How long do you have to claim a Refund?

I was watching a video, and the creator erroneously claimed that you have three years to file your taxes. I reviewed the comments and watched all of the people cyber high-fiving at this false information. It was painful. I’m here to set the record straight.

When do you have to file?

You are required to file your tax return generally by April 15th every year. If you cannot file your return, you must request an extension of time to file, which provides an additional 6 months to file your return. Filing the extension is requesting additional time to file your paperwork. It does not extend the payment deadline. There are no penalties for late filing when there is a refund. But this blog post isn’t about a tax bill, it’s about a refund.

Refund Statute Expiration Date

As I stated, the inspiration for this post came from a YouTube video. You are required to file your return on time every year (to include extension). If you don’t, you have three years to claim a refund. If you file an extension, the deadline is the extended due date. What does this look like?

Let’s assume you have not filed your 2021 tax return. The original due date for filing the 2021 tax return was Monday, April 18, 2022. One had to file the return or request an extension. Assuming you are due a refund on your 2021 tax return, the FINAL deadline to file your return to request a refund is April 15, 2025. If you file an extension, then the FINAL deadline would be October 15, 2025.

What happens if you don’t file within 3 years?

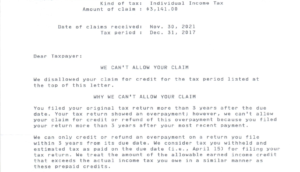

Let’s look at an actual example. A taxpayer filed his 2017 tax return late, and was due a refund. The original filing deadline for tax year 2017 was April 17, 2018. The taxpayer did not file an extension. The FINAL deadline for requesting the refund was May 17, 2021. Note: The normal deadline of April 15, 2021 was extended a month for Covid relief. The taxpayer did not file the return until November 30, 2021.

Once the Refund Statute expires (RSED), the IRS gets to keep your money. That’s it! Your refund becomes property of the Department of Treasury. There are generally no take-backs on this rule, unless there are extenuating circumstances. You have to be able to prove those circumstances. Even if you have past tax debt, you still do not get access to the refund to reduce the tax debt. This taxpayer 'donated' $3,141 to the Department of Treasury.

Here’s an example. This taxpayer had several unfiled years, and owed taxes for tax year 2015. They would have been due a refund for the 2017 tax return, which was filed in November 2021. The Refund Statute expired in May 2021, so the 2017 refund was NOT be applied to the 2015 tax debt.

I know what you may be thinking. If you OWE the government, they have 10 years to collect and there are penalties and interest! Yes, you are correct! You, however, only have 3 years to claim a refund.

If you learn nothing else from this post, file on time, even if you think you’re going to owe. If you have unfiled tax returns, reach out to us! We’re here to help!