Penalty Abatement Tax Relief

One thing that is for certain with the IRS is that there is a penalty for everything! Penalties are meant to encourage compliance with tax laws. What if you try to comply with the tax law, but you can't? That's where penalty abatements come in.

Penalty Abatement

A penalty abatement is when the IRS removes penalties after the penalties have been assessed to the taxpayer. There are two main types of penalty abatements - First Time Penalty Abatement and Reasonable Cause Penalty Abatement.

First-Time Penalty Abatement

The IRS may provide administrative relief from a penalty that would otherwise be applicable under its First Time Penalty Abatement policy.

You may qualify for administrative relief from penalties for failing to file a tax return, pay on time, and/or to deposit taxes when due under the IRS's First Time Penalty Abatement policy if the following are true:

- You didn’t previously have to file a return or you have no penalties for the 3 tax years prior to the tax year in which you received a penalty.

- You filed all currently required returns or filed an extension of time to file.

- You have paid, or arranged to pay, any tax due.

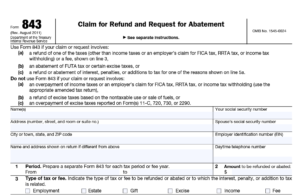

A First Time Penalty Abatement can be requested using form 843.

Case Study

Imagine $7 standing between you and $259,000 of penalty relief. That’s exactly what happened to Erik and Aspasia Oosterwijk.

Short story: For the 2017 tax year, the Oosterwijks reached out to their CPA to file an extension on their tax return and arrange a payment of approximately $1.8 million in taxes owed. The CPA made an error and did not actually file the extension, and the payment never came out. OOPS!

What about that First Time Penalty Abatement? For tax year 2014, the Oosterwijks received a $7 late payment penalty. That $7 late payment penalty made them ineligible for the First Time Penalty Abatement because the $7 penalty occurred within the 3 years prior to tax year 2017. Ouch!

If you don’t qualify for a First Time Penalty Abatement, you may qualify for a Reasonable Cause Penalty Abatement.

REASONABLE CAUSE PENALTY ABATEMENT

Reasonable Cause is based on all the facts and circumstances in your situation. The IRS will "consider any reason which establishes that you used all ordinary business care and prudence to meet your Federal tax obligations but were nevertheless unable to do so". Please note that the word ‘consider’ is underlined. The IRS will consider the circumstances, but that doesn’t mean they will accept your reasoning.

Here is a list of “sound reasons” IRS has listed on its website for failing to file a tax return, make a deposit or pay tax when due.

- Fire, casualty, natural disaster or other disturbances

- Inability to obtain records

- Death, serious illness, incapacitation or unavoidable absence of the taxpayer or a member of the taxpayer’s immediate family

- Other reason which establishes that you used all ordinary business care and prudence to meet your Federal tax obligations but were nevertheless unable to do so

The IRS also notes that a lack of funds, in and of itself, is NOT reasonable cause for failure to file or pay on time. However, the reasons for the lack of funds may meet reasonable cause criteria for the failure-to-pay penalty.

Facts necessary to establish reasonable cause

When trying to establish reasonable cause, there are certain facts one must be able to present:

- What happened and when?

- What exactly prevented you from meeting your tax obligation of filing and paying?

- Once the circumstances changed, how did you attempt to rectify the situation?

- You have to be able to provide documentation to support your claim. In the case of serious illness for example, one would provide hospital or medical records.

In the case of the Oosterwijks, one might believe that the CPA failing to file the extension would constitute reasonable cause. One would also believe that Oosterwijks “all ordinary business care and prudence to meet your Federal tax obligations but were nevertheless unable to do so”.

Uh. No.

In US v Boyle (1985), the Supreme Court decided that the failure to make a timely filing of a tax return is not excused by the taxpayer's reliance on an agent, and such reliance is not "reasonable cause" for a late filing under § 6651(a)(1).

The courts noted that the Oosterijks previously filed a paper extension in 2018. In the court’s eyes, they could have filed their own extension instead of relying on the CPA. The court ruled that the failure on the CPA’s part was not a reasonable cause for abatement.

My First Reasonable Cause Penalty Abatement case

When I first started my tax career, I had a client who was eligible for Reasonable Cause Penalty Abatement.

The client, we’ll call him Jim, came to the office the year prior (tax year 2014) to file his tax return. The office, at that time, was owned by someone else. Jim filed an extension. When he came back to file his return prior to the extension deadline, the office was SHUT DOWN! There was no warning. The previous owner did not notify anyone. What made it worse is that Jim had given the previous owner original documents!

NOTE: **Never give original documents to a tax professional.**

When we opened up the office in February 2016, Jim came to the office. We had to dig out Jim’s files from the old owner to assist him with completing his returns. Jim owed approximately $11,000 on his 2014, and another $9,000 on his 2015 tax return.

We drafted a Reasonable Cause Letter for Jim providing the timeline of events, including the approximate date of closure from the previous owner. The letter also noted that the office opened under new ownership in January 2016. Jim filed both the 2014 and 2015 taxes in February 2016, when he had all of his documents available. The IRS abated his failure to file penalties, but not the failure to pay since he had a history of owing (even though he normally paid on time). The IRS asserted that he should have paid something towards his tax bill because he normally owes.

Penalty Abatements are not guaranteed

Penalty abatements are a privilege, not a right. When requesting a Reasonable Cause Penalty Abatement, one must be able to document the reasonable cause. Remember, relying on your tax professional won’t necessarily get you off the hook either.