The New Self Employed Covid Credit

Ahhh… Have you seen the ads?

“1099 Gig Workers Claim up to $32,000 with the ‘New’ Covid Self Employed Tax Credit (SETC).

Oy! I decided to write this blog post once I got a few inquiries from my clients. Quite frankly, these companies make my skin crawl. I’ve even seen influencers, who have ZERO experience with tax, telling their audiences to go ‘get this money’, BUT … ‘check with your CPA first’. [Insert my best side-eye.]

The actual name of the credit is the Self-Employed Sick and Family Leave Credit. SETC is not a thing. If you ask a tax professional about the SETC, they’ll probably be confused, because that’s not the name of the credit. However, to gain understanding about this credit, I will use the Street Committee Name – SETC. Let’s talk about how we got here.

Employee Retention Credit Claims – FROZEN

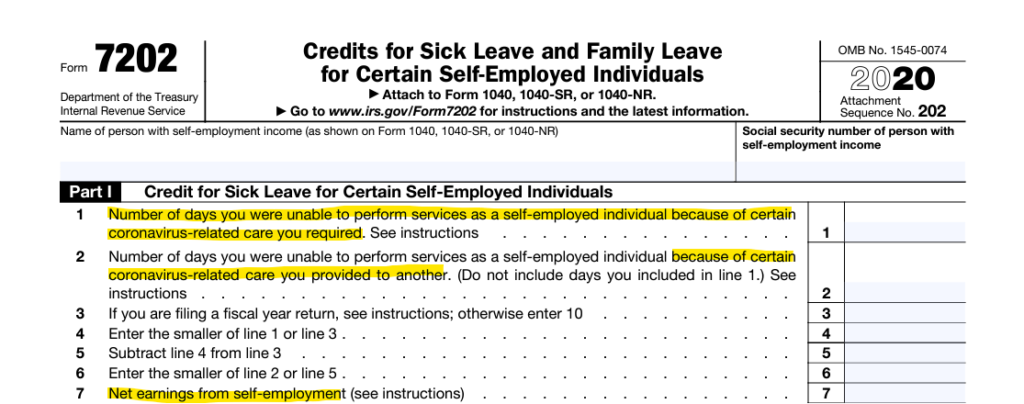

In September 2023, the IRS ordered the immediate stop to Employee Retention Credit (ERC) processing. They received several millions of ERC claims, many of them fraudulent. Employers could still submit claims, but they would not be processed. FYI, Tax Year 2020 ERC claims need to be submitted no later than April 15, 2024. The credit is claimed on Form 7202.

ERC claims were lucrative, and these companies made a BOATLOAD of money, charging 20% of the credit received. If a client received a claim for $60,000, the companies would be paid $12,000. That’s a heck of an incentive to submit fraudulent claims. Should the IRS come knocking, it would be at the employers’ doors, not the company that fabricated the information on the claim. The IRS pumped all the brakes on that.

SETC is the new ERC

Since the ERC well dried up, these companies shifted their sights to the Self-Employed Sick and Family Leave Credit. Now Self-Employed individuals are being bombarded with advertisements of being able to get ‘up to’ $32,000 from the SETC. It only takes a few minutes to apply (insert affiliate link). You didn’t think people were posting about it just to help – right? I’m not mad at anyone earning affiliate commissions. I do it all the time. I AM annoyed at promoting something that has serious consequences if the person doesn’t get all the information. A tax credit is not the same as promoting the latest email marketing tool.

Under the 2020 rules, a self-employed individual could claim up to $15,110. For 2021, they could claim up to $17,110; hence the total $32,000. The clock is ticking on claiming the 2020 tax credit, so the ads are on fire.

Qualifications for Self-Employed Tax Credit

There are three main questions you have to answer to determine if you qualify for the credit.

- Were you unable to work because you had Covid?

- Were you unable to work because you had to care for someone with Covid?

- Did you earn a profit?

