you owe $10,000 or more, but the actual collection efforts will be delayed. Penalties and interest will continue to accrue during the CNC period, as well. The delay means that they won't levy your income or seize your property. The Collection Statute Expiration Date (CSED) clock continues to run. The IRS has 10 years from the date of assessment to collect a debt. Currently Not Collectible status does NOT stop that clock from running.

Who is eligible for Currently Not Collectible Status?

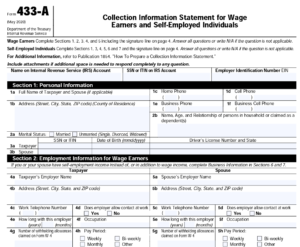

Just saying you can’t afford to pay your taxes isn’t enough to be placed in CNC status. A taxpayer who claims they can’t afford to pay their taxes will be asked to provide a Collection Information Statement (CIS) Form 433-A, 433-B, or 433-F. This Collection Information Statement details your financial situation - living expenses, assets, debts, and monthly income. Assets can include a wide variety of things - cryptocurrency, weapons, or a retirement account. The results of the CIS will determine if the taxpayer is eligible for CNC status.

National and Local Standards

As stated earlier, you can’t just ‘say’ you can’t afford to pay your taxes. You have to be able to prove that you can’t afford to pay your taxes, but this isn’t as easy it seems. The IRS has a guideline of allowable expenses, based on national and local standards. Items such as food, clothing and services, household supplies, and personal care products have a national standard for the allowable amount. There are national standards for healthcare and medical supplies. The amount of the standard takes into consideration the area of the country in which you live. The National Standard for housing in California is higher than in Virginia, for example. The standards also vary by county as well.

Monthly Disposable Income

The goal in completing the financial statement is to determine the taxpayer’s Monthly Disposable Income (MDI), which is the amount of money you have left after your allowable expenses are deducted from your income on a monthly basis. Your location and family size play a large part in calculating the amount of allowable expenses. If your MDI is zero or less, then you have a better chance to qualify for CNC. If your MDI is $1 or more, then you don’t qualify for CNC. Because you could actually be paying more for expenses than the IRS allowable amounts, your MDI may be different from the IRS's calculations.

Let’s look at an example: Jerry owes the IRS $27,000. The IRS is asking for $250 per month for payment. Jerry says, ‘I don’t have that money.’ Jerry is single, living in Alexandria, VA. He reports his expenses as this:

Monthly income: $4600

Rent and utilities: $3000 ($2500 rent + $500 Utilities)

Car Payment: $533

Car Insurance: $300

Food: $800

Credit card payments: $400

____________________

-$133 (monthly deficit)

However, the IRS reviews their National and Local standards for expenses. The IRS's CIS looks like this:

Monthly Income: $4,600

Rent and Utilities: IRS Allowable $2738

Car Ownership Allowable Expenses: $907

Food and supplies Allowable expense: $785

_______________________

$170 monthly disposable income

While Jerry doesn't have the $250 the IRS was initially asking for, based on the IRS's standards, he does have $170 monthly disposable income to pay toward his outstanding tax debt. This is when Jerry should contact us for assistance.

What about personal debt?

Personal debt tends to be a sticking point for taxpayers. As far as the IRS is concerned, they are your number one creditor. The IRS tends to ignore payments on personal debts such as credit cards or personal loans. There are some cases where the IRS will take those payments into consideration, but generally, payments on personal debt do not count toward your monthly expenses.

CNC is not permanent

The purpose of CNC is to provide relief to the taxpayer who is in a bad financial situation. The IRS will review the CNC status on an annual basis to see if your financial situation has changed. They may take refunds and apply them to the outstanding tax debt. It is important that the amount of tax debt does not continue to increase. The IRS may determine that you are not eligible for CNC status if your tax liability increases every year. You must remain current with your filings as well.

Penalty Abatement Tax Relief

One thing that is for certain with the IRS is that there is a penalty for everything! Penalties are meant to encourage compliance with tax laws. What if you try to comply with the tax law, but you can't? That's where penalty abatements come in.

Penalty Abatement

A penalty abatement is when the IRS removes penalties after the penalties have been assessed to the taxpayer. There are two main types of penalty abatements - First Time Penalty Abatement and Reasonable Cause Penalty Abatement.

First-Time Penalty Abatement

The IRS may provide administrative relief from a penalty that would otherwise be applicable under its First Time Penalty Abatement policy.

You may qualify for administrative relief from penalties for failing to file a tax return, pay on time, and/or to deposit taxes when due under the IRS's First Time Penalty Abatement policy if the following are true:

- You didn’t previously have to file a return or you have no penalties for the 3 tax years prior to the tax year in which you received a penalty.

