Injured Spouse or Innocent Spouse

Marriage is not a business, but there is business in marriage. Taxes have an impact on marriage. Outstanding tax debt definitely impacts a marriage. I recommend any couple contemplating marriage to swap credit reports and IRS account transcripts. Anywho, married couples have two options for filing - Married Filing Jointly or Married Filing Separately. Each has its pros and cons.

Married Filing Jointly

For married couples, filing jointly is usually the best way to go. The couple gets access to all the tax credits, and normally has a lower tax liability than filing separately. The downside of Married Filing Jointly is that each spouse is responsible for a tax liability, even if one spouse created it. The responsibility is attached to the tax year. It doesn’t matter if the couple divorces. Each person remains responsible for the tax debt until it is paid. For example: You were married in 2019 and filed jointly, but the tax bill was never paid. You got a divorce in 2021. Both spouses are still responsible for the tax debt for tax year 2019, even though you are no longer married.

Let’s assume that your spouse owes back taxes. When you and your spouse file your taxes, you’re due a refund. Yay! Then a few weeks later, you check the status of your refund to find that it had been applied to your spouse’s past tax debt.

Married Filing Separately

The benefit of filing separately is that each spouse is responsible for their own tax bill. While that is a great benefit, the cumulative tax bill is generally higher. Married Filing Separate couples are not eligible for certain tax credits: earned income credit or American Opportunity Credit for example. The only thing really gained from filing separately is that neither spouse is responsible for the other spouse’s tax liability.

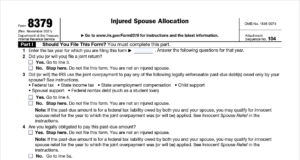

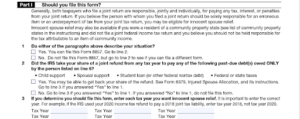

Married Filing Jointly Injured Spouse

If a spouse owes a tax debt that was in place prior to the marriage, the current spouse won’t be held liable for the debt; HOWEVER any refund due to the couple will be applied to the owing spouse’s tax debt. The Injured Spouse provision in the tax code allows married couples to take advantage of filing jointly without having to be financially responsible for past tax debt. Here’s how it works:

Jack and Sue were recently married. Jack discovered that Sue owed back child support. When Jack and Sue prepared their tax return, they were due a refund of $1500. Since Jack did not want to be responsible for paying Sue’s back child support, Jack filed the Injured Spouse Form 8379 with the tax return. Jack will receive his portion of the refund back. Sue’s portion of the tax refund will get held and applied to back child support.

What is Innocent Spouse Relief?

An Innocent Spouse claim is related to a tax bill. Essentially, one spouse is saying, “yes, there is a tax bill, but I should not be responsible to pay it.” It can be a real challenge to prove an innocent spouse claim.

Since a joint return requires both signatures, it would be difficult to prove that one spouse didn’t know about the tax bill or only one spouse should be responsible. The first question anyone will ask is: If you were not responsible for the tax liability or believed the return to be incorrect, why did you sign the return?

There are cases of domestic and financial abuse, in which one spouse controls access to the finances, to include taxes. Innocent spouse claims are filed on Form 8857, separate from the tax return.

The issue with an innocent spouse claim is that Spouse 1 is arguing that Spouse 2 created the tax bill and Spouse 1 shouldn’t be held responsible to pay it. Spouse 2 is claiming that Spouse 1 should be responsible to pay the tax bill as well.

The IRS looks at different variables such as your age, educational level, and the type of job you have, or if there was documented abuse involved. If the IRS determines that you were intelligent enough that you should have known about the tax bill, and abuse can’t be proven, then an innocent spouse claim will probably get denied.

Facts and circumstances will determine the success of the Injured Spouse or Innocent Spouse claim. Please note: The IRS also does not follow divorce decrees. If your divorce decree says your spouse is supposed to pay the tax bill, and they don't, you're still responsible in the eyes of the IRS.

If you require assistance with either of these claims, reach out to us to schedule a call.