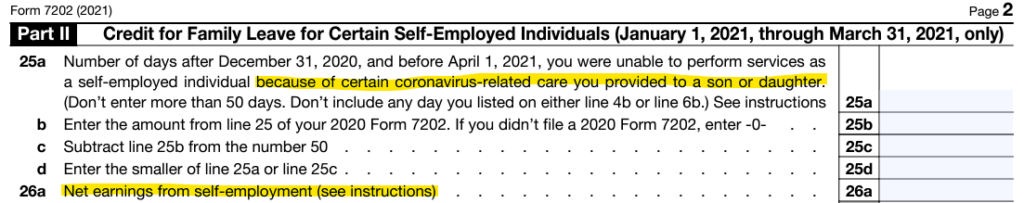

In 2021, the qualifications were tweaked a bit. In part II of the form below, Form 7202 specifies “January 1- March 31, 2021”, and also specifies caring for a son or daughter (see instructions). The instructions say: “because of certain coronavirus-related care you provided to a son or daughter whose school or place of care is closed or whose childcare provider is unavailable for reasons related to COVID-19 or for any reason you may claim sick leave equivalent credits.

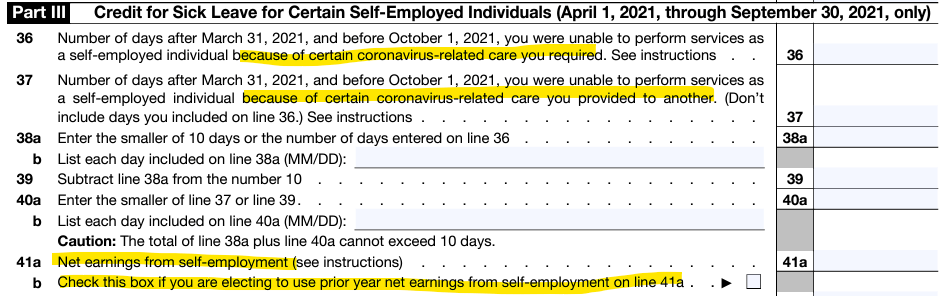

Part III of the 2021 version of Form 7202 specifies April 1 through September 30, 2021, for yourself or care you provided to another. The section specifically for children was removed. The great thing about the credit is that you could separate the time you needed to care for yourself or another from the time you needed to care for your children.

Part III 2021 Form 7202

Plenty of Self-Employed individuals were impacted by Covid. I don’t know any that were not; however, being impacted by Covid did not automatically mean you qualified for the credit. Millions of self-employed individuals lost money in their businesses during Covid. If you look at both the 2020 and 2021 Form 7202, it asks for ‘net earnings’ from self-employment (amount of profit). If you claimed a loss, you did not qualify for the credit. The advantage of the 2021 version of the credit is that you could use net earnings from 2020. If you posted a loss in 2020, then you still did not qualify for the credit.

Be prepared for an audit

If you qualify for the credit and didn’t claim it, by all means, amend your return to claim your credit; however, I also caution you to be ready for an audit. The auditor will ask for bank statements to confirm revenue and expenses. They may also ask for proof that you had Covid, a family member had Covid, or that your childcare facility or school was closed. Closed daycare and schools won’t be hard, for sure. While your health information may be protected, your banking information is not. You have to be able to prove anything you claim on your return.

Don’t be duped into claiming false credits. The false claims are why there is a moratorium on the Employee Retention Credit. If the IRS or State comes knocking on your door (figuratively, they’re not coming to your house right now), but if you get the letter being notified of an audit, reach out to us at ETS Tax Relief to help you!

More Related Articles

February 15, 2024

BEWARE Military Disability Scam

My husband retired from the military in April 2022. It was an awesome occasion when it finally got here; however, getting there was slightly painful. He had to go through tons of briefings on his…

February 8, 2024

1099K Reporting 2024

There has been another delay in the change of the 1099K reporting. It has also caused more confusion for payors to know if they should issue a 1099K or a 1099-NEC to a provider. Let’s chat about how…

February 5, 2024

Employee Gifts are Taxable

I was perusing the news a few weeks ago. The news headlines said, “Wal-Mart Slammed After Gifting Employees 55-Cent Ramen Noodles” for working during a blizzard. Needless to say, Wal-Mart was…