- You filed all currently required returns or filed an extension of time to file.

- You have paid, or arranged to pay, any tax due.

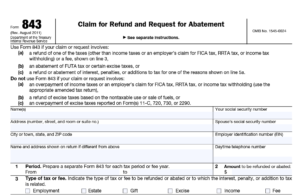

A First Time Penalty Abatement can be requested using form 843.

Case Study

Imagine $7 standing between you and $259,000 of penalty relief. That’s exactly what happened to Erik and Aspasia Oosterwijk.

Short story: For the 2017 tax year, the Oosterwijks reached out to their CPA to file an extension on their tax return and arrange a payment of approximately $1.8 million in taxes owed. The CPA made an error and did not actually file the extension, and the payment never came out. OOPS!

What about that First Time Penalty Abatement? For tax year 2014, the Oosterwijks received a $7 late payment penalty. That $7 late payment penalty made them ineligible for the First Time Penalty Abatement because the $7 penalty occurred within the 3 years prior to tax year 2017. Ouch!

If you don’t qualify for a First Time Penalty Abatement, you may qualify for a Reasonable Cause Penalty Abatement.

REASONABLE CAUSE PENALTY ABATEMENT

Reasonable Cause is based on all the facts and circumstances in your situation. The IRS will "consider any reason which establishes that you used all ordinary business care and prudence to meet your Federal tax obligations but were nevertheless unable to do so". Please note that the word ‘consider’ is underlined. The IRS will consider the circumstances, but that doesn’t mean they will accept your reasoning.

Here is a list of “sound reasons” IRS has listed on its website for failing to file a tax return, make a deposit or pay tax when due.

- Fire, casualty, natural disaster or other disturbances

- Inability to obtain records

- Death, serious illness, incapacitation or unavoidable absence of the taxpayer or a member of the taxpayer’s immediate family

- Other reason which establishes that you used all ordinary business care and prudence to meet your Federal tax obligations but were nevertheless unable to do so

The IRS also notes that a lack of funds, in and of itself, is NOT reasonable cause for failure to file or pay on time. However, the reasons for the lack of funds may meet reasonable cause criteria for the failure-to-pay penalty.

Facts necessary to establish reasonable cause

When trying to establish reasonable cause, there are certain facts one must be able to present:

- What happened and when?

- What exactly prevented you from meeting your tax obligation of filing and paying?

- Once the circumstances changed, how did you attempt to rectify the situation?

- You have to be able to provide documentation to support your claim. In the case of serious illness for example, one would provide hospital or medical records.

In the case of the Oosterwijks, one might believe that the CPA failing to file the extension would constitute reasonable cause. One would also believe that Oosterwijks “all ordinary business care and prudence to meet your Federal tax obligations but were nevertheless unable to do so”.

Uh. No.

In US v Boyle (1985), the Supreme Court decided that the failure to make a timely filing of a tax return is not excused by the taxpayer's reliance on an agent, and such reliance is not "reasonable cause" for a late filing under § 6651(a)(1).

The courts noted that the Oosterijks previously filed a paper extension in 2018. In the court’s eyes, they could have filed their own extension instead of relying on the CPA. The court ruled that the failure on the CPA’s part was not a reasonable cause for abatement.

My First Reasonable Cause Penalty Abatement case

When I first started my tax career, I had a client who was eligible for Reasonable Cause Penalty Abatement.

The client, we’ll call him Jim, came to the office the year prior (tax year 2014) to file his tax return. The office, at that time, was owned by someone else. Jim filed an extension. When he came back to file his return prior to the extension deadline, the office was SHUT DOWN! There was no warning. The previous owner did not notify anyone. What made it worse is that Jim had given the previous owner original documents!

NOTE: **Never give original documents to a tax professional.**

When we opened up the office in February 2016, Jim came to the office. We had to dig out Jim’s files from the old owner to assist him with completing his returns. Jim owed approximately $11,000 on his 2014, and another $9,000 on his 2015 tax return.

We drafted a Reasonable Cause Letter for Jim providing the timeline of events, including the approximate date of closure from the previous owner. The letter also noted that the office opened under new ownership in January 2016. Jim filed both the 2014 and 2015 taxes in February 2016, when he had all of his documents available. The IRS abated his failure to file penalties, but not the failure to pay since he had a history of owing (even though he normally paid on time). The IRS asserted that he should have paid something towards his tax bill because he normally owes.

Penalty Abatements are not guaranteed

Penalty abatements are a privilege, not a right. When requesting a Reasonable Cause Penalty Abatement, one must be able to document the reasonable cause. Remember, relying on your tax professional won’t necessarily get you off the hook either.